Target-date retirement funds, or TDFs, are a popular way to save for retirement. Rather than building and maintaining a portfolio, these funds hold a diversified basket of stocks and bonds with an asset allocation that adjusts over time based on your expected retirement date. As a result, you can buy a single security to handle all your savings needs.

While many passively managed target-date retirement funds have existed for quite some time now, actively managed alternatives are just starting to hit the market. These funds provide more targeted solutions to manage risk and optimize returns rather than simply investing in the broader market. And they could be valuable in today’s volatile markets.

In this article, we’ll look at Putnam’s newly launched, actively managed target-date retirement funds.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Putnam Adds Active ETFs

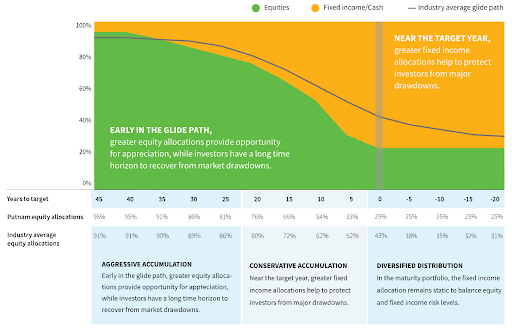

Putnam Investments recently announced a series of actively managed sustainable target-date retirement funds. Using a unique glide path philosophy, the firm offers vintages every five years from 2025 through 2065, along with a maturity fund. But unlike other TDFs, the sustainable funds hold a portfolio of actively managed ESG-focused ETFs.

Source: Putnam Investments

Putnam’s target-date retirement fund invest in the following active ETFs:

| Name | Ticker | Expense Ratio | Assets |

| Putnam Sustainable Future ETF | PFUT | 0.64% | $7.7M |

| Putnam Sustainable Leaders ETF | PLDR | 0.59% | $5.7M |

| Putnam ESG Core Bond ETF | PCRB | 0.35% | $6.2M |

| Putnam ESG High Yield ETF | PHYD | 0.55% | $26.2M |

| Putnam ESG Ultra-Short ETF | PULT | 0.25% | $7.5M |

| Putnam PanAgora ESG Emerging Markets Equity ETF | PPEM | 0.60% | $2.5M |

| Putnam PanAgora ESG International Equity ETF | PPIE | 0.49% | $2.0M |

These actively managed ETFs offer several potential advantages over their passively managed counterparts. For example, fund managers can find and invest in companies actively working to solve sustainability challenges rather than relying on exclusionary screens. Or they could selectively seek alpha in fixed income markets.

Active vs. Passive TDFs

Actively managed ETFs have become increasingly popular, particularly amid the rise in mutual fund conversions. But passive TDFs continue to grow faster than their actively managed alternatives, according to new research. Passive TDF assets grew 14% annually in 2022, compared to just 4% for active TDFs.

Many retirement investors tend to focus on fees over risk and returns, and active TDFs had a 2.7x higher median asset-weighted expense ratio than passive TDFs. Moreover, collective investment trust (CIT) TDFs experienced the most growth due to their lower expense compared to mutual fund TDFs, further illustrating these tendencies among investors.

Despite these trends, higher interest rates and volatility could encourage more investors to try active TDFs over the coming years. With more and more emphasis being paid to manage downside risk while ensuring adequate returns, active TDFs can have their own place, especially during uncertain economic times.

The Bottom Line

Target-date retirement funds offer an easy way to save for retirement. While most investors use passively managed TDFs (and increasingly CITs), Putnam’s decision to add active ETFs to its active TDF lineup could start a paradigm change. Low-cost ETFs could make active TDFs more cost-competitive at a time when active strategies could help better manage risk.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.