Apple Inc. (AAPL ) is a company that needs no introduction, thanks to its timeless branding and innovative products. Starting as a computer company in 1976, Apple today sells a variety of products like consumer electronics, computer software, hardware and online services. Based in Cupertino, California, Apple is most known for its iPhone, iPad, iPod and Mac products, which have all become household names.

On Tuesday, May 1, Apple released its second-quarter (Apple’s fiscal year 2018 runs from October 1, 2017 through September 29, 2018) earnings report and beat expectations on both revenue and earnings. More importantly, the company just announced another $100 billion of share repurchases and a 16% increase in dividend, thanks to the savings incurred from the new tax reform changes. Upon release of the news the following day, the stock shot up over 4.5% as several analysts have increased.

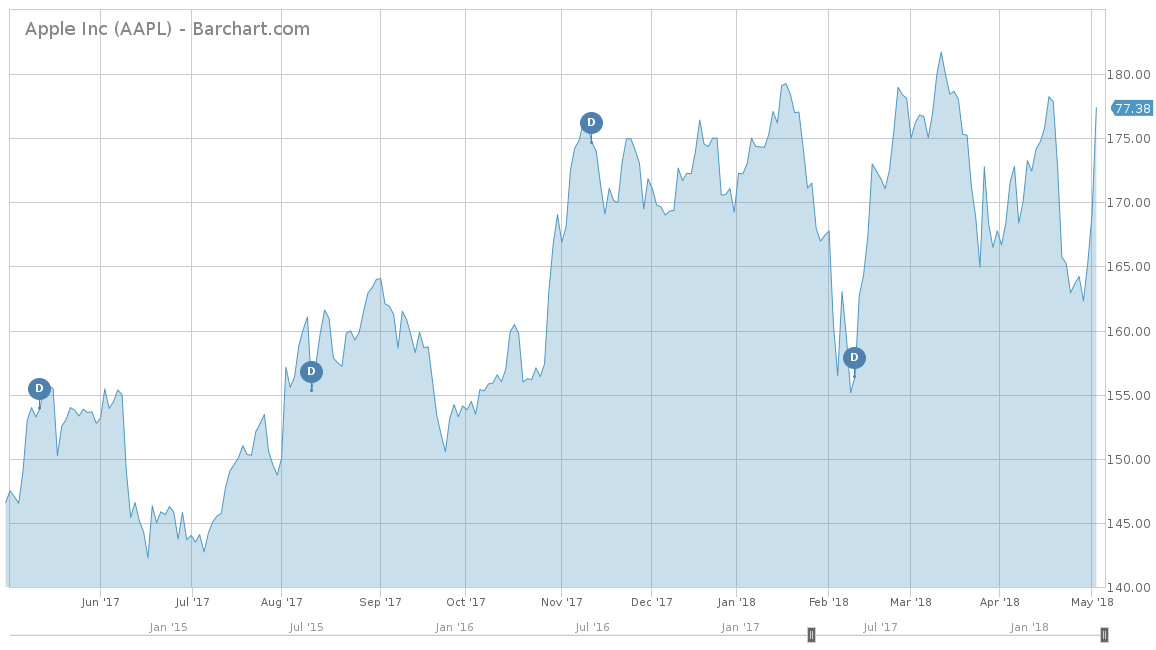

On a year-to-date basis, Apple has fared really well in comparison to the S&P 500 and is up 4.72% versus the S&P 500’s return of negative 1.23%. Over the trailing one-year, Apple has had an excellent return of just over 20%, which was nearly double the return of the S&P 500. Over the long term, Apple has been one of the best performers in the marketplace, up more than 175% over the trailing five-years. This is more than two and half times the return of the S&P 500 during the same timeframe.

Fundamentals

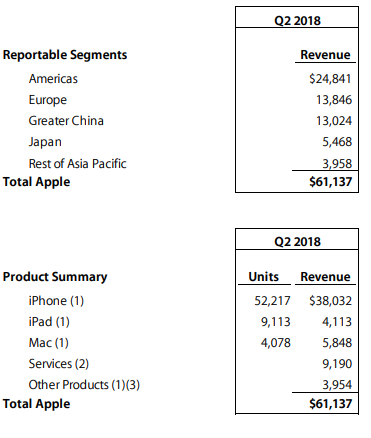

Over the last five years, Apple has had excellent revenue growth with a five-year average of 7.9%. In fact, Apple has seen positive revenue growth every single year since 2013, with the exception of 2016, during which the company struggled with its first decline of iPhone sales. However, it was able to bounce back in 2017, with a 6%+ revenue growth rate. As mentioned previously, Apple just beat its revenue expectations in the first quarter of 2018 with $61.1 billion revenues. Although analysts were expecting 53 million of iPhone shares during the quarter, Apple sold just a hair below at 52.2 million. However, the company saw an unexpected boost in revenue from its services business, which helped offset the slight iPhone performance. Moving forward, analysts believe that Apple will finish the year at $260 billion in total revenue for 2018, making it a 13.5% increase. Same goes for 2019, where analysts will see revenues touching nearly $270 billion, representing a modest increase of 3.5%.

From an earnings-per-share perspective, Apple has again been a stellar performer with a five-year average earnings growth rate of 7.9%. Like its revenues, the only decline was in 2016, but the company quickly bounced back with a 10.8% earnings growth in 2017 to $9.21 per share. Analysts are even more optimistic with Apple’s earnings due to the increased tax savings, and in fact, the company is looking for another buyback. The second quarter of 2018 has set the tone, with earnings beating expectations. Expectations are that Apple is estimated to close out 2018 with total earnings of $11.40 per share, a more than 21% increase. Analysts expect Apple to continue its pace but not nearly as high with a 10.79% increase in 2019 to $12.63 per share.

To discover more investment ideas, visit our Dividend Investing Ideas Center.

Strengths

The strength from Apple is primarily based on its ability to keep its customers loyal to its brand. The company does this by having compatibility across all of its products, making it easier for Apple customers to adapt to new Apple products. For example, an iPhone user would be more keen to set up an iTunes account to play their music. This would easily migrate to an iPod or iPad, without having any issues with setup or transfer. All of these products could also easily pair and communicate with a Mac, Apple TV or the new Apple HomePod. Generally, when Apple has one product with a customer, the chances of staying with the Apple brand is very likely.

However, most of these products tend to relate to how well the leading revenue generator, the iPhone, is doing. If iPhone sales are dwindling, it could lead to issues with its future products if consumers are beginning to switch to the Android-based competition.

Growth Catalyst

With Apple, growth is always unexpected due to the company’s innovative past. No one could have foreseen the success that a computer company would have when it first released the iPhone. However, the company now has the troublesome task of keeping up with its own groundbreaking past, as some analysts believe that if Apple isn’t coming out with the latest and greatest technologies, the stock will plummet.

With that in mind, Apple is seeing a lot of its recent growth from its international markets. As of the last quarter, nearly 60% of the company’s total revenues came outside of North America. Although North America saw a nice 17% gain in year-over-year revenues, both China and Japan saw its revenues grow 21% and 22%, respectively. What is more promising is that China has now has seen $13+ billion in revenues over the first two quarters of 2018, with plenty of upside potential.

Another area of growth for Apple is the potential growth within its services division. Last year, the services division saw a 31% growth in revenue to surpass the $9 billion mark. Although Apple does not specifically break down this segment, Apple now has 1.3 billion users who could all benefit from some of the services. Purchases from the App Store have been receiving record-pace revenue growth and now average $58-per-user.

Paid subscriptions recently increased by 100 million on a year-over-year basis to total $270 million total. Apple Pay is continually gaining traction, as consumers are becoming more comfortable using their phone as a form of payment. Apple Music just announced it now has 40 million subscribers, making its growth comparable to Spotify. Finally, AppleCare subscriptions also saw the highest growth in five full quarters. With all the different revenue streams and its continually growing customer base of 1.3 billion, expect the services segment to help drive future growth for Apple’s bottom line.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Dividend Analysis

One of the best features of owning Apple is that investors get a growth stock that also happens to pay a decent dividend. Since 2012, when Apple first announced it will pay a dividend again, the company has raised it every single year. Most recently, the company raised it 16% to a quarterly distribution of $0.73 per share. On an annual basis, this equals $2.92 per share for a yield of 1.65%, which is above the technology sector average of 1.09%.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

Apple has a variety of risks to its future, such as consumers switching away from the iPhone to an Android-based competitor.

For the near future, the biggest risk is the ongoing trade turmoil between the U.S. and China. As mentioned, Apple’s largest growth potential is the untapped Chinese marketplace. Apple has been gaining momentum in this regard but has not nearly reached the saturation level it has achieved in the U.S. This is so important that even CEO Tim Cook visited the White House earlier this month to discuss the ongoing issue and how important its success is to Apple. If the U.S. and China trade relations continue to worsen, this could be a major risk factor to Apple’s growth.

Another risk for Apple is that the company has shifted to a more mature company versus the high-growth stock that investors have become accustomed to. Part of this is due to the sheer size of Apple now, with revenues to be projected over $260 billion this year. Many analysts believe the company should look for growth through acquisitions, rather than increase its share buybacks or dividend payments. However, with the mammoth size of Apple, a single acquisition would have a tough time moving the barometer for the company. As a company that grew on its innovation, Apple could have a tough time keeping up with expectations.

The Bottom Line

Overall, the tax plan has given Apple a major boost in terms of earnings and the financial flexibility to initiate another $100 billion share buyback and hike the dividend. However, the company is too reliant on the success of its iPhone, as it accounts for over 62% of total revenue. If the iPhone X and future models don’t continue to keep their sales momentum, it will be hard for the company to maintain its high revenue goals.

This risk, paired with the U.S. and China trade relations dilemma, creates a lot of uncertainty for Apple in the future. Consider Apple a hold, especially since the stock has gone up over 7.5% in the last five days. If the U.S. and China trade relationship gets worse, use the opportunity to buy on dips.

Check out our Best Dividend Stocks page by going Premium for free.