On Monday, May 16, the Dow Jones Industrial Average soared more than 200 points on news that Warren Buffett’s Berkshire Hathaway (BRK-A) purchased a stake in technology giant Apple, Inc. (AAPL ). According to Berkshire’s most recent 13F filing with the Securities and Exchange Commission, as of Mar. 31, it held 9.81 million shares of Apple, for an investment stake worth approximately $1 billion.

At first, the news of Warren Buffett’s huge investment in Apple stock could come as a shock, because the legendary investor has been vocal in the past about only investing in businesses that are easy to understand. Buffett has commented at length about the importance of knowing what you own. For that reason, he has historically shied away from investing in technology companies, which are often more speculative and volatile than his other investments like Coca-Cola (KO ) and Kraft Heinz (KHC ).

Why is Tech-Shy Buffett Buying Apple?

Upon digging deeper, it is rather easy to see why Buffett is appearing to have a change of heart. In many ways, Apple is as much of a consumer products company as it is a technology company. Apple’s business model is not difficult to understand, and its financial statements are fairly easy to comprehend. Moreover, one of the other key aspects Buffett looks for in a business is what he has referred to as an “economic moat”. That means, Buffett insists upon investing in best-of-breed companies with industry leadership positions. This helps insulate companies from the threat of competition, and protects market share.

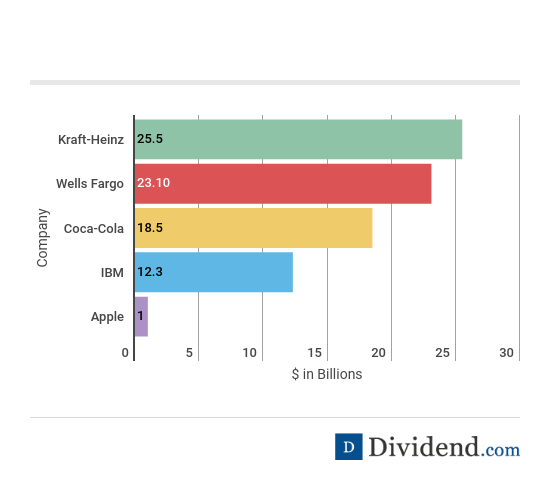

Apple has a very effective management team, along with one of the world’s most valuable brands. As a result, even though the smartphone industry is highly competitive, Apple enjoys some of the highest profit margins in the business. It is also worth noting that Buffett has invested in technology companies before, including Berkshire’s stake in International Business Machines (IBM ). In the latest quarter, Berkshire added another 198,000 shares of IBM, for a total investment of 81.2 million shares. That stake is worth approximately $12.3 billion, so it is clear that while Buffett typically is reluctant to invest in technology, he has set a precedent of significant investment in the sector.

In the context of Berkshire’s stock holdings, the investment in Apple is a relatively small bet. Here is how Berkshire’s Apple investment stacks up in comparison to its top four holdings, which are Wells Fargo (WFC ), Coca Cola, IBM, and Kraft Heinz.

Berkshire Hathaway Top Holdings

Apple: A Value Investor’s Dream

The other main reason why Berkshire Hathaway investing in Apple makes a great deal of sense is because Warren Buffett is perhaps the most famous value investor in history—and Apple is the epitome of a tremendous value stock. Apple generates massive free cash flow, high margins and has a tremendous balance sheet.

Even in a difficult year, in which Apple has struggled with the rising U.S. dollar and slowing economic growth in the emerging markets, Apple still generated $33 billion of free cash flow over the first half of the fiscal year. Apple is in a product lull in terms of the iPhone; the iPhone 7 will not be released until later this year. This matters because the iPhone represents approximately 65% of Apple’s total revenue. And still, Apple sold 51 million iPhones last quarter alone. In that time period, Apple earned $1.90 per share in profit on $50.56 billion of revenue.

Apple ended last quarter with $232 billion in cash, short-term investments, and long-term marketable securities on its balance sheet, and just $69 billion in long-term debt. Its tremendous balance sheet allows the company to create a great deal of value for shareholders through its capital allocation program. In April, Apple announced a 10% dividend increase and added $35 billion to its stock buyback program. In all, the company will raise its total shareholder capital allocation by $50 billion. Apple now expects to spend a total of $250 billion under its current capital return program, which will conclude at the end of March 2018.

Moreover, the stock is very cheap. Apple is expected to grow earnings per share to $9.92 next year, which means the stock is valued at approximately 11.5 times forward earnings for the company. This is significantly below the broader market valuation as indicated by the S&P 500. This indicates a cheap stock that is undervalued relative to the stock market. From a valuation perspective, the stock is attractive.

The Bottom Line

Warren Buffett is well-known for not investing in technology companies, which is why the news that Berkshire Hathaway has made a billion-dollar bet on Apple is so surprising. But Apple fulfills many of Buffett’s stated criteria for investment, including a world-class brand, effective management team and competitive advantages. In addition, Apple stock is very cheap, and as the world’s foremost value investor, it was only a matter of time before Buffett bought Apple stock.