When it comes to investing, knowing your dates is important. Although long-term buy-and-hold investing means that investors don’t really need to worry about the quarterly dates tied to dividend payouts, it’s still helpful to be familiar with the terms. Likewise, more aggressive traders can actually use dividend dates as part of an alpha-generating strategy, including the dividend capture strategy.

Find one-day trades returning 1% on our Best Dividend Capture list.

The All-Important Dividend Dates

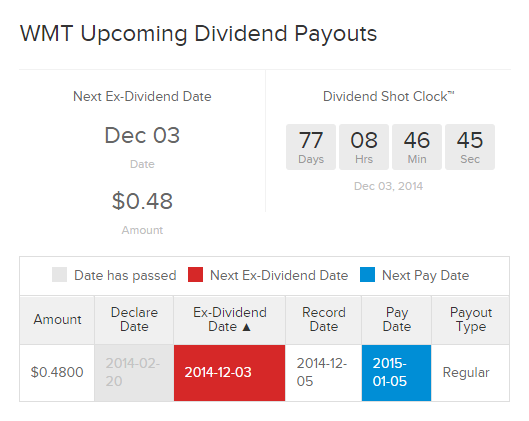

There are four primary dates that investors need to keep in mind for dividend-paying stocks. All of these dates can be found on our Dividend Stock Ticker Pages, as pictured below.

1. Declaration Date

The declaration date is the day that the company declares that it will pay a dividend. With this declaration, the company announces how much it will pay, the ex-dividend date, and the payment date. The declaration date is sometimes called the “announcement date” and most reliable dividend-paying companies keep to a regular declaration schedule (adjusting for weekends and holidays, of course). Likewise, companies generally now announce changes to their dividends along with earnings announcements or in separate press releases.

Declaration dates can be more significant for foreign companies, where payouts are often based as a consistent percentage of profits and where it is less common to “pre-announce” changes to the dividend.

2. Ex-dividend Date

As of the ex-dividend date, buyers of this stock will no longer be entitled to receive the declared dividend and the stock is said to thereafter trade “ex-dividend” (without dividend). Before trading opens on the ex-dividend date, the exchange marks down the share price by the amount of the declared dividend.

As an example, ABC Inc declares a $1 dividend with an ex-dividend date of January 10th. Anybody who buys the shares on the 7th, 8th, or 9th—or any date prior to the 10th—will get that dividend. When the stock opens on the 10th, it will be adjusted down by $1 from the 9th’s closing price. Anybody who buys on the 10th or thereafter will not get the dividend.

Another important note to consider: as long as you purchase a stock prior to the ex-dividend date, you can then sell the stock any time on or after the ex-dividend date and still receive the dividend. A common misconception is that investors need to hold the stock through the record date or pay date.

Ex-dividend dates are the single most important date to consider whenever buying a dividend-paying stock. Thus, we strongly encourage readers to use our ex-dividend calendar.

3. Record Date

The record date is simply the date where the company looks at its ledger and determines to whom they send the dividend checks (“the holders of record”). At present, the record date is always the next business day after the ex-dividend date (business days being non-holidays and non-weekends). This date is completely inconsequential for dividend investors, since eligibility is determined solely by the ex-dividend date.

4. Payment Date

As the name suggests, the payment date (or “pay date”) is the date on which a company actually pays out its dividend. Generally speaking, this date falls about two weeks to one month after the ex-dividend date.

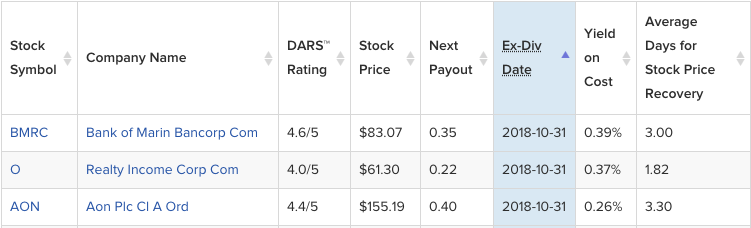

Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. Ex-dividend dates are extremely important in dividend investing, because you must own a stock before its ex-dividend date in order to be eligible to receive its next dividend. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, 2018.

Dividend Capture: Boring Idea to Dynamic Trading Strategy

Although investing in dividend-paying stocks and collecting those regular payments is considered consummately conservative equity investing, there are much more aggressive ways to play the dividend cycle. We want to emphasize that “aggressive” part — dividend capture is a type of trading and it carries above-normal risks and potential tax consequences.

In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins (or ends) that day. Likewise, the desire to reap the benefit of the upcoming dividend often spurs interest in the stock ahead of the ex-dividend date, leading to short periods of outperformance. For more dividend education, check out The Truth About The Dividend Payout Ratio.

In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. To harken back to the hypothetical ABC Corp, investors may notice that although ABC pays a $1 dividend, the stock only declines by an average of $0.50 on the ex-dividend date. That being the case, an investor can buy the stock on the day prior to ex-dividend (say, for $100), sell it on the ex-dividend date (say for $99.50), and collect the $1 dividend a few weeks later, leading to a total return of $0.50 on the trade (losing $0.50 on the stock, but gaining the $1 dividend).

A few words are in order about this strategy. First, because the stock is held for less than 61 days, the dividend is not eligible for the preferential tax treatment that qualified dividends get, though the capital loss on the stock trade offsets that to some extent. Second, this analysis does not include trading costs or the time value of money. If it costs more than $0.50 per share to do the trade and/or that money could earn more than $0.50 per share in interest, it makes no sense to do the trade.

There are more involved/longer-term dividend capture strategies as well. As some stocks do show a tendency to trade higher into the ex-dividend date, it can be possible to buy the shares ahead of time (sometimes even 61-plus days ahead, thereby triggering qualified dividend eligibility) and reap outsized returns by selling the stock on or before the ex-dividend date. Likewise, there are strategies involving options that take advantage of similar aberrations, but those are beyond the scope of this article.

The key to successfully executing the Dividend Capture Strategy is to find stocks that recover quickly after committing to a dividend payment and timing it right in order to minimize the risk from holding the stock. We’ve created a tool to help you do just that! Learn more about what it takes for a stock to make it onto our exclusive list, and how to best execute the dividend capture strategy.

Beware of the Risks?

So why doesn’t everybody capture dividends? For starters, academics will tell you that it can’t work — dividend capture is basically a form of arbitrage and market theory holds that savvy market participants will ensure that any “easy money” opportunities like this quickly vanish. To that end, it does seem to be the case that once people start widely discussing particular dividend capture stocks, those strategies seem to stop working.

Likewise, dividend capture is not a risk-free or cost-free strategy. The commission charges to get in and get out apply whether you make money or not, and investors pursuing dividend capture often find that they must execute the strategy across multiple names to diversify the risk. That ties up capital, which carries its own not-always-obvious costs.

The Bottom Line

Last and not least, this strategy takes a lot of work. It takes lots of research to find suitable candidates, it takes an appetite for risk to pursue the strategy, and it takes discipline and attention to detail to successfully execute. Capture is absolutely not a strategy for the “I’ll do it tomorrow” crowd, and quite frankly not all investors are going to find that the potential rewards (after subtracting the costs and those dividend capture attempts that fail) are worth the effort.

Dividend.com’s tools help investors make sound investment decisions. Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks.