Active ETFs have become increasingly popular over the past few years. While they represented just 5.3% of the ETF market in 2023, they account for nearly 22% of all ETF inflows for the year with a total of $532 billion in assets under management.

Dimensional Funds was the most successful active ETF issuer, bringing in more than $30 billion in active ETF assets – but they weren’t the only ones scaling up the nascent asset class. J.P. Morgan, Avantis and Capital Group each attracted at least $10 billion in assets into their new and existing active ETF lineups, helping to expand the market.

However, many of the most popular active ETFs underperformed the market, with the biggest winners having concentrated portfolios of large-cap growth stocks, like NVIDIA Corp. (NVDA).

A Concentrated Market Rally

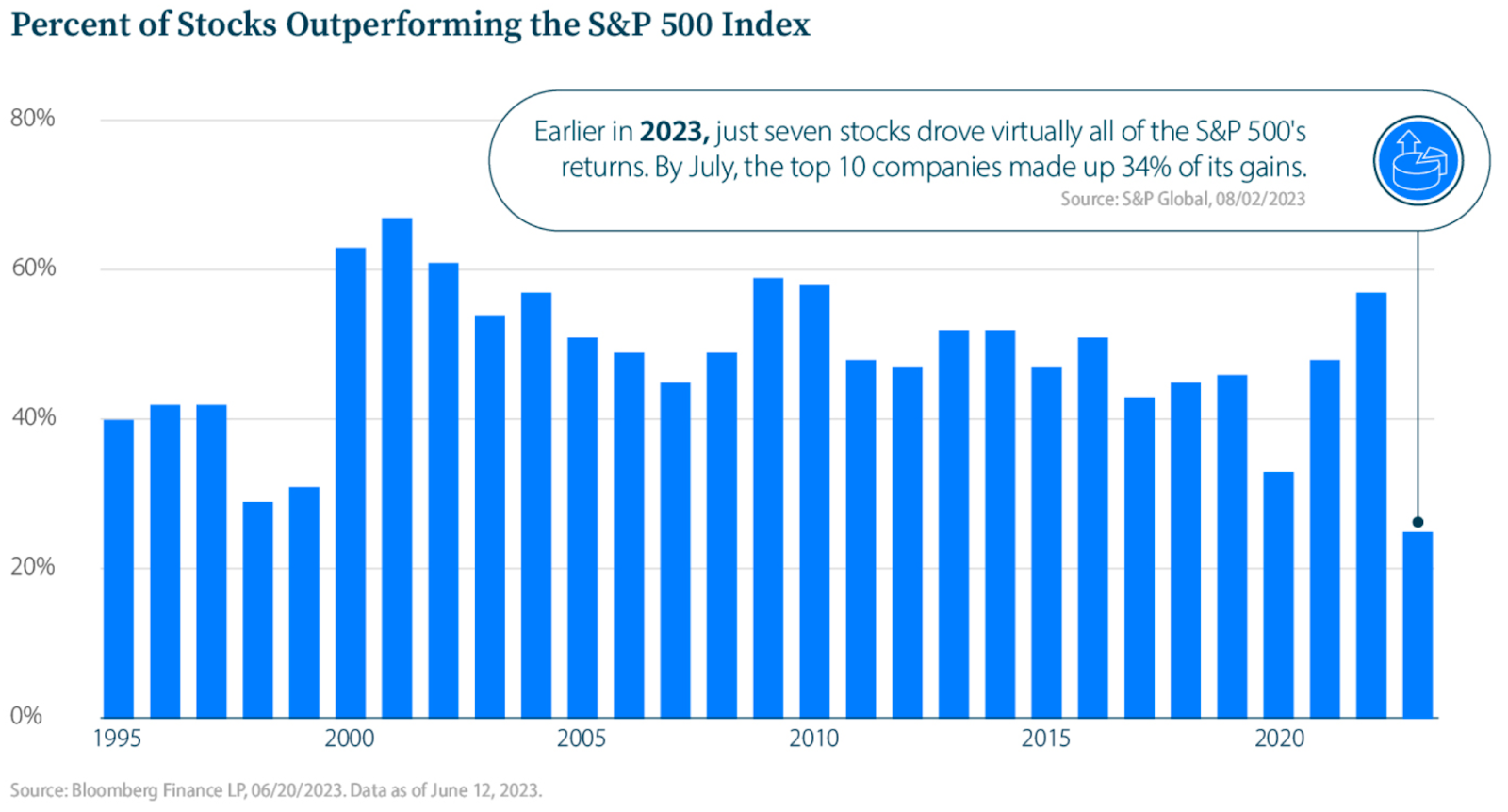

The S&P 500 Index rose a whopping 26.19% last year after a devastating 18.17% drawdown in 2022. While the rally might be surprising amid high interest rates, you can see the rationale if you look beneath the surface. Only ten companies accounted for 34% of the gains in 2023 – a much narrower breadth than previous market rallies.

Source: Visual Capitalist

Moreover, in terms of sector performance, big tech and consumer spending stocks accounted for nearly all of the market’s rally. For example, Nvidia Corp. (NVDA) rose 227.57%, DraftKings Inc. (DKNG) soared 254.74% and Palantir Technologies Inc. (PLTR) rose 218.31%. These returns helped offset much more modest returns in non-tech and consumer spending sectors.

More Exposure With Active ETFs

The SPDR S&P 500 ETF (SPY) may have returned 26.19% last year, but, as a passive ETF, it held a broad portfolio of 500 companies spanning every corner of the economy.

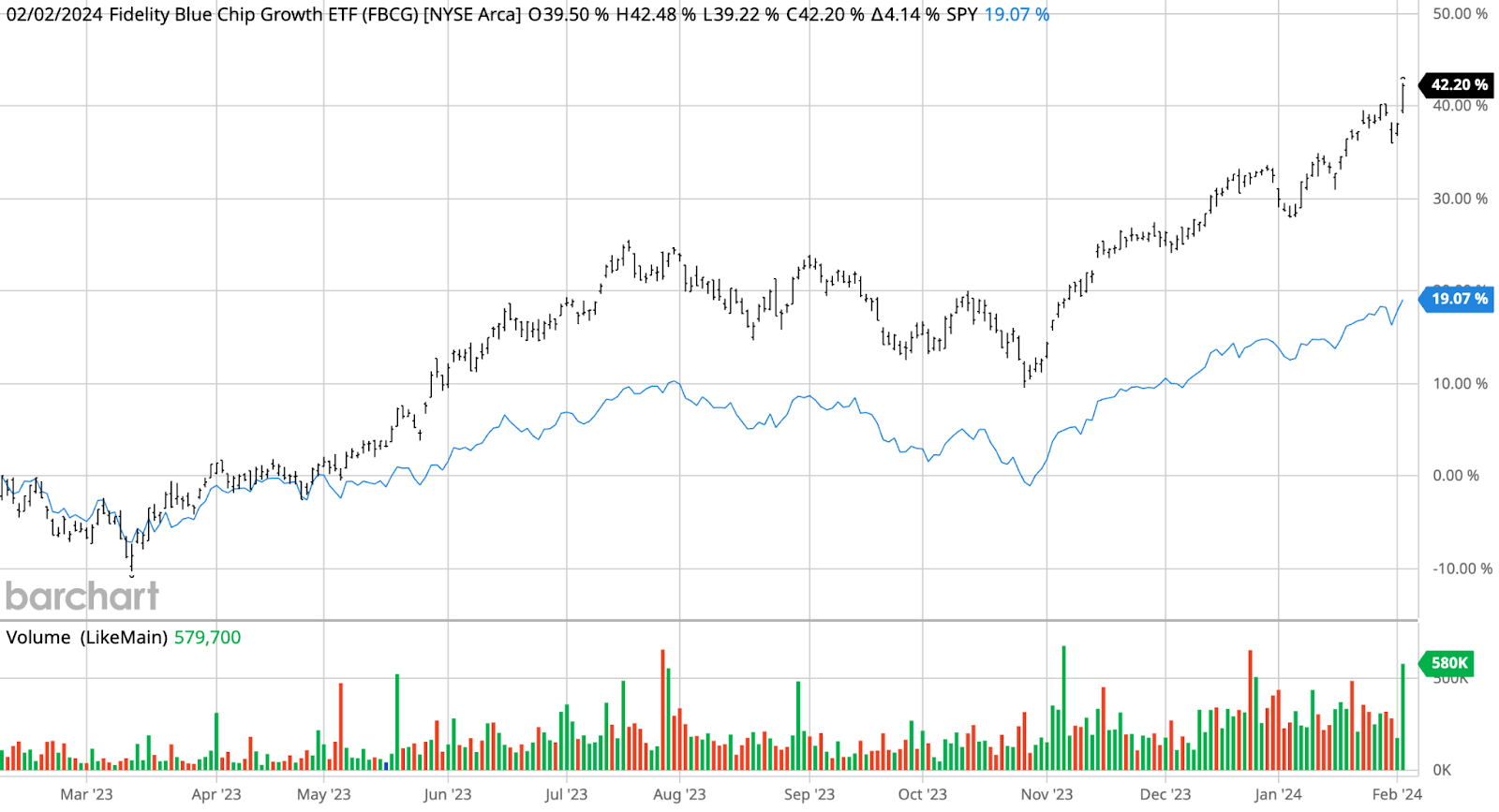

Active ETFs with the flexibility to double down on the few high-growth, large-cap names fared much better than their passive counterparts. For example, the Fidelity Blue Chip Growth ETF (FBCG) rose 57.98% with more than $1 billion in assets under management by the end of the year.

FBCG versus SPY – Source: BarChart.com

The fund has 44.07% exposure to tech stocks compared to just 30.53% for the SPDR S&P 500 ETF (SPY). In addition, the fund holds just 158 equities (versus 503 for the S&P 500) and has 60% of its assets in the top ten holdings compared to 31% for the S&P 500 fund. This meant more exposure to high-performing tech stocks, including its top holding, Microsoft Corp. (MSFT).

Another popular, growth-focused active ETF was the T. Rowe Price Blue Chip Growth ETF (TCHP), which rose nearly 50% last year. Like FBCG, the fund is overweight technology stocks with a 42.69% allocation and 62% of its total assets in the top ten stocks, helping it outperform the broader S&P 500 Index.

The JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) has also become popular among income investors with a 33.5% 1-year total return and a 7.9% yield. As the name implies, the fund holds tech-heavy Nasdaq stocks that experienced stronger capital gains while using covered calls to generate extra income beyond dividends.

Active Large-Cap Growth ETFs

These ETFs are sorted by their 1-year total return, which ranges from 18.5% to 45.1%. They have AUM between $375M and $5.6B and expenses between 0.12% and 0.59%. They are currently yielding between 0% and 7.9%.

| Name | Ticker | Type | Active? | AUM | 1-Year Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| Nuveen Growth Opportunities ETF | NUGO | ETF | Yes | $2.49B | 45.1% | 0% | 0.55% |

| Fidelity Blue Chip Growth ETF | FBCG | ETF | Yes | $764M | 44.2% | 0.1% | 0.59% |

| T. Rowe Price Blue Chip Growth ETF | TCHP | ETF | Yes | $375M | 43.2% | 0% | 0.57% |

| JPMorgan Nasdaq Equity Premium Income ETF | JEPQ | ETF | Yes | $5.58B | 33.5% | 7.9% | 0.35% |

| Capital Group Growth ETF | CGGR | ETF | Yes | $2.72B | 31.4% | 0.4% | 0.39% |

| Dimensional US Core Equity Market ETF | DFAU | ETF | Yes | $3.89B | 18.5% | 1.6% | 0.12% |

The Bottom Line

Last year’s stock market rally was driven by a handful of tech and consumer spending stocks. While passive index funds posted strong returns, active ETFs with more concentrated portfolios were better positioned to capitalize on these moves. And that could help draw more investors into the fold over the coming years as they chase returns.

Looking ahead, the preference for large-cap growth stocks could transition to value stocks as the economy finally sees the impact of higher interest rates. But, on the other hand, the Federal Reserve’s timeline for cutting interest rates could impact the market reaction. And any unexpected dovishness could send broad indices higher.