Don’t look now, but your classic mutual fund has some serious competition. The exchange traded fund (ETF) structure changed the game with regard to passive investing and investors have taken notice. And now they are doing the same with regard to active fund management.

Active ETFs are growing like weeds.

Both in the number of fund launches and assets under management, active ETFs continue to gather the lion’s share of investor interest and funds. And it’s easy to see why. Combining the best of both worlds and bringing out what active management can do, active ETFs could be a portfolio’s best friend.

Assets Surge

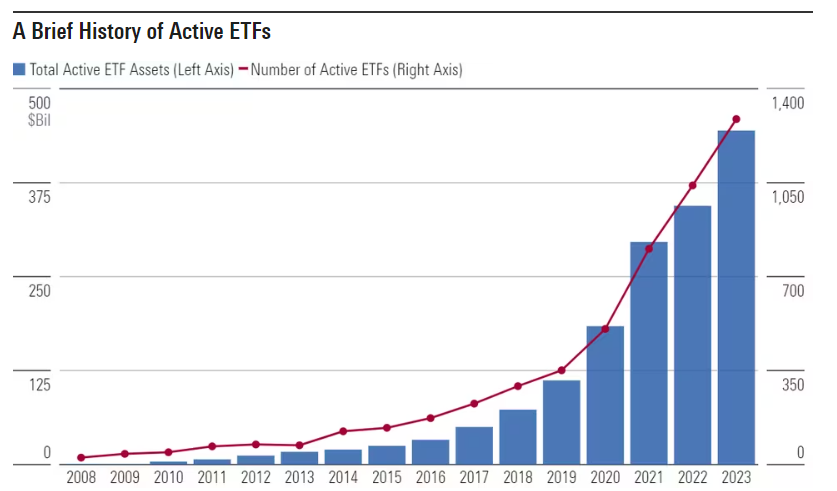

Active ETFs first came into the market in the early 2010s. However, at that time, passive and index ETFs were all the rage. It wasn’t until recently when they took off and they haven’t looked back.

The latest report from Morningstar shows the sheer growth of active ETFs versus other fund structures and types. According to the report, since 2018, active ETFs have gathered at least $25 billion per year and have had an organic growth rate of 30%. That’s a staggering amount of money and asset gathering in such a short amount of time. Today, active ETFs boast total assets north of $450 billion. 1

This chart from Morningstar shows the sheer growth pattern and J-curve of assets.

Source: Morningstar

Aside from investors placing their money in active ETFs, the number of those funds has expanded exponentially as well. Active ETF launches outnumbered passive ones 3-to-1 in 2023. Since 2022, there have been more than 789 active ETF launches. That’s roughly the same number of total launches in two years as the previous decade.

The Reasons Are Vast

The reason why active ETFs are growing like weeds are vast and play into the fund structure’s benefits.

For one thing, there is the cost. Thanks to the ETF’s lower structure of operation, active ETFs often cost far less than mutual funds. Moreover, the cost to run an active ETF has continued to drop. Today, investors can buy active ETFs costing as little as 0.15% in expenses. That’s cheaper than some index funds. With lower fee hurdles, active managers can actually deliver on their promises of better returns.

Second, ETFs continue to win on the tax front. Because ETFs live in two separate worlds—the primary and secondary market—they have unique tax advantages versus other fund structures. The creation/redemption mechanism allows fund sponsors to pass on assets and cash to authorized participants to create or redeem ETF shares. This allows them to avoid capital gains taxes. Investors in the secondary market can control when they incur those gains.

The creation/redemption mechanism also allows managers to be fully invested. This avoids so-called cash drag that mutual funds have and leads to better returns.

Morningstar cites another reason for active ETFs growth and popularity. It turns out investors like knowing what they own. Mutual funds are only required to show their holdings once a quarter. Most active ETFs disclose their funds daily. And while non-transparent and semi-transparent ETFs do exist, they make up a very small part of the market. This transparency is valuable, according to Morningstar. In the banking rout of the summer, holders of ETFs were quickly able to see what funds held troubled stocks and adjust accordingly. Those who owned mutual funds were not so lucky.

Two Big Disadvantages

Weeds do have some disadvantages to gardens. And Morningstar in their report has brought up two valid counterpoints to active ETFs’ growth.

One, is that mutual funds can close the gates if they are too large. Asset bloat is one of the leading causes of lower returns. With billions in assets, fund managers aren’t able to buy the opportunities they want because they need to move all that money around. This leads to closet indexing and underperformance. Because of the creation/redemption mechanism, ETFs can’t turn off the spigot.

Second, while ETFs can hold a variety of assets, they can’t hold everything. Mutual funds, however, are pretty free to hold whatever they see fit. This can include holdings in private companies. Fidelity and T. Rowe Price have successfully used this fact to own pre-IPO tech stocks in many of their funds to boost returns.

While these aren’t issues so much today, Morningstar does mention that if active ETFs continue their pace, investors may start to feel the effects of these issues. That could hinder the long-term future growth of the fund type.

Still Not Stopping Active ETFs

Even with the concerns, active ETFs continue to gather assets at a quick pace. Overall, the benefits of the fund structure are wonderful portfolios both big and small. As such, active ETFs should continue to gather plenty of assets as new funds launch and investors look to the structure for enhanced returns.

Popular Active ETFs

These ETFs are sorted by their YTD total returns, which range from -3.2% to 8.1%. They have expense ratios between 0.17% to 0.75% and have assets under management between $5.1B to $30B. They are currently yielding between 0% and 7.8%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| JEPQ | J.P. Morgan Nasdaq Equity Premium Income ETF | $5.58B | 8.1% | 7.8% | 0.35% | ETF | Yes |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $20.9B | 5.3% | 1.3% | 0.17% | ETF | Yes |

| JEPI | JPMorgan Equity Premium Income ETF | $29.2B | 4.6% | 6.4% | 0.35% | ETF | Yes |

| DFUV | Dimensional US Marketwide Value ETF | $8.5B | 4.6% | 1.5% | 0.21% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $9.7B | 1.2% | 5.2% | 0.35% | ETF | Yes |

| JPST | JPMorgan Ultra Short Income ETF | $22.8B | 0.9% | 5.2% | 0.18% | ETF | Yes |

| FBND | Fidelity Total Bond ETF | $5.1B | -0.6% | 4.5% | 0.36% | ETF | Yes |

| AVUV | Avantis U.S. Small-Cap Value ETF | $6.7B | -0.7% | 2% | 0.25% | ETF | Yes |

| DFAT | Dimensional U.S. Targeted Value ETF | $8.2B | -0.9% | 1.50% | 0.28% | ETF | Yes |

| ARKK | ARK Innovation ETF | $6.9B | -3.2% | 0% | 0.75% | ETF | Yes |

The Bottom Line

Active ETFs continue to gather assets at a fevered pace. It’s easy to see why. Lower costs, tax efficiencies, and overall better returns are some hallmarks of the structure. While some new risks have emerged with their size, the benefits outweigh those issues.

1 Morningstar (November 2023). Here’s Why Active ETFs Are So Hot Right Now