Chevron Corporation (CVX ) is a major energy conglomerate that is active in more than 180 countries around the world. Chevron is the seventh-largest oil and gas company according to its 2017 revenues, which were over $141 billion. The company specializes in the exploration, production and refinement of oil and gas with facilities in the United States, South Africa and Asia.

Chevron can trace its roots all the way back to 1879, when a group of explorers and merchants established the Pacific Coast Oil Company. Years later, in 1906, the company merged with Iowa Standard and formed the Standard Oil Company of California. Over the next seventy years, the company grew both throughout the U.S. and the world. In 1977, the company made a major organizational change when it formed Chevron U.S.A. Inc., merging six domestic oil and gas operations into one for major brand name recognition.

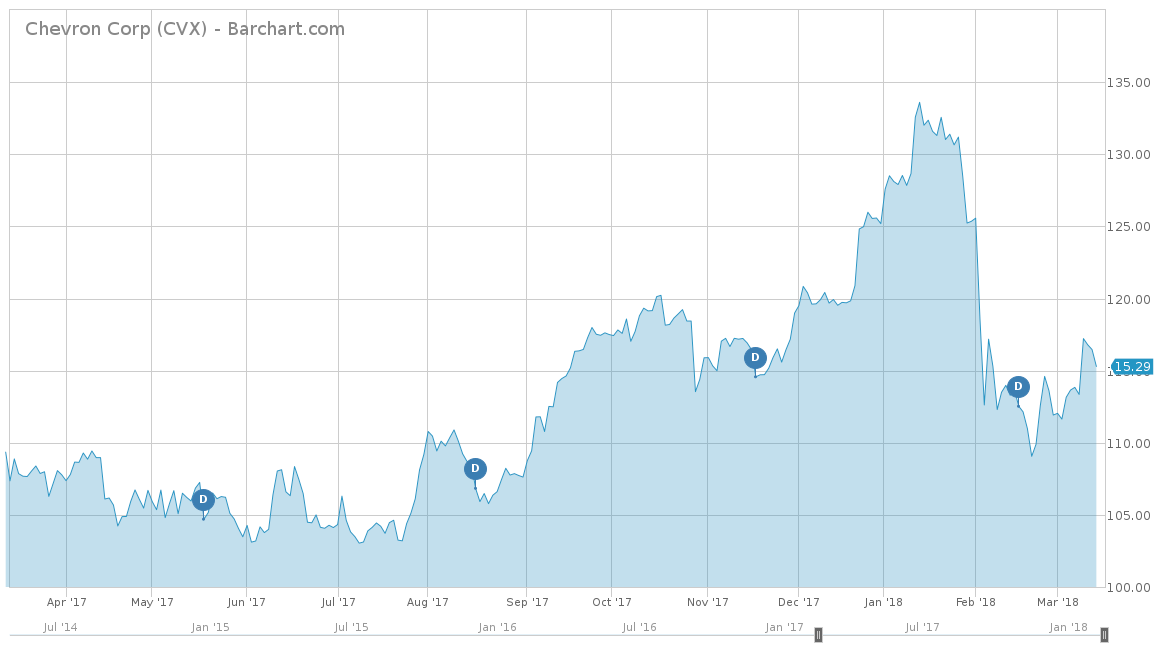

On a year-to-date basis, Chevron’s stock price has underperformed and is down 8.04%. CVX has also underperformed in the longer term, with a positive return of 7.24% for the trailing one-year and a negative 4.06% return for the trailing five-years. The S&P 500 Index has outperformed CVX in all three time periods, with a 2.84% year-to-date return, a 16.24% for the trailing one-year and up 75.88% for the trailing five-years. However, when compared to Exxon Mobil Corporation (XOM ), Chevron looks much better. On a year-to-date basis, Exxon is down 12.0%, down 9.12% for the trailing one-year and down 18.07% for the trailing five-years.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years Chevron has struggled to grow its revenues, which declined at an average rate of 10.1%. Chevron has seen a decline in its revenues in every year since 2012. However, 2017 finally turned the corner and revenues increased from $114 billion to over $141 billion, representing an increase of over 23%. Analysts believe that Chevron will continue its growth in 2018 with an estimate of $163 billion, equal to a 14.47% increase. However, 2019 does not hold the same story, as analysts expect a decline of 2.48% or $159 billion.

On an earnings-per-share basis, Chevron has also not performed well. Over the last five years, Chevron has had an average EPS growth rate of negative 18.3%. The biggest drop off was from 2016, when CVX reported negative earnings of $0.27 per share, a decline of over 111% from 2015. However, 2017 also proved to be a bounce back again for Chevron’s EPS measures. In 2017, CVX reported year-end EPS of $4.85 per share, its best reading since 2014. Analysts are optimistic for 2018 as well, with estimates of $6.36 per share. However, analysts feel that 2018 will be a tough act to follow and estimates for 2019 are reporting at $6.12 per share. This represents a decline of 3.77% in 2019.

On a price-over-earnings multiple, CVX currently has a 17.79, which is below that of the S&P 500’s 25.87. However, CVX has a higher P/E than Exxon, which currently has a multiple of 16.10.

Strengths

Chevron has established one of the leading oil portfolios in the world, topping in both margins and return on capital. The company has seen new production from the Gulf of Mexico, Permian Basin, West Africa and Australia to a total of 2.728 million barrels per day of oil. The exploration segment of Chevron saw a 67% drilling success rate last year, which added 1.6 billion barrels of oil. Chevron has also begun to benefit from its liquified natural gas projects, the Gorgon and Wheatstone, which will eventually create 400,000 barrels of oil per day in 2018.

During 2018, the company plans to invest approximately $1.1 billion in exploration activities and to drill 25 exploration and appraisal wells worldwide. The program primarily sustains continued exploration and appraisal efforts in the Gulf of Mexico off the U.S. coastline, Western Australia and West Africa, and in shale and tight resource plays in the United States, Canada and Argentina.

Growth Catalyst

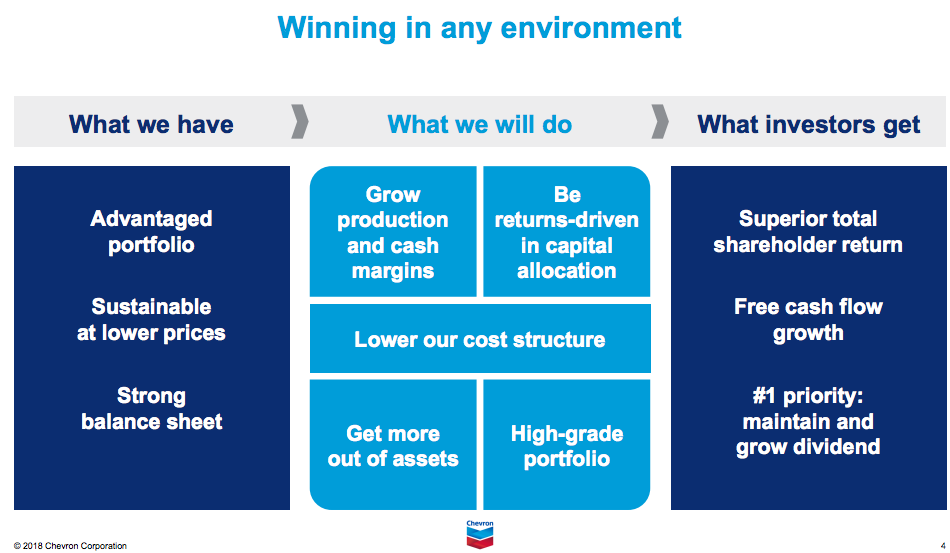

The biggest growth comes from the breath of fresh air from the newly appointed CEO, Mike Wirth. During Chevron’s most recent analyst meet, Wirth thoroughly explained the company’s new focus to cut costs and capital spending while increasing production and free cash flow. Chevron has a projection of $14 billion in free cash flow for the year, which would provide more than enough cash to support the dividend and possibly a share repurchase program, which the company had moved away from for several years.

Management has mentioned that the repurchase program will be for the longer term, especially if oil prices remain stable at their current levels. With the new CEO directly impacting Chevron’s bottom line and bringing back its repurchase program, the stock price should see an uptick over the next year.

Dividend Analysis

Chevron stock has a yield of 3.93%, which is a higher yield than the major integrated oil & gas industry average of 3.13%. The company pays its dividend on a quarterly basis to equal a total annual amount of $4.48 per year. One of the real draws to Chevron is that even with the price fluctuations of oil over the last few years, the company has continued to raise its dividend for the last 32 years in a row.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

One of the biggest risks to Chevron, like in all energy companies, is that both profits and cash flow are tied to the price of oil and gas. If oil prices drop like they have in the past, Chevron will have difficulty generating growing revenues if margins keep narrowing. However, if oil can maintain its current price levels, expect Chevron to continue its growth as it saw in 2017.

The Bottom Line

With a new CEO who has clear plans to cut costs while ramping up production, Chevron looks to be on the right path to succeed. With 2017 finally showing both revenues and earnings growth, Chevron should also see growth from its new production discoveries, especially with the Gulf of Mexico. If earnings continue to grow on a regular basis, expect management to begin its share repurchase program sooner rather than later. This, combined with Chevron’s long history of hiking its dividend, should make the stock more attractive for investors who have given up on the energy sector.

Check out our Best Dividend Stocks Page by going Premium for free.