Apple (AAPL ) is one of the most popular stocks on Wall Street, as the tech giant is one of the largest companies in the world. Though its stock made quite a run-up in recent years, things were not always smooth sailing for AAPL; it certainly had its fair share of poor trading performances. Below, we outline the worst trading day that AAPL has ever seen and what caused the big loss.

Bullish euphoria remained a dominant theme for the first half of 2000 on Wall Street as investors desperately piled into stocks amid the stellar equity market uptrend at hand. In hindsight, the U.S. stock market had peaked by the middle of 2000, with the Nasdaq rolling over first among the major indexes in March, while the Dow Jones Industrial Average and S&P 500 followed suit by the end of the year. It was during this tumultuous stretch in Wall Street’s history that Apple Inc. saw its worst trading day of all time [see also The Complete History of Apple].

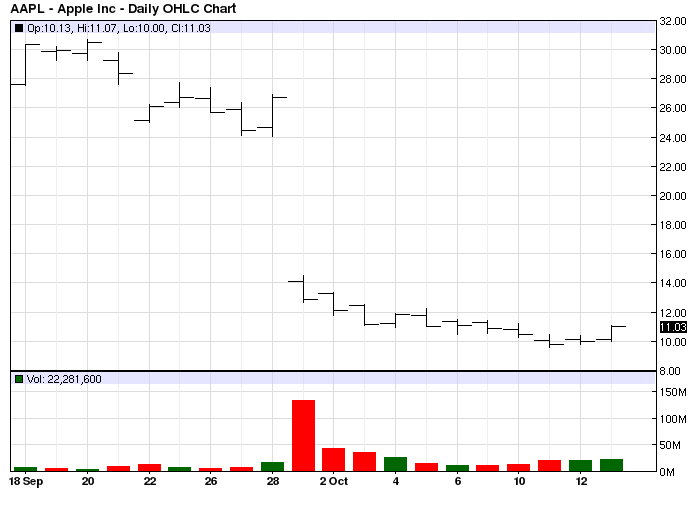

September 29, 2000: Apple Drops 51.89%

On September 29th, 2000, AAPL saw a massive one-day drop of 51.89%. The stock’s steep decline was due to a number of factors, which in hindsight combined to form a perfect storm of headwinds that proved too fierce for shareholders to deal with at the time. First and foremost, shares of Apple were fairly flat YTD at that point, following a meteoric rise of 151% the year prior in 1999; this in turn set the stage for a potentially nasty sell-off for the stock in light of it stellar gains up to that point.

Second, the company issued an early warning on Thursday, September 28th, 2000, after the closing bell, stating that its fourth quarter results would come in substantially below expectations. In retrospect, the stock’s stellar run-up leading to that day, and the early earnings warning sign combined to create a laundry list of reasons for shareholders to ditch the company and take profits.

As the trading bell rang on the morning of the 29th, investors fearfully jumped ship and shares of Apple dropped below $13 a share after closing at $26.75 the prior day, effectively slashing its market cap in half overnight.

Apple shares failed to rebound right away, even after such a steep sell-off; AAPL stock proceeded to decline 5.82% on Monday, October 2nd, and another 7.98% the following day.

The Mood of the Times

The mood during the year 2000 spanned from bullish euphoria to countless pundits calling “the top” amid the ever-expanding internet bubble. Apple’s early warning that its quarterly earnings would slump wasn’t the only concern permeating Wall Street at the time; semiconductor bellwether Intel (INTC), had reported the prior week that its revenue growth for the quarter could be as little as half what many analysts had projected. Apple’s sell-off sparked a flurry of analyst downgrades across the entire PC segment as many feared a gloomy macro picture would likely persist.

Steve Fortuna, an analyst with Merrill Lynch at the time, responded to Apple’s slump by downgrading the stock to “Neutral” from “Accumulate,” claiming the problems Apple was facing were ‘just the beginning’. He went on to say, “We believe there is a high likelihood that investors will overreact to this news and take down the PC names in sympathy. We would particularly view this as a buying opportunity for Gateway, and to a lesser extent, Compaq and Dell.”

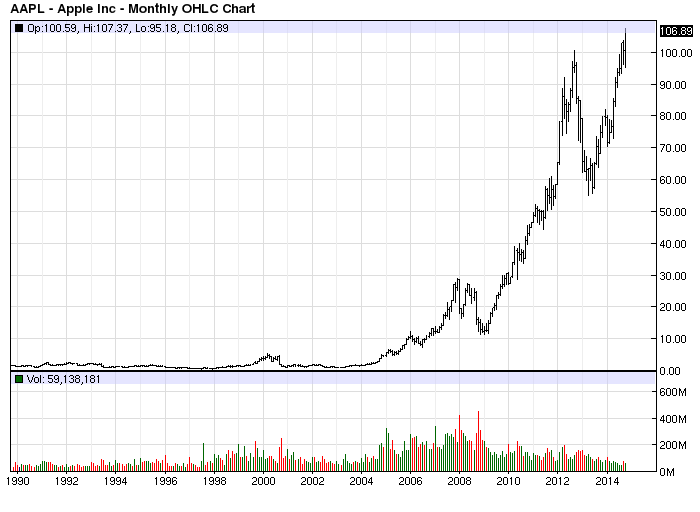

Shares of Apple proceeded to sink lower over the coming months and traded sideways with a downward bias through 2003 until finally breaking above $15 a share again in the second half of 2004 [see also 5 Charts That Put Apple’s Cash Pile in Perspective].

In retrospect, Apple has far outpaced all of the other firms cited in Fortuna’s note, and since its nasty sell-off on 9/29/2000, the stock hasn’t looked back.

The Bottom Line

As of the beginning of 2014, shares of Apple have gained a monstrous 4,345% since enduring their worst day ever on 9/29/2000. While few could have predicted Apple’s success when it was still a young “speculative tech stock,” the takeaway here is to do your homework and stick with your convictions; the market has a nasty way of testing our beliefs, and many times market hysteria can prompt even seasoned veterans to wrongfully abandon their convictions in the face of uncertainty.

Follow us on Twitter @Dividenddotcom