One of the biggest and oldest debates among investors continues to be “value” versus “growth.” Both styles of investing focus on different metrics and are often at odds with each other at points in the market cycle. The last decade has been no different, with both styles flip-flopping leadership positions. It’s enough to make your head spin.

Which is why active management and ETFs allow investors to have their cake and eat it too.

The secret is in so-called quality stocks. By blending growth and value attributes together, quality stocks have long outperformed both in most market cycles. But they can be a tough nut to crack and are subjective to rates. This is where active ETFs and management can benefit investors.

In the end, quality trumps both growth and value. And being active is the way to get it.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

It’s All About Fundamentals

It’s time to break out our Finance 101 textbooks. The essence of finding quality stocks lies within those metrics and valuation tools from early finance education. We’re talking about company and stock fundamentals.

Company metrics, such as low levels of debt on a balance sheet, higher return on equity (ROE), positive profit growth trends, rising revenues, profits earned via better margins and sales rather than financial engineering/cost cutting, are all hallmarks of quality stocks. At first blush, you might be thinking quality stocks equal more familiar value or growth stocks. But there are actually a few key differences. It isn’t just about a lower price or faster-growing revenues relative to the broader market. It’s the combination and extra metrics that go along with them.

The win for investors is that quality stocks tend to be the best of both worlds when it comes to returns.

Data shows that quality factors have long been able to mitigate high valuation and outside risks in a portfolio. Stocks that exhibit strong earnings profiles, dividend growth and low debt tend to be more stable and less volatile than growth stocks or the broader market. According to investment manager BlackRock, monthly data from the 1970s to now shows that quality stocks outperformed the broader market 60% of the time. Looking at the data via a rolling 12-month basis, quality outperforms 76% of the time.

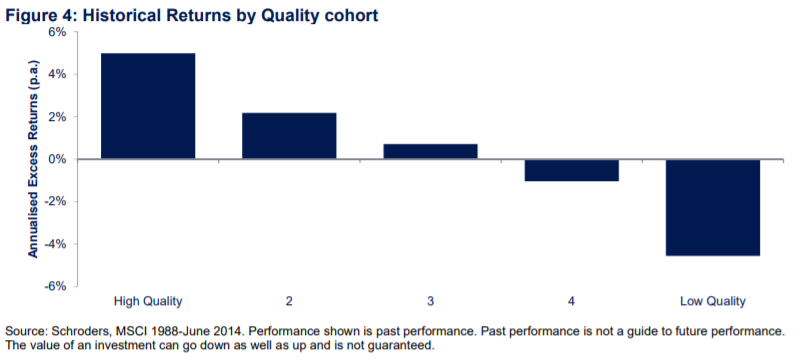

And this outperformance can be significant. The following chart from asset manager Schroder’s shows the huge difference in excess returns by focusing on high-quality versus low-quality stocks.

Source: Schroders.

Active Management Plays a Major Role

The thing is, fundamentals of any kind are subjective to interpretation and implementation. One investor’s perspective of a relatively low P/E, aka cheap stock, might be another investor’s expensive stock. Even then, how you create that P/E is up for interpretation. Do you use a 1-year earnings estimate or a five-year average? When looking at revenue trends, are we allowed to throw out events like the pandemic in which every company was hit hard? Or are we forced to keep those events in? When it comes to debt, do we measure all stocks the same? Or are we allowed to take allowances for certain sectors, like utilities, that naturally have larger debt loads?

Because of this subjectivity, looking at the metrics to define quality stocks is a bit more hands on than other styles of investing. As such, quality is difficult to index – at least in a traditional cut and dry sense.

This makes quality stocks a place for active managers to get their hands dirty. Here, managers can apply their subjective expertise in spades to build portfolios and determine what really goes into those holdings. And there is evidence to suggest that active managers who focus on quality tend to be the ones that outperform the market on a more consistent basis.

Better still is that the rise of active ETFs – both in traditional, full-on active management and in smart-beta index construction – have continued to help the cause. With fees for active ETFs lower than mutual funds, quality managers are starting to pull ahead as they now have much lower fee hurdles to jump.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

Getting Active With Your Quality

The continued ETF expansion has brought many new tools for investors to use in their portfolios. This includes a hefty dose of active and strategic beta ETFs focused on quality stocks. Investors can use these funds to build a portfolio and take advantage of ‘quality’ factors that tend to perform better than traditional funds.

For example, investors looking to take advantage of active management can use the Vanguard U.S. Quality Factor ETF (VFQY) or Fidelity Quality Factor ETF (FQAL). Both funds use their respective powerhouse investment managers’ expertise to craft portfolios of various quality stocks. Meanwhile, both charge a rock-bottom expense of 0.13% and 0.29%, respectively.

Because of the subjective nature of quality, the style is perfect for smart-bera or strategic indexing. The involvement of an actual human can ensure that the best ‘quality’ factors are utilised to enhance portfolio performance.. iShares MSCI USA Quality Factor ETF (QUAL) and FlexShares Quality Dividend Index Fund (QDF) are two of the biggest smart-beta ETFs covering this space.

The Bottom Line

Forget about value and growth. The secret is to instead focus on quality. And the way to add it into your portfolio is through active ETFs. Thanks to the subjective nature of defining “quality,” an active manager might know the best way to implement this investment style.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.