There’s a lot of credit card debt in the U.S; the average household with at least one credit card has nearly $15,593 in debt as of 2014. As a result, what we often hear about credit cards is how bad they are for our finances. To be fair, credit cards are designed to entice consumers to spend more – and more than they can afford. If they weren’t, the credit card business just wouldn’t be profitable. That said, a credit card can be a handy financial tool when used mindfully. This simple guide will provide some tips to help you enjoy the convenience of credit – and keep your cash too.

Choosing the Best Credit Card

There are legions of different credit cards out there with different types of features. That means choosing a credit card isn’t as simple as taking the first offer you get. In fact, it pays to check out various credit card offers and compare their interest rates (APR), fees, rewards and other features. Consider how you’ll use your card and then start shopping around to choose the one that’ll give you the features you need at the best price you can find.

The Federal Reserve is an excellent resource for information on how to analyze a credit card offer. In addition, sites like NerdWallet and CreditCards.com can help you compare different cards.

Understand APR

One of the key provisions of the Truth in Lending Act is that lenders must quote APR, or annual percentage rate, for all loans so that consumers can effectively compare loan offers. That’s a good thing, because understanding APR is simple. In essence, look for the lowest APR you can get. Here’s how it works: If your credit card has an APR of 20% and you charge $100 on it, you will pay $20 of interest on that $100 over one year. In one month, you’ll pay approximately 1/12th of that amount, or $1.66.

Where credit cards maximize this amount is by charging interest on interest when you don’t pay your bill. So, after one month, interest on your $100 will be calculated on 101.66. That same process will repeat month after month, which is how credit card debt can really get out control. The lower your APR, the less you’ll pay. The longer you wait to pay off your card, the worse your credit score will get.

Pay It Off

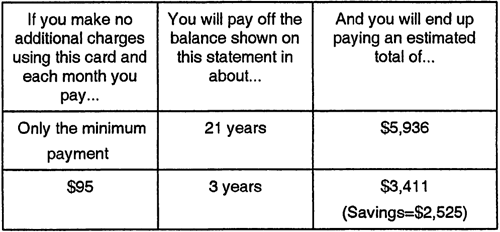

Now that you understand how credit card interest works, it becomes easy to see why paying down your balance is so important. New credit card legislation enacted in 2010 also forced credit card issuers to alert users to how long it would take them to pay off a balance if they made the minimum payment.

You can see this information on your credit card statements each month, below is an example:

Let’s say you have the average American credit card balance of $5,000 and an APR of 20 percent. Your minimum payment on this balance will be $100. The catch is that it’ll take you 49 years to pay off that balance, and you’ll pay more than $21,000 in interest doing it. That’s bad news for your budget, so if you can’t pay the full balance, pay more than the minimum – as much as you can. If you ever want to get out of debt, that is.

Calculate how long it’ll take you to pay off your own credit card balance using online credit card calculators)

Know Your Limit

When a credit card issuer approves you for a credit card, it will also provide you with a credit card limit based on your credit score and credit history. The higher your score, the more credit you’ll get. There’s nothing wrong with having a fairly high limit, because part of your credit score is based on how much of your available credit you actually use. Most experts recommend that you keep spending at about 30% of your limit. Therefore, if you often spend up to $1,500 on your credit card, it may be better to have a $5,000 or $10,000 limit than a $2,000 limit. A higher limit will also help prevent you from going over, which can trigger huge charges and significantly increase the APR on your credit card. Most credit cards allow you to check your balance online to ensure you aren’t running up a huge bill (and racking up additional fees as a result). Use this to stay on track with your spending.

Analyze the Annual Fee

A credit card annual fee is a yearly charge of between $15 and $300 per year that is charged on some credit cards. It’s easy to say that annual fees are bad news, but that isn’t the case for everyone. Some cards with an annual fee carry a lower interest rate. If you tend to carry a balance on your card, the fee might be a better bargain for you – although you’ll have to do the math to find out for sure. On the other hand, an annual fee can cancel out the benefits of credit card rewards. Evaluate the annual fee along with all the card’s other terms and features to ensure it’s a good deal, and a good fit for you.

Avoid Extra Fees

According to CreditCards.com, the average APR on a new card is right around 15%. Going over your limit or making late payments can boost that rate to well over 20%. But where credit cards get really expensive is in some of the other conveniences they offer. For example, if you withdraw cash from a bank machine, this “cash advance” carries an upfront fee of 2% to 4% of the amount advanced and has a higher interest rate than regular card charges. Worse still, there is no grace period, so interest begins to accumulate the minute the money is spit out of the machine.

Other additional fees can include:

- Late Payment Fees

- Return Check Fees

- Convenience Check Fees

- Foreign Transaction Fees

- Balance Transfer Fees

Be sure to read No Fee Banking: A Crash Course.

Consider Rewards

Rewards cards are big business, and they offer everything from free groceries to travel miles, and even cash. The key with these cards is not to allow your desire for a free gift to override your judgment. For example, if you carry a balance every month, a rewards card may not be for you because these cards often feature higher interest rates. A rewards card can also prompt consumers to spend more than they otherwise would, according to a 2010 study by the Federal Reserve Bank of Chicago. If, on the other hand, you own a business and can run expenses through a rewards card you pay off each month, you could stand to benefit from this type of card without much drawback.

Using a credit card is easy, but understanding the rules and fine print that come along with it is anything but. Some questions to ask are: So what does your credit card company have to do? And what rights do credit card holders have? Here we’ll take a look at both, because understanding the rules and your rights is the first step to ensuring that you don’t get stuck paying more than the law says you have to.

The Rules

Your credit card company has to tell you when it plans to increase rates and fees.

Your credit card company must give you 45 days’ notice before it increases your interest rate, makes changes to annual fees, late fees and cash advance fees, or makes other significant changes to your credit card’s terms.

Your credit card company has to tell you how long it will take to pay off your balance.

Under the Credit CARD Act, companies are forced to provide a more realistic picture of what the minimum payment would mean for cardholders by showing how long it will take to pay off the balance if only the minimum payment is made, as well as how much creditors will have to pay in order to pay off the balance in three years.

Your credit card company can’t increase your interest rate within the first year, and rate increases may only be applied to new charges.

When you open a new credit card, your credit card company can’t increase your rate for the first 12 months. When it does increase that rate, the new rate can only be applied to charges incurred after the increase. However, note that this rule will not apply if your card uses a variable interest rate tied to an index or the initial rate on your credit card is an introductory rate. Rates can also be raised immediately if you are more than 60 days late in paying your bill.

See also 50 Free Resources to Help Manage Your Money.

Your credit card company can’t charge you for exceeding your credit limit unless you agree to it.

If you want to be able to spend above your credit card limit–even by just a dollar or two–you must tell your credit card company. Otherwise, the transaction may be denied. If your credit card company does allow an over-the-limit transaction to go through, it can’t charge you a fee unless you’ve opted in to over-the-limit transactions.

Your credit card company can’t charge a fee that’s higher than 25% of the initial credit limit.

If your credit card includes fees such as an annual fee or application fee, the total of those fees in one year can’t be higher than 25% of the initial credit limit on the card. Note that penalty fees are not subject to this limit.

If you’re under 21, you can’t get a credit card unless you can prove you can make payments, or you get a co-signer.

If you’re under 21, you have to be able to show proof that you have enough income to pay your credit card bills, or get an adult to co-sign on the account. The days of credit card companies offering free gifts and food on college campuses are over; the law says they must stay 1,000 feet away if they’re giving things away to entice students to apply.

Your credit card company must mail or deliver your bill at least 21 days before it’s due and provide adequate time for you to pay it.

Your credit card company must mail or deliver your credit card bill at least 21 days before the payment due date and give you a fair chance to pay what you owe by ensuring that the due date’s the same each month and that the payment cut-off is no earlier than 5 p.m. on the due date. If your due date falls on a weekend or holiday, you must be given until the following business day to pay, without penalty.

Your credit card company can’t use a double-billing cycle.

Double-billing cycles compute finance charges on previous billing cycles, even if consumers have paid the balance in full. Fortunately, interest can now only be charged on credit card purchases made in the current cycle.

Your credit card issuer can charge no more than $25 for a late payment.

The Credit CARD Act capped late fees at $25. However, the fees can be higher if cardholders make a late payment more than once in a period of six months.

Your Credit Card Rights

You have the right to dispute credit card charges

Credit card holders have the right to dispute certain charges by sending a credit card dispute letter to the credit card company. Some of the things users can dispute include:

- An unauthorized charge to the card

- A charge for goods that were not received

- A charge for goods that were returned but for which credit was not received

- A charge for an incorrect amount

If you submit a dispute, your credit card company must look into it and send a response within 90 days. You do not need to pay the disputed portion of the bill until the issue is resolved. If the charge is canceled, you do not have to pay interest on that charge.

You have the right to be informed of credit card surcharges

As of January 27, 2013, retailers were given the right to charge consumers a surcharge of up to 4% for paying for goods with a credit card. However, stores that add a surcharge must alert consumers with a sign on the door. Laws prohibiting these surcharges also exist in 10 states, and may be enacted in more.

You have the right to a refund

If you happen to be carrying a cash balance on your credit card account rather than debt, you can keep it there to use later, or ask your credit card issuer for a refund. If you don’t make any purchases for more than six months, the issuer must send you a refund.

A Guide to Dealing With Credit Card Debt

If you’re deep in credit card debt, you’re paying a lot in interest just for the privilege of having that debt. If you’re looking at more than $10,000 in debt, you can be paying upwards of $2,000 per year, if you’re just making the minimum monthly payments, and even more if you’ve used your credit cards for cash advances. The bad news is that, unless you claim bankruptcy you’re on the hook for this debt; the good news is that there are options out there that will make it easier than carrying the debt for years and paying a fortune in interest payments. We’ll look at some options that are available for dealing with credit card debt, and what kind of scams you need to look out for.

Organizing Your Finances

To start, you’ll need to make a monthly budget, organize all of your expenses, and see where you can cut down so that you can start paying down debt more quickly.

In your monthly budget, figure out what expenses are necessities and what expenses are luxuries that you can do without. Look at food, clothing, electricity bills and entertainment as the primary areas where you can cut down on spending. As well, if you are currently putting aside money for retirement, it’s actually better to pay down your debt rather than continue saving. After all, if your debt is costing you 18% per year, and your retirement portfolio is earning 10% per year, it’s an overall loss. Once you’ve taken into account how much you have to pay down your debt each month, it’s time to prioritize your credit car repayments.

Categorizing and Consolidating Your Credit Card Debt

If you have balances on a number of different credit cards, go through your debts and figure out which cards are charging the highest interest, and whether there are any cards where you have taken out a cash advance. Prioritize paying these cards first. If you have any extra funds, they should be going to the cards that are costing you the most.

Be sure to read our Guide to Debt Settlement and Filing for Bankruptcy.

If your credit is still in OK shape, consider taking out a loan or line of credit to pay down all or part of your cards. Chances are that a loan or line of credit will give you favorable interest rates, and you will have consolidated your debts, and transferred all debt into a single debt that will cost you less over time; however, if you have this much credit card debt and have been holding it for a while, you may not be eligible to take on any more loans. Don’t worry, though, there are still options open to you.

Contact Your Credit Card Company or a Credit Counselor

Contacting your credit card company is a good move. These companies are usually willing to work with you to come up with a payment plan in order for you to completely pay off your debts. You will probably have to have missed a few monthly payments for them to work with you, but they will want to make sure they are paid back, and will not want you to file for bankruptcy, in which case they will get significantly less. Calling the card company and explaining your situation can lead to lower interest rates, a more flexible payment plan, or in some cases, an actual lowering of the balance you owe. Be warned, however, that this will affect your credit rating.

If you have more than $10,000 in credit card debt and are beginning to fall behind in making the minimum monthly payments, it may be time to seek outside help.

The main goal of the credit counselor will be to get your interest rate lowered on your credit card balance, reducing your monthly payments. You will often hear their strategy termed a “debt management plan.” What will happen is that you would be making your payments to the credit counselor, who will then pay off the creditors. This will affect your credit score as you will be tagged as being “on payment plan.”

You can visit aiccca.org or nfcc.org to find lists of companies to contact if you need assistance with getting your debt obligations possibly reduced. Some of the services are free, but there could be some fees involved. Credit counselors should be able to offer suggestions on how you manage your money and find solutions to your current financial problem, as well as develop a personalized plan to help you prevent future difficulties.

0% Balance Transfers

Though there definitely are resources to help you with your credit card debt consolidation, there are also things you need to be weary of. Consumers are constantly bombarded with credit card deals, especially balance transfer promos to get you to switch cards. These deals often aren’t actually what they promise to be.

The catch is that the transfer fee, which can be up to 5% of the amount transferred, gets placed on your card immediately. That raises your balance by 5% right off the bat, so you’ll need to do some math to find out what your actual savings will be, if any.

As in any credit card “deal,” the key is to read the fine print. If you happen to miss a payment, you could get slammed with late fees and dig yourself a deeper hole. Once the 0% introductory period expires, you might also be subject to significantly higher-than-average interest rates. Furthermore, your rates could be adjustable, meaning the company can raise them should interest rates begin to climb.

Instead of transferring your balance, a smarter move could be to call your current card company and inform them of your plans. You’d be surprised how willing to negotiate a credit card issuer becomes when faced with the prospect of losing a customer.

The Bottom Line

Credit cards can be a great tool in terms of convenience. The key is to remember that when it comes to credit, nothing comes for free. In order to get the best out of a credit card you have to choose it with care and handle it with common sense.