Lockheed Martin Corporation (LMT ) is a global and aerospace company that is engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. Lockheed Martin is based out of Bethesda, Maryland and employs more than 97,000 people at over 590 facilities in the United States and over 70 countries across the world. The company is the world’s largest defense contractor, with over $47 billion in sales as of 2016.

The company is divided into four divisions, with the largest revenue (over 40%) deriving from its aeronautics division. Aeronautics are led primarily by LMT’s fighter aircrafts like the F-22, F-16 and its biggest profit driver, the F-35. The second most producing division, with 27% of revenues, is rotary and mission systems. This segment designs, manufactures and supports military and civil helicopters and radar systems, and provides world-class systems integration, training and logistics support. The remaining portion of the company’s revenues come from the missiles and fire control and space systems divisions.

On a year-to-date basis, LMT’s stock has outperformed the major indices with a return of over 25%. This return is also in the middle of the pack when compared to other aerospace and defense companies. On a year-to-date basis, Northrop Grumman Corp. (NOC ) is up 29.2% and General Dynamics Corp. (GD ) is up 15.38%. For the trailing five-years, LMT’s stock has again outperformed the major indices with a total cumulative return of over 253%, but again remains in the middle of the pack, with NOC gaining over 372% and GD gaining just over 220%.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, Lockheed Martin has seen little movement in revenue growth, with an average of 0.3% over that time period. However, 2017 looks to be a breakout year for the defense company, with analysts projecting year-end revenue to total at $50.65 billion, a 7.22% increase from 2016. However, they expect 2018’s growth to be more stagnant, with only an increase of 1.26% to $51.29 billion.

Where Lockheed Martin really shines is on an earnings-per-share basis. Over the last five years, earnings have grown an average of 9.5%. However, most of this came from the big increase in 2016, when the earnings-per- share metric skyrocketed over 52% from year to year. However, this was an anomaly because Lockheed divested its Information Systems & Global Solutions division, creating a cash flow infusion of $1.2 billion during the year. However, analysts believe the EPS for Lockheed will come back down as they estimate 2017 to finish the year at $13.10 per share, which would result in a 15.48% decline from 2016 figures. At present, analysts expect a moderate uptick from 2017 to 2018, with estimates at $13.40 per share or an increase of 2.29%. Again, outside of the outlier figure in 2016, both the 2017 and 2018 EPS estimates are an indication of Lockheed Martin’s slow and steady earnings growth.

On a price over earnings multiple, LMT currently has a 25.30, which is slightly below that of the S&P 500’s 25.58. However, its P/E is higher than the measures of its competitors, like Northrup Grumman’s P/E of 22.40 and General Dynamic’s P/E of 19.78. However, the P/E is still reflecting 2016’s high earnings multiple and it should fall closer to its five-year average of around 15.9.

Strengths

One of the reasons why Lockheed Martin has seen such excellent stock appreciation paired with steady earnings and revenue growth is due to a solid management team. The current CEO is Marillyn Hewson, who took over for Robert Stevens in 2013. Prior to being CEO, she held 18 different leadership positions with the company and has over 30 years of experience. Management also continues to return value to its shareholders, as displayed by returning over $2 billion in dividends in 2016 as well as raising dividends by 10% in the third quarter of this year for the 15th consecutive year in a row.

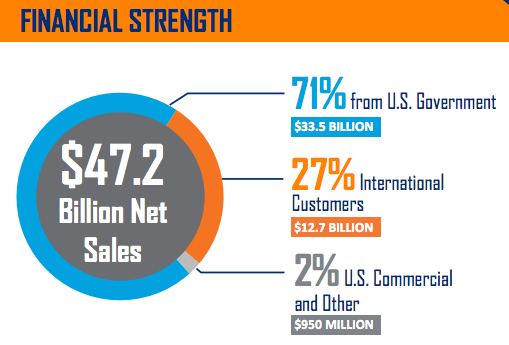

Another major strength for Lockheed Martin is its expertise when dealing with government rules and regulations. As a result of this expertise, LMT gets 71% of its sales directly from the U.S. Department of Defense and other U.S. government agencies. With decades of working with the government, Lockheed has strong intangible assets and long-term relationships that solidify its contracts with little to no competition. This provides a reliable source of revenue for Lockheed Martin on an annual basis.

Growth Catalyst

Lockheed Martin’s largest growth potential comes from its F-35 flagship fighter plane, which is called the “Lightning II.” The F-35 is currently sold to 12 different countries in the world and differentiates itself from other jets by incorporating a high level of stealth technology, paired with the ability to take off in both conventional and vertical fashion. In 2016 alone, the F-35 accounted for 23% of the company’s total annual revenue, with the sale of 46 aircrafts. Lockheed Martin believes these sales will only grow stronger, with the U.S. projected to grow its total fighter plane inventory from 2,443 to 2,800.

Dividend Analysis

As mentioned previously, Lockheed’s management is committed to rewarding its shareholders with dividend increases. After last quarter’s earnings report, management raised its quarterly dividend by nearly 10% to $2.00 per share, or $8.00 on an annual basis. This is equal to a 2.56% current dividend yield and much higher than that of both Northrop Grumman’s and General Dynamic’s current dividend yields. Management has made it a point to reward shareholders with a 10% or greater dividend increase for the last 15 years in a row. If Lockheed continues to see growth with its F-35 sales, expect another double digit dividend hike in 2018.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 10 consecutive years, in our 10 year dividend increasing stocks page.

Risks

The biggest risk to Lockheed Martin is its dependence on the outcome of the defense budget in fiscal 2018. Fiscal 2018 began on October 1, 2017 with a minor reduction in defense budget from current funding levels. At the same time, all defense spending is currently operating under a continuing resolution.

If Congress continues to disagree and not find an agreeable solution for the budget, then a possible U.S. government shutdown could occur and put a halt to defense spending. However, it is more likely that Congress will just extend the continuing resolution well into 2018, thus keeping the current contracts with Lockheed Martin status quo.

The Bottom Line

Overall, Lockheed Martin has seen great stock appreciation over the last five years and on a year-to-date basis. However, with the stock currently trading slightly below its 52-week high of $322.19, the company needs to show a dramatic increase in sales or earnings to break through to all-time highs. According to Morningstar analysis, F-35 Lightning II sales look very promising as the flagship fighter jet is expected to eventually be responsible for nearly 70% of its aeronautic sales. But this will only happen if Congress maintains or increases the United States’ budget on defense spending.

Check out our Best Dividend Stocks page by going Premium for free.