*For investors looking for high-growth and long-term opportunities, emerging markets (EM) have long been a great way to build wealth. However, the last few years haven’t exactly been stellar for these regions. Slowing growth, higher interest rates, and lingering pandemic issues have taken the wind out of emerging markets’ sails.

Or should we say China’s sails. Asia’s dragon economy has been pulling the entire segment down.

And that’s exactly why investors may want to get active with their emerging market allocations. Not all emerging markets are alike and each features its own pros & cons. And it turns out getting active in emerging markets can lead to higher returns.

Big Appeal Overweighed by China

An emerging market economy is generally defined as an economy with low to middle per capita income that is typically fast growing. Capital markets are beginning to strengthen, consumerism is being born, and jobs have started to significantly migrate from agrarian to industrial and high-tech. These nations often feature higher than average GDP growth rates. Today, more than 23 nations fit within the definition and are included in the MSCI Emerging Markets Index, the sector’s main benchmark.

As these nations have grown and expanded, so have their stock markets. Over a 20-year period—2002 through 2021—emerging markets posted an annualized compound return of 9.7%. That’s very impressive.

The problem is that much of that return has come at the beginning and has to do with its weighting to a single nation: China. From 2001 to 2010—which also has to do with China’s emergence as a major manufacturing power and entrance to the World Trade Organization—the MSCI Emerging Markets Index posted annualized returns of 15.9%. However, since 2011, EM equities have gained 0.9% annualized. 1

China’s slowdown, its policy shifts, and moves toward becoming a developed nation have cobbled the index. The iShares MSCI Emerging Markets ETF, which tracks the benchmark, has nearly 30% of its holdings in China. The MSCI China Index has managed to produce a negative 5.71% annual return over the last five years and has just barely shown a positive return since 2011.

Big Disparities in Returns Within Emerging Markets

The problem is emerging markets often get lumped together under one umbrella. Investors simply add exposure via an indexed ETF and call it a day. However, locally they couldn’t be more different from each other. To say that Peru has similar advantages and disadvantages as India is foolish. Each individual emerging market nation features different political environments, middle classes, trends of economic growth, etc. Each needs to be valued accordingly.

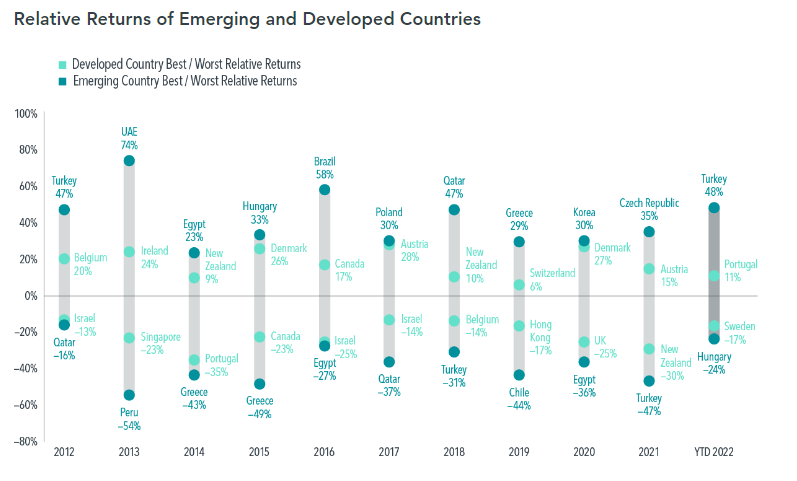

You can see just how different emerging markets are individually when looking at their returns’ disparity data. This chart from Dimensional Fund Advisors (DFA) highlights the best- and worst-performing emerging and developed markets over the last 10 years. As you can see, the spread between winners and losers each year is vast.

Source: DFA.

These highly differentiated markets are just the kind of places where active management can play a huge role in generating market-beating returns. Just like small-caps and fixed income, emerging markets feature plenty of nuisance, a lack of information, and illiquidity. And since most investors ignore or lump them all together, those managers that do the digging, get boots on the ground, and overweight/underweight the MSCI Index can prosper.

And it turns out, they do.

According to Morningstar, active managers do beat their passive rivals. Over the last 10 years, 69% of the lowest cost active emerging market managers beat their benchmarks. More than half of the highest cost managers did so as well. That’s one of the highest percentages of active managers beating their indexes out of any asset class. 2

The key to that sentence is low cost. Generally, emerging market funds are more expensive to manage than a large-cap U.S. stock fund, even when it comes to passive funds. However, ETFs are helping. With their lower cost of management, ETFs are helping more emerging market managers crush their benchmarks.

Getting Active With Your Emerging Market Exposure

Given the issues with major emerging market indexes such as overweighting certain nations as well as the disparity among developing nations, investors may want to ditch the passive funds and go active with their emerging market exposure. ETFs could be the way to do it.

Thanks to the surge in active ETF popularity, emerging markets are now getting their turn as a variety of issuers begin to launch funds and gather assets. For example, the JPMorgan ActiveBuilders Emerging Markets Equity ETF has gathered more than $1 billion in assets, while the Dimensional Emerging Markets Core Equity 2 ETF holds more than $2 billion. That makes them bigger than some passive funds in the space. Nonetheless, more funds continue to launch with emerging market specialist Mathews launching a whole suite of emerging market funds, including the broad Matthews Emerging Markets Equity Active ETF and Global X launching two new active ETFs in the space.

The key is that managers in these funds are given the freedom to find the best stocks, from the best nations, and change the makeup of the index, overweighting better opportunities and underweighting China. Given the nature and difference among these regions, this can and does produce returns.

Here's a list of ETFs to get exposure to emerging markets

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| JEMA | JPMorgan ActiveBuilders Emerging Markets Equity ETF | $1.006B | 15.3% | 0.33% | ETF | Yes |

| RFEM | First Trust RiverFront Dynamic Emerging Mkts ETF | $33.1M | 8.5% | 0.95% | ETF | Yes |

| DFEV | DFA Dimensional Emerging Markets Value ETF | $408.7M | 7.2% | 0.43% | ETF | Yes |

| DFEM | DFA Dimensional Emerging Markets Core Equity 2 ETF | $2.044B | 5.9% | 0.38% | ETF | Yes |

| AVEM | Avantis Emerging Markets Equity ETF | $3.397B | 5.6% | 0.33% | ETF | Yes |

| MEM | Matthews Emerging Markets Equity Active ETF | $57.5M | 4.3% | % | ETF | Yes |

| EEM | iShares MSCI Emerging Markets ETF | $23.503B | 3.1% | 0.69% | ETF | No |

| EMM | Global X Emerging Markets ETF | $27M | 0% | 1.15% | ETF | Yes |

Here's a list of mutual funds to play with the emerging markets theme

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| FEDDX | Fidelity® Emerging Markets Discovery Fund | $368.9M | 12.2% | 1.19% | MF | Yes |

| PEIFX | PIMCO RAE Emerging Markets Fund Institutional Class | $1.264B | 10% | 0.75% | MF | Yes |

| GERIX | Goldman Sachs Emerging Markets Equity Insights Fund International | $1.162B | 5.7% | 1.09% | MF | Yes |

| MIEFX | Matthews Emerging Markets Equity Fund Institutional Class Shares | $12.6M | 4.9% | 0.9% | MF | Yes |

| JFAMX | JPMorgan Emerging Markets Equity Fund Class A | $384.9M | 4.4% | 1.25% | MF | Yes |

| VEMAX | Vanguard Emerging Markets Stock Index Fund Admiral Shares | $15.076B | 2.9% | 0.14% | MF | No |

The Bottom Line

Emerging markets have plenty of potential. However, current index strategies may be strangling that potential. Active management, especially via low-cost active ETFs, can solve the issue, enabling managers to truly leverage these nations to produce better returns. Accordingly, investors looking to boost their portfolio returns may want to add a dose of emerging market securities.

1 AllianceBernstein (June 2023). Don’t Look Back. The Next Emerging-Market Decade Will Be Different

2 Morningstar (August 2022). Where Do Active Fund Managers Hold the Upper Hand?