Crude oil futures briefly dipped below zero on April 20, 2020 for the first time in history. With a severe shortage in crude oil storage, producers actually paid traders to take oil off their hands. The move caused widespread pain throughout the oil and gas industry, even among the ‘safer’ MLPs.

Master Limited Partnerships, or MLPs, combine the tax benefits of private partnerships with the liquidity of a publicly-traded company. Most energy MLPs are pipeline operators that generate a stable income from transporting crude oil and natural gas across the United States and other parts of the world.

Let’s take a look at how the collapse in oil prices has impacted energy MLPs, including some recent dividend suspensions, and how income investors should respond.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with Dividend.com Rating (previously called DARS) above a certain threshold.

Impact of COVID-19 & Oil Prices

Crude oil prices collapsed into negative territory due to a combination of supply and demand factors.

The impact of COVID-19 on the energy sector became apparent in February when China started turning away oil tankers amid its growing lockdown. By March, the World Health Organization had declared COVID-19 a pandemic and lockdowns around the world eliminated a lot of demand for crude oil.

Don’t forget to check our oil and gas pipeline and oil and gas refining and marketing pages to explore more companies.

In early March, OPEC+ talks collapsed when Russia walked away from negotiations with Saudi Arabia and the rest of OPEC. Saudi Arabia responded by offering $6 to $8 per barrel discounts to customers in Europe, Asia, and the United States. The ill-timed maneuver contributed to the collapse in oil prices.

Saudi Arabia and Russia agreed to cuts by early April, but oil prices had already hit their lowest point since the 1990s. The futures market’s move below zero came in late April as oil tankers sat anchored along the coasts of China and the United States with 160 million barrels on board.

Energy MLPs earn a set fee for each barrel of oil or MMBtu of natural gas transported, stored or processed regardless of the underlying price. Moreover, many MLPs sign long-term contracts that range between five and 20 years in length, which insulates them from the impact of short-term price movements.

Don’t forget to check out this article to know more about the differences between a common dividend paying stock and an MLP.

Recent MLP Dividend Cuts

Energy MLPs might be less affected by short-term changes in oil prices, but even long-term contracts could be impacted by a prolonged drop in demand and an oversupply. Many MLPs also have sizable debt levels that could be at risk if cash flow dries up from prolonged low oil prices.

Follow Dividend.com’s Education section to get answers to all your dividend-specific questions.

A handful of energy MLPs have already cut or suspended their dividends to shore up capital.

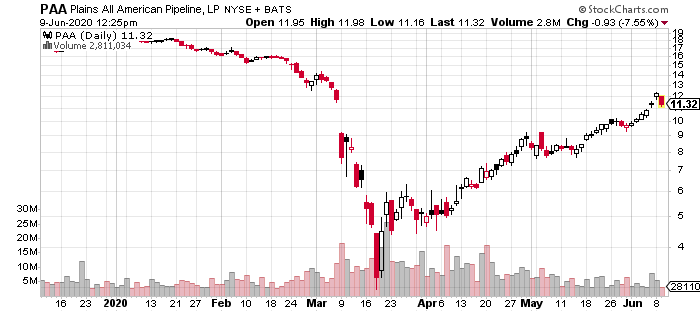

Plains All American (PAA) cut share distributions by 50% in May to $0.18 per unit during the first quarter. In addition, the company reduced its capital program by $750 million, or 33%, and sold $440 million in assets so far this year. Management will continue these efforts moving forward.

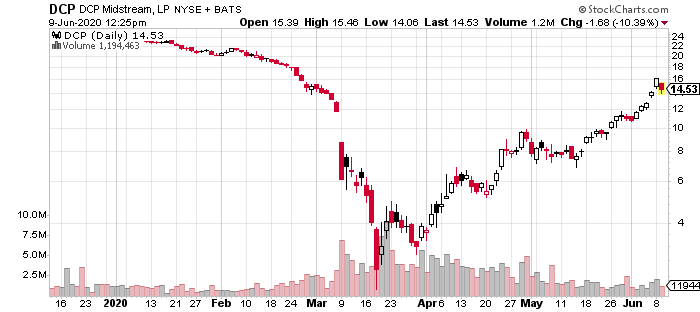

DCP Midstream LP (DCP) reduced its quarterly distributions by 50% to $0.39 per unit during the first quarter. The move comes as the company reduced its capex by 75% to $150 million and pursued other cost and sustained capital reductions to improve cash flow and reduce debt levels.

A few others include:

- Enable Midstream Partners (ENBL) reduced its quarterly distribution by 50% to $0.1653 per unit.

- Noble Midstream Partners LP (NBLX) reduced its quarterly distribution by 73% to $0.1875 per unit.

Implications for Income Investors

Energy MLPs have averaged a 7% yield over the past decade, making it a much better investment than REITs, utilities, bonds, and the S&P 500 yields. While the recent reductions hurt yields, these companies still offer some of the most attractive yields as other industries suffer a similar fate.

That said, income investors might want to consider diversifying their assets away from solely energy MLPs and into other dividend-paying assets. For example, high-quality REITs could offer attractive yields along with corporate bonds and other fixed income investments.

The Bottom Line

MLPs have provided investors with a consistently higher yield over the past decade. With sharply lower crude oil prices, some companies have cut their distributions to preserve capital, but that doesn’t mean they will do so indefinitely.

Income investors concerned about the stability of their income stream should consider diversifying into non-energy assets to help mitigate some of the risk.

Be sure to visit our complete recommended list of the Best Dividend Stocks.