Despite winning with investors over the last few years, it may be too early to call a passive/index fund victory. That’s if fund flows have anything to say about it. It turns out active management is still very much alive. And not just alive, but thriving.

The key is that investors are choosing active exchange traded funds (ETFs) to get that human touch.

Fund flows for active ETFs have continued to be strong during the first half of the year, hitting records. Clearly, investors have sought active management to get through the tough environment. And thanks to their benefits, ETFs will continue to shine.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

A Record Amount

Investors continue to migrate away from mutual funds and into ETFs. Increasingly, they are choosing an active fund over a passive fund. That’s the gist behind the last fund flow data from research and consulting firm ETFGI. According to ETFGI, investors have plowed more than $8.2 billion in net inflows into active ETFs, listed globally, during July. While that may seem small, in the context of the larger picture it’s very impressive.

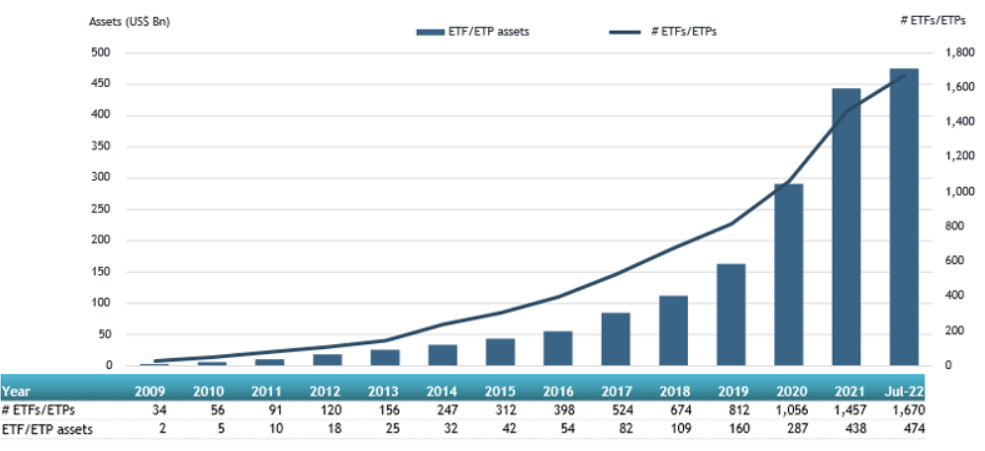

For starters, July’s gain was now the 28th month of straight net inflows for the active ETF industry. Looking at fund flows for the entire year, ETFGI data shows that active ETFs, listed globally, have had net inflows of $71.41 billion year-to-date. This is the second highest year on record compared to last year’s $88.97 billion. All in all, active ETFs, listed globally, now have a record amount of assets under management of $474 billion or about 7.1% over AUM’s realized during 2021. This is even taking into account any recent market losses due to the volatile environment, with the S&P 500 being down about 12% this year.

You can see from this chart, courtesy of ETFGI, just how fast the active ETF market has grown. You can also see that the sheer number of active ETFs available has surged. Today, there are more than 1,670 active ETFs listed globally.

Source: ETFGI

Easy to Understand the Surge & Switch

While active ETFs realized net inflows for the first half of the year, investors managed to pull more than $640 billion from actively managed mutual funds for the same time period. So why have active ETFs managed to gain net inflows while mutual funds lost assets?

The problem with active management isn’t so much security selection, with many segments and sectors of the market benefiting from a human touch. It’s the cost. The problem with mutual funds is the fact that expense ratios are often double those of ETFs, as they can come with sales loads and other nasty costs like 12b-1 fees. As a result, this fee hurdle results in lower returns for investors. This has ignited the passive investment boom and the great switching from mutual funds to ETFs.

The win now is that active managers are using the structure to provide lower costs to shareholders. It’s here that active management has the ability to shine and compete with passive/index investing.

At the same time, ETFs structured through their creation-redemption mechanism, with generally zero capital gains taxes, are ideal for active management. Managers can freely make buy/sell decisions without having to worry about the effects on the fund. The same could be said for the secondary market nature of ETFs and underlying assets in the fund. Cash drag is eliminated.

Because of this, ETFs are perfect vehicles for active management. And investors have acted accordingly. They’re dumping their expensive and underperforming mutual funds for portfolios of ETFs. Increasingly, they are doing so with an eye toward active management.

Still the First Inning

The beauty in all of this is we are still in the first inning of active ETF growth. Thanks to recent structure approval changes (semi- & non-transparent ETFs) from the SEC, mutual fund-to-ETF conversions (such as those initiated by J.P. Morgan & Dimensional), and overall launch activity, active ETFs have a long runway to see their assets under management grow.

Investors and advisors clearly want them too. A new survey by Pensions & Investments showed that 37% of institutional, endowment, and large investors said they plan to boost the portion of active ETFs in their portfolios by at least 5% this year. Meanwhile, similar surveys of advisors and individual investors have suggested similar results and overall adoption of active ETFs in their portfolios and practices.

The Bottom Line

In the end, the recent ETFGI survey underscores how active ETFs are growing and becoming the preferred vehicle for active management in a portfolio. With new records already being hit and plenty of growth ahead, active ETFs should have no problem overcoming mutual funds as the dominant vehicle for getting a human touch and better returns.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.