Financial “experts” are everywhere, each of them with a different mantra or method for getting rich. True, there are a number of people out there who have made bold investing moves and walked away with some serious gains, but for every story of someone making a large profit, there are dozens more of investing decisions that are utterly incorrect. Some make these bold calls simply because it draws attention and readership, making them more money; others truly believe in the calls they make, but still end up on the losing side of a major investment.

Even some of the most respected analysts make mistakes – it’s simply human nature. A careful, calculated approach to creating a balanced portfolio that suits your objectives is a far superior strategy than putting it all on the line for one call. To help our readers understand why listening to “experts” making bold and sometimes outlandish calls can be a dangerous strategy, we present 10 bull or bear market predictions that went miserably wrong:

10. Dow 30,000 by 2008

A book titled “Dow 30,000 by 2008: Why It’s Different This Time,” written by Robert Zuccaro has some of the most entertaining Amazon reviews you will ever come across. To be fair, Zuccaro was once part of a mutual fund team that achieved triple digit returns in 1998 and 1999, but his 2008 call was wildly inaccurate.

Not only did the Dow not hit 30,000 (a benchmark it is still a long ways away from), but 2008 began the worst financial crisis since the Great Depression and watched the Dow plummet more than 30%.

9. The Internet Will Have No Impact on Investing – Paul Krugman

In 1988, Long before his days as a Nobel Prize-winning economist, Krugman made a bold statement concerning the internet. Specifically, Krugman thought that the internet would have no greater economic impact than the fax machine adding:

“As the rate of technological change in computing slows, the number of jobs for IT specialists will decelerate, then actually turn down; ten years from now, the phrase information economy will sound silly.”

He attributed this theory to Metcalfe’s law, which states that the number of potential connections in a network is proportional to the square of the number of participants. Krugman would go on to win the Nobel Prize in 2008 and the internet would go on to revolutionize the investing industry and become one the most significant technological developments the financial world has ever seen.

Be sure to check out the Top 10 Tech Stocks That Pay a Dividend.

8. Dow to 36,000

This is another book that bit off a bit more than it could chew, as the Dow has yet to crack 20,000 let alone 36,000. Titled “Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market,” the book was published in November of 2000, not long before the early 2000s recession.

The book was co-written by James K. Glassman and Kevin A. Hassett. If that last name sounds familiar, it’s because Hassett was one of Mitt Romney’s main economic advisors when he campaigned for the Presidency, making the call all the more ridiculous.

One Amazon customer called the book the “best puppy cage liner ever!” as the book can be purchased for 1 penny and its pages used for resources other than reading.

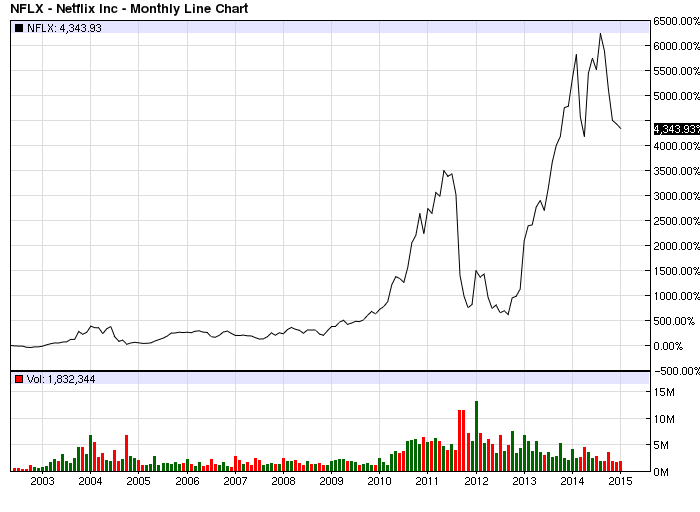

7. Netflix Overvalued

Tech stocks have long puzzled analysts and investors, as a number can trade at absurd price-to-earnings multiples and still continue to climb. That, among other things, prompted Paul La Monica to call out NFLX back in 2003, as he took a dive behind the company and warned investors of not picking a stock simply because “it’s cool,” as La Monica worried about it trading at 200-times earnings (which it still does today). At the time, Blockbuster was still a viable company and La Monica warned that its upcoming service “Filmcaddy” could take a bite out of Netflix and its earnings, along with Wal-Mart’s DVD service.

All to no avail. At the time La Monica wrote of his dissent, NFLX was trading at $10.98 per share; the stock is now trading above $300 per share, a gain of over 4,000%. And let’s not even mention NFLX’s all-time high cracked $450 per share.

6. Dow to Crash in 2013

Since the 2008 crisis, a number of pundits put their names into the headlines with calls for a double dip recession and an ensuing market crash. You can probably find a dire prediction published somewhere on the web today, as someone tries to title-grab readers for more views to their site or blog. So, no doubt this one caught our attention.

“Dow Could Crash to 3,000 in 2013: Author” is the title of this 2011 piece. This outlandish prediction came from Harry Dent, CEO of economic research company HS Dent and the author of the ambiguously titled book “The Great Crash Ahead.” Dent predicted in 2011 that the Dow would have a tough 2012 and eventually crash to 3,000 in 2013; the index has not been that low since the early 1990s.

As you already know, no crash ensued and the Dow went on to have its best year in over a decade, crushing bears who had hoped for the opposite.

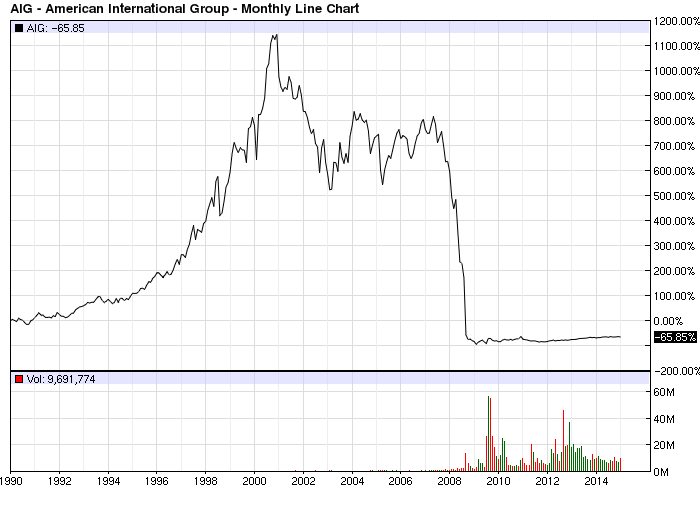

5. AIG Bullish on Its Credit Default Swaps

Heading into the 2008 Financial Crisis, AIG (AIG) had been prominently using Credit Default Swaps (CDSs), which had some investors uneasy as the instruments can be quite complex. The firm had this to say (in 2007) to alleviate investor anxiety:

“It is hard for us, without being flippant, to even see a scenario within any kind of realm of reason that would see us losing one dollar in any of these Credit Default Swap transactions.”

It turns out that the CDSs were the main cause of the company’s financial distress in 2008. Just a year after the reassuring comments, the company completely collapsed, suspended its dividend, and took a bailout from the U.S. government to the tune of $85 billion.

Be sure to also check out The Biggest Dividend Stock Collapses of All Time.

4. Naysaying the Google IPO

There are plenty of IPOs that investors wish they could have purchased, with Google (GOOGL) being one of the biggest hindsight regrets. Whitney Tilson may have the most regret, as he penned a 2004 article trashing the tech IPO, saying that leading search engines will likely not be able to maintain their market share:

“I believe that it is virtually certain that Google’s stock will be highly disappointing to investors foolish enough to participate in its overhyped offering — you can hold me to that.”

Since GOOGL’s first close (when it was just GOOG) the stock has been one of the most relentless tech companies of the past decade, with a virtual stranglehold on the search engine industry as well as numerous other business ventures. We are, however, still waiting on the company to pay a dividend.

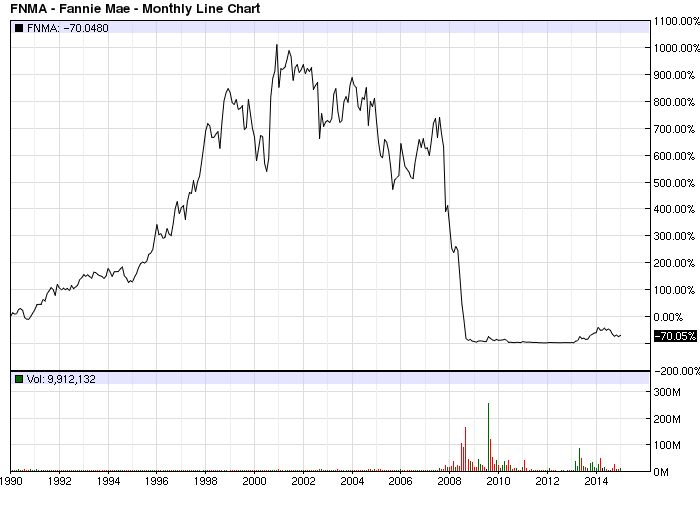

3. “Riskless” Subprime Mortgages – Fannie Mae

Putting one’s foot in their mouth seemed to be a trend around the time of the 2008 Financial Crisis and Fannie Mae was no exception, stating on 6/10/2004:

“These supbrime assets are so riskless that their capital for holding them should be under 2 percent.”

The subprime mortgages that Fannie were bundling and selling were toxic and became one of the most infamous causes of the 2008 crash. The company’s stock reflects that action and the government was forced to intervene to help out Fannie in 2008. Here’s what the stock did from the time the company made the above comments:

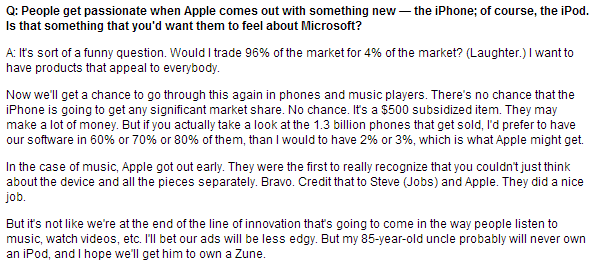

2. No Chance the iPhone Will Get Significant Market Share – Steve Ballmer

To be fair, Steve Ballmer, then CEO of Microsoft (MSFT ), was probably just being competitive when he stated that, “there’s no chance that the iPhone is going to get any significant market share. No chance.” But Apple (AAPL ) blew everyone out of the water with its iPhone device, which has seen numerous iterations and has become a staple release from the company each year.

Apple’s iPhone controls approximately 40% of the smartphone market and is one of the most alluring consumer products of the last decade. Microsoft’s phones, meanwhile, take up around 3%-4% of the smartphone world.

Be sure to read How Does Apple Stock React to Product Releases?.

1. Should I be Worried about Bear Stearns? NO! NO! NO! – Jim Cramer

This list would not be complete without an entry from Jim Cramer. Cramer has made his fair share of wise investing decisions, but he has also had a few epic flops. His most memorable comes from his call about Bear Stearns on March 11, 2008, just before the crash. When asked by a viewer if they should be worried about Bear Stearns, Cramer emphatically replied “NO! NO! NO! Bear Sterns is fine. Don’t move your money from Bear, that’s just being silly.”

Five days later (3/16/2008), after scavenging for and failing to get a loan from the Fed to remain liquid, Bear was purchased by JP Morgan (JPM ) for $2 per share, less than 7% of what the stock was worth the day before. When Cramer spoke on 3/11/2008, Bear was trading around $60 per share. The stock opened at just over $3 per share on Monday 3/17/2008 after JPM made the purchase over the weekend.

The Bottom Line

As demonstrated above, even the best of intentions (and in some cases the worst of intentions) can lead a financial prediction astray. It is an important lesson for investors to learn, as an investing decision should never be wholly based on one source or opinion. Compiling the facts, negative and positive, about a prospective investment and viewing each side of the coin is the best way to make an allocation for your portfolio.

Be sure to follow us on Twitter @dividenddotcom.