Dividend stocks have become popular partially due to the fact that they are viewed as safe investments. Unfortunately in investing, there is always some risk involved.

Although many investors have been very successful with dividend stocks, others have lost money when share prices drop or dividends are cut. Since dividends are not guaranteed, if a company is experiencing problems, they often reduce or even completely suspend dividends.

Below we review 11 former big-time dividend players that imploded in recent years, sucking down billions of dollars in shareholder value along with them.

Be sure to also read the Top 10 Myths About Dividend Investing.

1. General Motors {% dividend gm %}

The General Motors Company is an American multinational corporation founded in 1908, and the largest automaker in the United States. GM paid reliable, consistent dividends for several decades during its glory days. In the mid-2000s, however, the company hit a major snag. With a dividend yield rising over 10%, the stock was seemingly still an attractive investment. After all, it had reliably paid a 50 cent dividend each quarter from 1997 to 2005. The reason for such a high yield? A sharply dropping share price. GM shares plunged from over $60 in early 2003 to under $20 in early 2006.

Unfortunately, all too many investors didn’t realize that eye-popping yield was simply too good to be true. In February 2006, GM cut its dividend in half to 25 cents per share. On May 15, 2008, the company paid its last 25 cent dividend. GM promptly suspended its dividend altogether, sold $4 to $7 billion in assets, and cut 20% of its salary costs to save billions of dollars. And still, some investors held on.

Then came the final blow. In 2009, GM declared bankruptcy. The stock price went to zero. Thankfully for its employees, the company was subsequently bailed out by the U.S. government. GM later became public once again in October 2011 on the NYSE, and on January 15, 2014 the company announced it would re-instate its dividend.

Read on for a more in-depth look at what led to GM’s downfall: How to Bankrupt a Multi-Billion-Dollar Company: General Motors.

2. J.C. Penney {% dividend jcp %}

J.C. Penney (JCP) was founded in 1902 and became famous for its catalogs and department stores. JCP initated its first quarterly dividend in 1987. The company increased its dividend until 2000 when it cut its dividend for the first time from 54.5 cents to 28 cents.

In October 2000, JCP slashed its dividend again to 12.5 cents. This payout amount remained unchanged until the company saw an upside in 2005. In 2006, JCP increased its dividend from 12.5 cents to 18 cents. Although JCP’s share price began to sink in 2007, the company boosted its dividend again to 20 cents per share. During this time, its share price tumbled, and JCP’s share price continued to fall 80% over the next two years. JCP suspended its 20 cent dividend completely in 2012.

Be sure to read on for a more in-depth explanation behind JCP’s downfall: The History of J.C. Penney’s Collapse.

3. Kodak

Eastman Kodak is a photographic and imaging equipment company that was founded in 1888. The company was very well positioned in the industry during the 1970s, but began to struggle in the 1990s when the print photo industry began to crumble. Kodak paid a quarterly dividend for several decades, hitting its prime in 1988 with a quarterly payout of 50 cents per share. The dividend amount later declined to 40 cents in 1994, but went up by 4 cents to 44 cents in 1997. For the next six years until 2003, the company paid consistent 44 cent dividends every quarter with an average of a 6.7% dividend yield.

In October 2003, the company cut its dividends by 43% to 25 cents quarterly, decreasing the dividend yield to 1.9%. Kodak reported that the drastic cut in dividends was due to a new company strategy that included increased investment in newer technology. The news brought Kodak’s stock down 18% in a single day.

Finally, in April 2009, Kodak announced that it would no longer pay dividends on its stock as a result of declining sales. In January 2012, the company, which had been struggling for years, declared bankruptcy.

4. RadioShack

RadioShack (RSH) was founded in 1921 and is an electronics retailer with locations in the United States, Europe, South America and Africa. RSH was acquired by Tandy Corporation in 1962, but was later divested.

RSH paid its first quarterly dividend of 3 cents in 1987. The company held a steady quarterly dividend with occasional increases until 2001. Weak sales in cell phones and computers hurt electronic retailers in 2000-2001, sending shares of RSH plummeting.

In 2002, RSH initiated an annual dividend while the share price continued to collapse, and RSH’s yield skyrocketed by 2012. In the second half of 2012, RSH suspended its dividend completely.

5. Barnes & Noble {% dividend BKS %}

Barnes & Noble was founded in 1917, and is the largest book retailer in the United States; in addition to books, the retail chain also offers magazines, newspapers, DVDs, graphic novels, gifts, games, and music.

BKS paid a quarterly 15 cent dividend from 2005 to 2008. In 2008, the company increased its dividend payment amount by 40% to 25 cents, averaging a 5% dividend yield at the time. After major competitor Borders declared bankruptcy, BKS suspended its dividend payments in February 2011 in order to save money to invest in digital strategies so that it would be better positioned to compete with leading competitor Amazon.com. The stock plunged some 69% in the two months following its dividend suspension.

6. Books-A-Million

Books-A-Million (BAMM) was founded in 1917 and operates bookstores in the United States in three formats, including: superstores, traditional stores and Joe Muggs Newsstands.

BAMM initiated a quarterly dividend of 3 cents in 2004 and raised its dividend every year until 2008 when it cut its dividend from 9 cents to 5 cents. With increased competition from companies like Amazon (AMZN), BAMM’s share price dropped.

The company paid its last dividend in 2011 after the company had officially become a penny stock.

7. Washington Mutual

Washington Mutual, also known as WaMu, was a savings bank holding company that was founded in 1889. The Seattle based company’s goal was to be the “Wal-Mart of Banking.” With this goal, the company’s target market was lower and middle class consumers that were not able to receive financing from other banks since they were considered too risky.

WaMu was at one time the largest savings and loan association in the U.S., building its fortune on the backs of subprime loans. Over the years, it steadily grew its dividend to 56 cents per share by the end of 2007, yielding over 5% at the time. But in December of that year, the bank, facing the implosion of the housing market and utter annihilation of its subprime mortgages, slashed its dividend to 15 cents.

Just over a year later, the company cut its dividend again to one penny a quarter. On September 26, 2008, WaMu declared bankruptcy, and JP Morgan acquired what was left of the company’s operations.

8. The McClatchy Company

The McClatchy Company (MNI) is a publishing company that focuses primarily on operating newspapers and websites. MNI was founded in 1857 when it published its first newspaper: The Sacramento Bee.

In the 1990s, MNI purchased several local newspapers. The company continued to make notable acquisitions in the early 2000s, including American media company Knight Ridder. These purchases helped the company maintain its growth in a tough industry, but MNI could only grow for so long. The company began to decline in 2005, but was able to maintain its 18 cent dividend until 2008 when it slashed its dividend in half.

In the first quarter of 2009, MNI suspended its quarterly dividend.

9. Citigroup {% dividend C %}

This New York based firm is among the largest financial services company in the world, operating in over 140 countries. Starting with 9 cents a share in 1998, the company paid increasing dividends every quarter for several years. By May 2003, the company’s dividend had increased to 23 cents, and then increased again three months later to 35 cents. In 2007, dividend payments for Citigroup were at an all-time high of 54 cents.

At this time, the subprime mortgage crisis was becoming more and more of a problem, resulting in the company cutting its dividends by 40% in the beginning of 2008 to 32 cents.

In October 2008, the dividends were sliced again by 50% to 16 cents, and then to just 1 cent in January 2009. The company chose not to pay a dividend for the next two and a half years. With its stock sitting under $5 per share in May 2011, Citi pulled some real financial chicanery, executing an almost unheard-of 1-for-10 reverse stock split. That move pumped its share price up to $45 per share, and it resumed a one penny per share dividend payout, which continues to this day.

10. Rite Aid

Rite Aid (RAD) is a drugstore chain in the United States that was founded in 1962.

Rite Aid initiated its first quarterly dividend in 1987. As the company saw growth during the mid ’90s, it was able to raise its dividend. Despite the dividend increases, RAD was not able to raise its dividend enough to maintain its attractive yield as its share price grew.

In 1999, RAD’s share price began to tumble and its dividend was suspended completely.

11. Bank of America {% dividend bac %}

Bank of America was founded in 1998 and the Charlotte, NC-based company serves consumers, small and middle market businesses, corporations, and governments. Since the 1980s, Bank of America paid regular quarterly dividends, which increased a couple cents every year, seeing its peak in 2007 and 2008 with a dividend of 64 cents a quarter. When the financial industry began to suffer and the company started declining in profit, BAC cut its dividend in half in December 2008 to 32 cents, and then down to 1 cent the following quarter.

Bank of America currently pays an annual distribution of 20 cents per share on a quarterly basis.

It’s not often that a company is forced to suspend its dividend, especially when that company emphasizes returning earnings to shareholders. It is even more rare to see a firm suspend its dividend only to be able to reinstate it further down the road. Though not a common event, there are a handful of companies that have been forced to halt their dividend for a period of time.

Below, we highlight some of the most famous dividend resurrections.

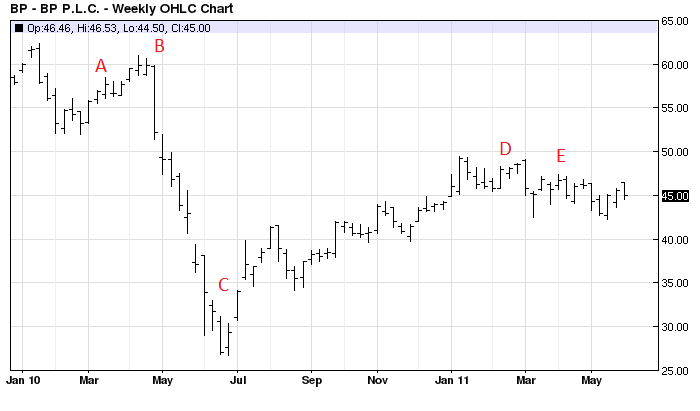

BP {% dividend bp %}

One of the most recent examples stems from BP and the 2010 Deepwater Horizon oil spill. That event, which took place in April, is currently the largest environmental disaster in U.S. history. Transocean (RIG) conducted the drilling for BP at the time of the accident, leaving the lion’s share of the blame to fall on the latter. Prior to the spill, BP had increased its payout 15 out of the 17 years it had maintained a dividend. The company made its final payment on 3/8/2010 of 84 cents per share and would not make another until 3/28/2011, when it paid out 42 cents per share.

- A – 3/8/2010 BP’s Final Dividend: Though nobody knew at the time, this would be the last dividend for BP for the next year.

- B – 4/20/2010 The Deepwater Horizon Spill: On this day a deadly explosion ruptured a deepwater well, allowing oil to flow freely into the Gulf of Mexico.

- C – 6/16/2010 BP Officially Suspends Dividend: The market looked favorably upon this move, as the stock jumped 1.36% on the day.

- D – 2/11/2011 BP Officially Reinstates Dividend: After strong earnings, the company announced a reinstated dividend.

- E – 3/28/2011 BP Pays a Dividend: BP made its first dividend payment in a year.

Due to the company’s large size and extensive operations, it was able to return to its dividend-paying ways, but its stock price took a major hit, sinking 54.9% following the spill. The litigation and lawsuits continued after the spill for several years, with the company paying out billions in fines to date.

American International Group Inc {% dividend aig %}

American International Group Inc is one of the largest insurance providers in the world, which made it all the more important when the company fell prey to plummeting CDOs and CDSs that it had purchased. A fair portion of those securities were backed by subprime mortgages and led to inevitable bankruptcy in late 2008 for the firm. In one of the first and largest “too big to fail” moves, the Federal Reserve stepped in and bailed out the firm for a hefty price tag of $85 billion, and this is when dividends were suspended.

- A – 9/15/2008 Collapse of Lehman Brothers: This is widely regarded as the event that set the financial crisis in motion.

- B – 9/19/2008 AIG Pays a Dividend: This would be the last dividend AIG would pay for five years.

- C – 9/23/2008 AIG Officially Suspends Dividend: The government bailout forced the company to suspend its dividend.

- D – 8/1/2013 AIG Officially Reinstates Dividend: After strong earnings, the company announced that it would bring back its dividend distribution.

- E – 9/26/2013 AIG Pays a Dividend: In its first dividend in 5 years, AIG paid out $0.10 per share to its shareholders.

Prior to the bailout, AIG had been a dividend-payer since 1992, with a strong history of increasing its payouts for shareholders. The company made its last dividend payout on 9/19/2008 for $4.40 per share. It would not be able to reinstate its dividend until 9/26/2013 when it made a distribution of 10 cents per share.

Ford Motor Company {% dividend f %}

Ford Motor Company is arguably one of the most popular names in automobiles across the globe, dating all the way back to Henry Ford and the revolutionary Model T. Fast forward to 2006 when the company was having trouble maintaining profitability and its dividend alike. In September of that year, the firm announced a major move in which it would cut 10,000 salaried jobs and shutter two plants with the goal of returning to profitability in 2009. This plan also included halting the company’s dividend, which had been decreasing in recent years as Ford had struggled to stay relevant.

- A – 9/5/2006 Ford Pays Dividend: In September of 2006 Ford made its last dividend payment for the next 6 years.

- B – 9/16/2006 Ford Officially Suspends Dividend: Later in the month, the company announced it would be halting its dividend and slashing jobs.

- C – 12/8/2011 Ford Officially Reinstates Dividend: In December of 2011, the company announced it would reinstate its dividend.

- D – 3/1/2012 Ford Pays a Dividend: On this day, the company made a quarterly distribution of $0.05.

Ford made its last dividend payment in September of 2006 for an amount of 5 cents per share. The firm would not reinstate its dividend until 3/1/2012 when it made a payout of 5 cents. The dividend reinstatement came as the company had effectively lowered its debts and had consistently generated positive earnings and cash flow.

The Bottom Line

The dividend stock world is littered with its fair share of recent disasters. The factors that led to the downturn of once mighty dividend payers vary greatly. Some companies simply failed to change with the times, while others have incompetent management to blame. Still others took on massive risks that eventually came back to bite them. Most of these companies exhibited at least one of the following signs before their massive dividend cuts: a sharply falling share price, or a lack of dividend raises over a long period of time. If investors do their homework and heed these warning signs, they should be able to avoid dividend blow-ups like the ones profiled above.