Colgate-Palmolive (CL ) is a prized stock and for good reason. With its high-quality brand portfolio, the company has generated steady earnings growth for several decades, and it has rewarded shareholders with rising profits and steady dividend payments along the way. On March 10, Colgate-Palmolive increased its quarterly dividend to $0.39 per share from $0.38 per share. The company has increased its dividend for 53 years in a row.

Indeed, many of the stocks with the longest histories of paying and raising their dividends over many years come from the consumer staples sector. Because of their popular products, high degree of earnings predictability, and dividend growth, consumer staples stocks like Colgate-Palmolive command premium valuations. Investors are willing to pay a higher relative price for Colgate-Palmolive because of its defensive qualities and attractive dividends. This has sent Colgate-Palmolive’s stock price higher, and its shares have significantly outperformed the broader market in recent years.

However, investors must consider whether Colgate-Palmolive’s stock price rally has gone too far. The stock appears overvalued on a valuation basis, both in terms of relative analysis and when compared to the S&P 500. While Colgate-Palmolive is a strong stock for dividend income, value investors should not view the stock favorably right now.

Is Colgate-Palmolive Overvalued?

Colgate-Palmolive’s tremendous dividend record is the result of its earnings growth for many years. Colgate-Palmolive’s large, diversified portfolio includes brands like Colgate toothpaste, soap brands including Palmolive and Irish Spring, and an animal health business under the Hill’s Science Diet brand. The stock has richly rewarded shareholders for many years. In fact, according to the company, the stock delivered a 1,021% total return over the 20-year period from Dec. 31, 1995 through Dec. 31, 2015. This handily beat the 383% total return for the S&P 500 in the same period.

In recent years, income investors have bid up prices for dividend stocks in a broader reach for yield. With interest rates sitting close to historic lows, investors are starved for yield. Stocks like Colgate-Palmolive are a haven for income investors and, as a result, dividend stocks now broadly hold above-average valuations. This is a problem in a context of slowing earnings growth.

Last year, Colgate-Palmolive’s GAAP earnings fell 35% year over year to $1.52 per share. On this basis, the stock looks severely overvalued. At its March 10 closing price, the stock trades for 44 times these earnings. However, viewing the valuation in this context is misleading. Colgate-Palmolive took a number of one-time charges last year which suppressed earnings, including a $1.29 billion after-tax charges resulting from the change in accounting for the company’s Venezuelan operations. This one-time charge amounted to $1.42 per share in lost earnings. As this charge is not expected to recur in subsequent years, investors should exclude this temporary item from valuation analysis.

Excluding all one-time items, Colgate-Palmolive’s non-GAAP adjusted earnings were actually $2.81 per share last year, which was down just 4% year over year. That is a much more accurate approximation of Colgate-Palmolive’s earnings power. Using the adjusted earnings figure, the stock trades for a more reasonable 24 times earnings. On a relative basis, this is not an extreme valuation. The S&P 500 Index trades for 20 times EPS, while the S&P 500 Consumer Staples sector is valued at 21 times EPS. Therefore, Colgate-Palmolive is modestly overvalued when compared to its peer group.

A Dividend Record That Is Hard to Beat

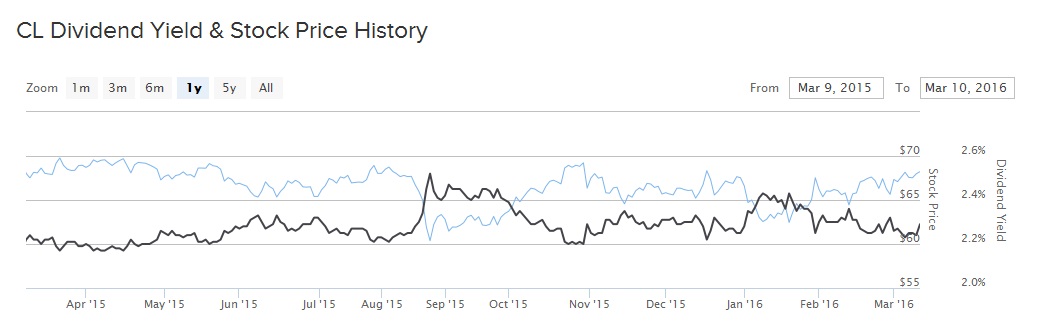

On an annualized basis, the new dividend rate is $1.56 versus $1.52 per share previously. At its March 10 closing price, Colgate-Palmolive’s new dividend yields 2.28%. Colgate-Palmolive has paid uninterrupted dividends on its common stock since 1895, an incredible streak that justifiably places Colgate-Palmolive in the good graces of income investors.

But Colgate-Palmolive’s dividend growth has slowed significantly in recent years. This year’s raise is the lowest dividend increase in the past decade and is due to its slowing earnings growth. The company is struggling to grow earnings in this difficult climate. It faces stiff headwinds from a variety of challenges including stagnating shipment volumes, weakening economic growth in the emerging markets, and the rising U.S. dollar which has eroded revenue generated from international markets.

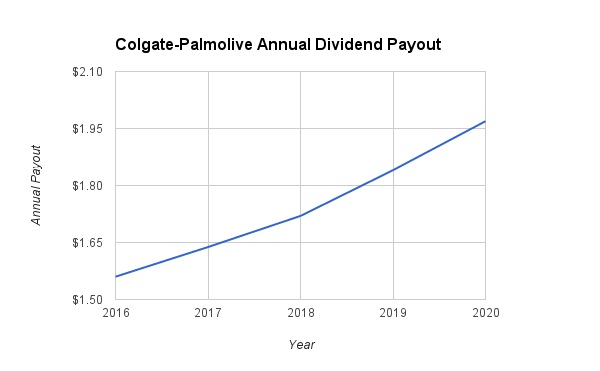

With this in mind, investors should price in modest dividend growth going forward. For the purposes of analysis, we are forecasting 5% dividend growth for the next two years. Assuming the difficult foreign exchange conditions ease at some point, we believe Colgate-Palmolive can grow its dividend by 7% in 2019 and 2020. This would take Colgate-Palmolive’s annual dividend to $1.97 per share in 2020.

The Bottom Line

There is little doubt that Colgate-Palmolive is a great stock for dividends and reliability. But whether the stock is an attractive investment opportunity right now is a different question. To answer this question, investors must take valuation into account. This is where the situation becomes less clear. Colgate-Palmolive, for all its attributes as a dividend stock, holds a premium valuation.

Colgate-Palmolive is an attractive income stock, but it is not a compelling value stock. Value investors should not commit to buying the stock until its valuation multiple compresses to a market multiple or below.