When it comes to portfolio construction, we often spend most of our time focusing on asset allocation and asset location: the percentage of stocks we should own, which bond subsectors are appealing, or whether to choose taxable or tax-deferred accounts. We spend much less time on what vehicles are best for our portfolios. Truth be told, mutual funds and exchange traded funds (ETFs) do much of the driving, and perhaps rightfully so. Both fund types offer plenty of benefits for investors.

However, they aren’t the only way to build our portfolios.

There are a host of other fund types that are of use to portfolios and investors’ needs. From closed-end funds (CEFs) and interval funds to unit investment trusts (UITs) and separately managed accounts (SMAs), investors have choices other than the classic mutual fund or ETF.

ETFs & Mutual Funds

Investors and their advisors tend to focus on what they own rather than how they own it. That is because mutual funds and ETFs dominate the conversation. It’s easy to see why – both fund varieties offer plenty of benefits for portfolios. For instance, with a single mutual fund or ETF investors can pool their assets, collect interest and dividends, and build diversified portfolios.

While there are some differences between ETFs and mutual funds, including the tax-efficient structure and lower costs of ETFs, they can provide similar experiences for investors. Additionally, they are pretty easy to set up from an asset manager’s point of view, and in the case of mutual funds, they are compliant with qualified retirement plans such as 401(k)s.

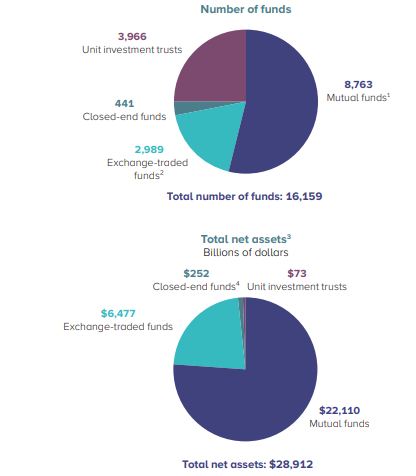

With that, trillions of dollars have flowed into these two fund types. According to the Investment Company Institute’s (ICI) last Fact Book, there were more than 8,500 mutual funds and nearly 3,000 ETFs at the start of 2023, with each holding nearly $22 trillion and $6.5 trillion in assets, respectively. 1

These two pie charts from the ICI report show the dominance of these fund types.

Source: ICI

But, you will notice two other fund choices in the chart: CEFs and UITs. These are just two examples of other fund vehicles that investors can use to build portfolios. These alternative vehicles could be just what portfolios need depending on an investor’s goals and risk tolerance.

Closed-end Funds

Closed-end funds or CEFs are one of the oldest fund types in the history of the market, with a few dating back to the 1850s. They are also one of the largest non-traditional fund types, whereby a fund launches at an IPO with a fixed number of shares. Managers then buy assets according to their mandate. The shares of the CEF are subsequently traded on the major exchanges.

Because their values are driven by supply and demand, they can trade at discounts or premiums to their underlying net asset values, allowing investors to potentially get exposure for pennies on the dollar.

The structure has several benefits for investors. One is that they can use leverage via preferred share issuance or debt, allowing them to potentially boost yields and returns. For example, a municipal CEF may be able to pay 6 to 7% in dividends versus 3 or 4% for an ETF. Secondly, because funds trade on exchanges, managers don’t need to worry about capital fleeing the fund, allowing them to own more illiquid securities. It also lets managers be fully invested, eliminating cash drag.

Unit Investment Trusts

Rounding out the main fund types is the unit investment trust (UIT). UITs are like mutual funds, CEFs and ETFs in that they pool investors’ money together to own assets. UITs are often managed for a specific purpose such as “stable income” or “growth & income”.

UITs are created via an IPO and managers then purchase stocks or bonds to meet the fund’s mandate. Those assets are fixed once they are purchased and not actively traded. One key difference between other fund types is that UITs have a termination date. At that point, investors will receive the proceeds from the fund. UITs also feature daily liquidity, enabling redemptions before the actual termination date. Believe it or not, some of the earliest ETFs were structured as UITs. For example, both the popular SPDR S&P 500 Trust and the Invesco QQQ Trust are technically UITs and are set to terminate in the years 2118 and 2124, respectively.

The advantage of a UIT is that, unlike a mutual fund, it can provide tax benefits such as sheltering investors from unrealized capital gains.

Two New Fund Structures

CEFs and UITs are two old-school alternatives to ETFs and mutual funds, while Wall Street has limited the innovation of new fund varieties and portfolio choices from being created.

Separately managed accounts (SMAs) have long been used by high-net-worth individuals, family offices, and other institutional investors. But thanks to a decline in costs, the rise of fractional trading, robo-advisors, and other factors, regular Joes now have access to SMAs.

Just as the name applies, SMAs are professionally managed. Investors work with a broker or asset manager to design a mandate/portfolio. Here, investors physically own the individual stocks, ETFs, and bonds in the portfolio, allowing for potential tax-loss harvesting and increased alpha as managers can buy/sell assets.

As investors have clamored for more illiquid assets, Wall Street has delivered and created the interval fund. These investment vehicles are quickly becoming the way to invest in real estate, seed investments, and private capital/fixed income securities. BlackStone’s BREIT is probably the most famous and largest interval fund.

Interval funds are essentially CEFs that do not trade on exchanges. Because they don’t trade but offer daily liquidity, interval funds will periodically have times when investors can redeem their shares. Often these repurchases include gates and maximums of outstanding shares. The idea is that investors’ capital is locked up for a long time, and this time can make the most of returns. Many interval funds pay monthly or quarterly dividends

Purchasing Alternative Fund Types

While mutual funds and ETFs are still the big boys on the block, other fund types can fit into a portfolio. For example, investors looking for extra income could turn to CEFs due to their leverage, or those who are seeking to add a commercial real estate allocation could pick up an interval fund.

Getting a hold of these alternatives is quite easy in most cases. CEFs are widely traded on the NYSE and other major exchanges, while interval funds and UITs can be purchased directly from their sponsoring asset managers.

Top-Performing CEFs

These CEFs are sorted by their YTD total returns, which range from 6.5% to 9.6%. They are AUM between $100M and $1.65B and have expenses between 0.86% and 3.4%. They are currently yielding between 6.1% and 13.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type |

|---|---|---|---|---|---|---|

| BGR | BlackRock Energy Resources Trust | $380M | 9.6% | 6.1% | 1.29% | CEF |

| JQC | Nuveen Credit Strategies Income Fund | $790M | 9.2% | 13.1% | 2.67% | CEF |

| JFR | Nuveen Floating Rate Income Fund | $1.22B | 8.7% | 12.8% | 3.4% | CEF |

| BGT | BlackRock Floating Rate Income Trust | $285M | 8.2% | 12.1% | 3.05% | CEF |

| BDJ | BlackRock Enhanced Equity Dividend Trust | $1.65B | 7.3% | 9.1% | 0.86% | CEF |

| JLS | Nuveen Mortgage and Income Fund | $104M | 7% | 10.8% | 1.57% | CEF |

| JPC | Nuveen Preferred Income Opportunities Fund | $783M | 6.5% | 9.3% | 2.68% | CEF |

As for SMAs, most major banks with investment arms or any top asset manager offer these products. Moreover, the rise of robo-advisors puts SMAs into the hands of the masses for a reasonable cost.

And speaking of expenses, many of these alternative fund types cost roughly the same as mutual funds and many ETFs. It all depends on the manager. However, like more traditional fund types, lower expenses keep more returns in your pocket.

In the end, investors strictly looking at mutual funds or ETFs to build their portfolios could be missing out. These other fund vehicles can offer benefits to portfolios and be better at completing strategy than simply using traditional funds.

Bottom Line

ETFs and mutual funds are typically how investors construct their portfolios – but they are not the only games in town. SMAs, CEFs, interval funds, and UITs offer different ways and benefits to build a portfolio. Investors should give them a look before simply buying an ETF or mutual fund.

1 ICI (May 2023). Investment Company Fact Book