PepsiCo, Incorporated (PEP ) is a food, snack and beverage company that serves over 200 countries worldwide. PepsiCo began originally with the creation of the company’s most popular soft drink, Pepsi-Cola, which was formulated in 1898 by Caleb Bradham, a New Bern, N.C. pharmacist. Pepsi-Cola then merged with the snack manufacturer, Frito-Lay Inc. in 1965 to create the PepsiCo, Inc. of today. PepsiCo is now a major player in the soft drink, non-carbonated beverage and snack business that consists of over 22 brands that each generate more than $1 billion in annual retail sales.

The company is helmed by President and CEO, Indra Nooyi, who has been with the company for over twenty years and has spent the last ten as CEO. Many analysts believe that Nooyi’s guidance has helped the company thrive in an otherwise challenging market environment, where consumer trends continually shift. She has helped transition the company to be predominantly soft drink-based to a diversified portfolio that includes healthier products. She has also kept shareholders happy by regularly returning a significant chunk of profits back to investors. In 2016, PepsiCo returned over $7 billion in the form of share repurchases and dividends.

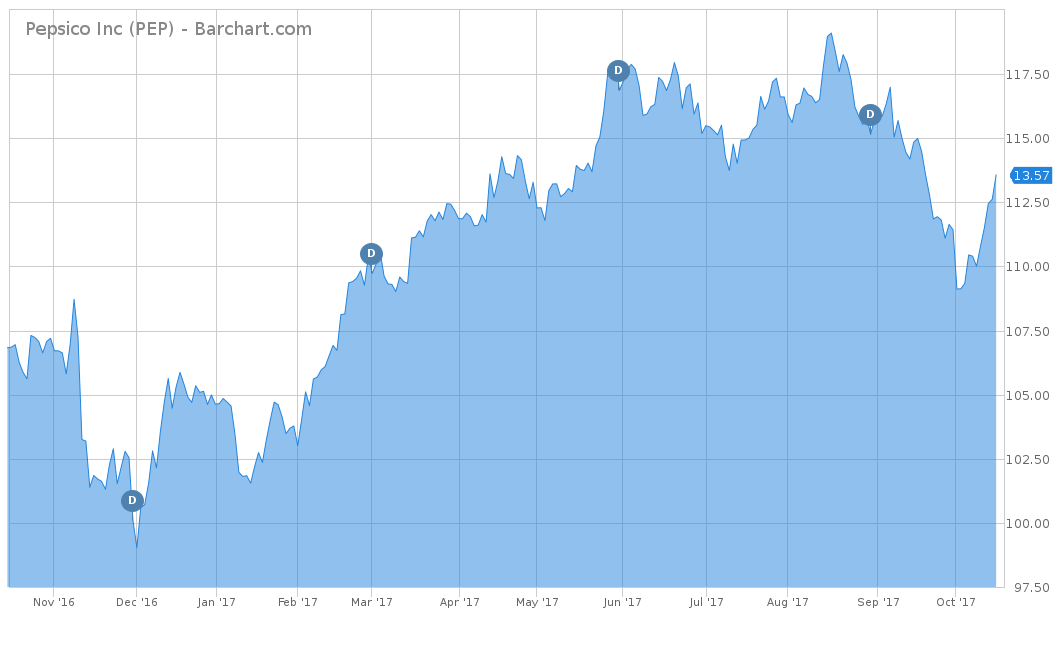

However, from a stock perspective, PepsiCo has been relatively underperforming when compared to the broad market indices. On a year-to-date basis, PepsiCo is up only 7.23% versus the S&P 500’s return of 14.32%. Compared to the company’s largest rival, Coca-Cola Co. (KO ), Pepsi has also vastly underperformed. In the same time period, Coca-Cola is up 12.19%. However, PepsiCo has been a more consistent investment over a longer term, with a cumulative return of 60.15% versus Coke’s 21.67% over the trailing five-years.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

PepsiCo’s diversified portfolio between drinks and snacks has kept the revenues consistent but stagnant at between $62.7 and $66.6 billion over the last five years. Over that time, the company has had an average revenue growth of negative 1.1%. Analysts don’t expect big growth in 2017 or 2018, with consensus coming in at $63.41 billion and $65.61 billion, respectively. If this is accurate, PepsiCo would see revenue growth of 0.97% and 3.46% in the next two years. In the third quarter 2017, PepsiCo did miss revenue expectations to report at $16.24 billion versus estimates of $16.31 billion as beverage sales declined in North America.

From an earnings-per-share perspective, PepsiCo has fared slightly better with a 1.6% average EPS growth rate over the last five years. In 2015, EPS dropped off by 14.1% from the year prior, but in 2016, EPS bounced back with an EPS growth of 18.8%. Analysts are very optimistic on the year-end total of 2017, with average estimates coming in at $5.22 per share, which would be a 19.7% increase. Analysts don’t expect as much of a jump in 2018, with averages coming in at $5.60, making it a 7.27% increase from 2017. On the third quarter 2017 earnings call, although revenues missed, earnings did not. Earnings came in at $1.48 per share versus $1.43 per share estimates.

On a price-over-earnings viewpoint, PepsiCo is currently reporting an attractive 22.8 and a five-year average of 21.8. This is lower than the S&P 500’s P/E of 25.5 and considerably lower than Coca-Cola’s P/E of 49.07.

Strengths

PepsiCo’s undoubtedly largest strength is its massive and diverse portfolio. With major brand names like Pepsi, Lays, Tropicana, Quaker’s and Gatorade, PepsiCo has a very broad-ranging customer base that extends from carbonated soda buyers to athletes. In an effort to grow its healthy line of products, PepsiCo has brands like Aquafina, SoBe Lifewater, Propel, Stacy’s, KeVita and Naked. As mentioned previously, 22 of PepsiCo’s brands each generate more than $1 billion of revenue each year, showing that even though consumer demand for soda may be on the decline, PepsiCo can still generate sales.

PepsiCo also has done an excellent job from an efficiency standpoint, which is probably the main cause of the company showing recent EPS growth while revenues staying unchanged. PepsiCo consolidated about 80% of its North American beverage system in 2010, which allowed the company increased control over packaging and deeper integration between its snack and beverage product lines. This efficiency provides almost $1 billion in synergies to PepsiCo’s bottom line. The company plans on continuing this efficiency initiative, with a continued annual target rate of $1 billion.

Growth Catalyst

PepsiCo’s largest growth catalyst comes from its continued strength in the snacks business, which is driven by new product launches and innovative packaging. This area of focus is a particularly large driver in areas outside of North America, such as Asia, Middle East, North Africa and Latin America. These areas have little saturation by competition and a population that has no current brand loyalty to any snack provider. Analysts believe that these regions can help the company grow at a mid-single-digit pace over the next ten years to contribute up to 26% of total sales by 2026.

The non-carbonated beverage business will also be another driver for growth. The company has changed its core-focus to “guilt-free” products that are more aligned with the current consumer trend of a healthier alternative. In an effort to expand in this non-carbonated area, Pepsi has established agreements to distribute brands like Starbucks and Rockstar Energy.

Dividend Analysis

One of the claims to CEO Nooyi’s tenure is her continually showing investors the importance of the dividend. The company has continued its dividend hiking trend during her tenure every year, which makes it 44 years in a row that PepsiCo has raised its dividend on an annual basis. Over the last five years, the company has seen an average dividend increase of 7.9% and most recently an increase of 7% this year. The company also looks to maintain its payout ratio in the 60s range, with its current ratio at 61.7%. The stock currently pays investors an annual amount of $3.22 per share, or 2.87%.

To see why PepsiCo is a Core Dividend stock, click here.

Potential Risks

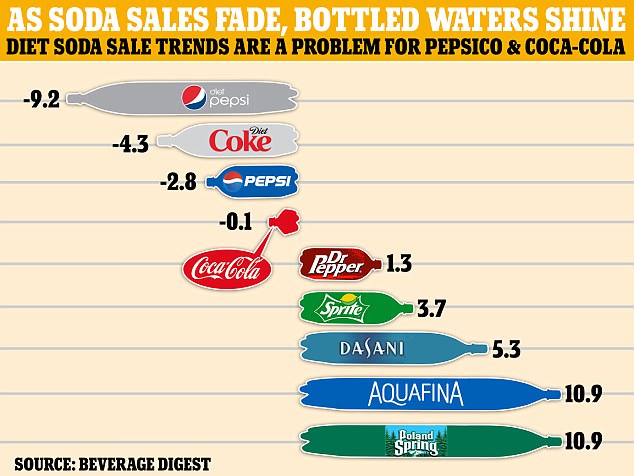

The largest risk to PepsiCo is that soda and other carbonated beverage sales are continually dropping. In 2016, soda consumption sunk to its lowest level in 31 years. This is also paired with the fact that bottled water is now the most popular U.S. beverage, overtaking soda’s long tenure as king.

However, health reasons are not the reasons why consumers are no longer drinking soda. The two most declining sodas of 2016 were Diet Pepsi and Diet Coke. Consumers are becoming more aware and more fearful of the effects of artificial sweeteners and aspartame, which are large components of the calorie-free diet sodas. However, if PepsiCo can continually shift its focus and offset the sales from the declining soda to the non-carbonated beverage and bottled water brands, it should stay relevant in the beverage industry.

The Bottom Line

PepsiCo faces a real challenge with soda continually falling out of favor with consumers. However, PepsiCo’s management has had the foresight to identify this trend and diversify the company’s brand portfolio with more favorable non-carbonated beverages and snacks. If PepsiCo can incrementally increase its revenues and earnings, it should have no problem continuing its trend of raising its dividend for a 45th consecutive year in 2018.

Check out our Best Dividend Stocks page by going Premium for free.