Introduction

Dividend.com analyzed the search patterns of visitors to our site during the past week ending March 14, 2016. Below, we give an analysis of how intelligently readers used Dividend.com to help them in their investment decision-making process by providing a breakdown of what was searched the most on Dividend.com ranked by volume spikes to ticker pages.

Special Dividends

Our Special Dividends Tool was trending last week as Symantec (SYMC ) and Equity Residential (EQR ) both recently announced special dividends. We told users last week that Equity Residential’s price drop was a good buying opportunity, as the stock only had the normal adjustment that every stock has post a special dividend announcement. Last week the stock was up 3%, and still looks good to go up by approximately 2% more, as it retraces back to where it was before the pre-special dividend announcement.

Special dividend announcements can be used as a fantastic trading opportunity if you know the underlying dynamics behind the movement.

Some rules which can be used to trade special dividends post the ex-dividend date are as follows:

- Look for a genuine special dividend announcement. This can be in the form of a cash influx that a company receives in the form of a stake sale or an asset sale which it wants to distribute to its shareholders. The special dividend could also be distributed because of great business that the company did in the most recent quarter or trailing 12 months.

- Once the announcement is genuine, look for the ex-dividend date in our Special Dividends Tool and jot it down. You can go short one day before the ex-dividend date expecting a huge price drop on the ex- date. The price would drop approximately the same as the special dividend payout. Cover your position after the price drops by the amount of the payout.

- You can also go long on the ex-dividend date and expect the price to go back up by the amount of the payout as the stock tries to achieve those price levels it was previously trading at.

- Make sure that when you go long, the stock is trading at its support level.

- Another confirmation for you to go long on the ex-dividend date is its valuation. If the stock was consistently trading at or around the price it was trading pre-announcement then you know that the market valued the stock at that price. If the fundamentals point towards a higher valuation that the stock should receive, but is temporarily not receiving only due to the announcement, then you know that you should go long.

All these rules were in practice in the EQR special dividend announcement.

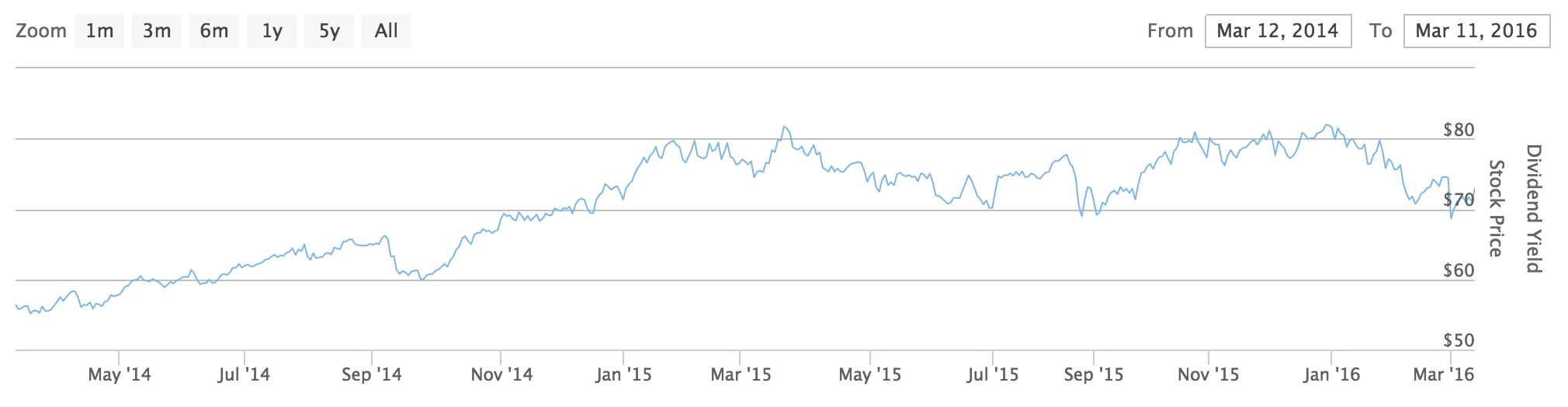

Source for the chart – Barchart

The above chart shows you that EQR consistently traded in the $75-$80 range in the last 2 months.

They recently sold a non-core asset (an asset not part of its primary business) which resulted in an influx of $6 billion to the company. EQR decided to pay the dividend out in the form of an $8 payout on the ex-dividend date of 3/1/2016.

EQR traded at a P/FFO of 23 assuming a $3.20 FFO guidance that the company gave for 2016 assuming a share price of $75 (which was pre-announcement). That valuation is at par with what REITs and dividend stocks are currently getting in the market. The announcement meant that the share price gapped down to $67 on the ex-dividend date. That resulted in a temporary valuation of 20.9, which is a significant undervaluation to what the company was getting pre-announcement.

Viewing the 2 year chart for EQR above, you can see that it has a solid support at $70. Another bullish sign for the stock to go up post the announcement.

Ford - Special Dividend

Another special dividend announcement was trending last week. Our complete coverage of the Ford (F ) announcement can be found here.

Digital Realty Trust

Digital Realty Trust (DLR ), our highest rated stock was trending last week as it hit a 52 week high of $85.81. The stock yields 4.11% with a payout of 88c per quarter.

Dividend.com has always maintained that DLR is a crown jewel for your dividend portfolio. With a 93% occupancy rate and an 80% retention rate, DLR has had an outstanding stock price performance as analysts become more optimistic about the company’s growth trajectory. Digital Realty has raised its dividend for 10 consecutive years, despite already being a high-yield stock.

While rising interest rates are a concern, Digital Realty maintains a sound financial position and is highly profitable. Demand for data centers and technology real estate is set to grow for many years. This should lead investors to believe that the stock can experience modest multiple expansion into next year. DLR’s 2016 FFO estimate are in the range of $5.45-$5.60. This results in a valuation of 15.5 at the lower range and 15.17 at the upper range. We believe Digital Realty can earn an FFO multiple of 15-17 times, which is closer in-line with its historical averages. Given this estimate there is more room for the stock to soon go in triple digits.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Each week, we’ll share search patterns from the previous week in order to assist you in making insightful decisions for your portfolio.