The old adage tells us, “Not to stick all our eggs in one basket.” In the investing world, that comes down to diversification. The ability to spread your portfolio among stocks allows you to reduce risks and potentially limit losses. After all, if you own the entire market, a blowup at one or two names doesn’t really affect your bottom line.

But, it turns out that while diversification can do wonders for losses, it can hinder gains.

Concentrated portfolios or those that only hold a few winners tend to outperform by a mile. And when it comes to focus, actively managed ETFs could be the best way to secure those gains and benefit from the concentration factor.

Not Looking Like an Index

One of the main draws of indexing is that investors own everything. Buying the S&P 500 via an ETF or mutual fund instantly creates diversification. With one ticker, you can now own 500 stocks, which is wonderful for reducing risk. If Microsoft has a bad quarter and sees its stock price decline, Apple’s positive quarter and price increase will help reduce the losses.

Ultimately, over the long haul, this helps balance out the index and investors enjoy a good return.

But what if you can avoid the blowups and mishaps in the first place? That’s the thesis behind active management. Managers don’t have to look like an index and can own whatever stocks or bonds they feel meet their investment criteria. By not looking like an index, an active manager can drive additional alpha.

Even here, however, the number of holdings an active manager chooses for their portfolio can make a difference. It turns out that managers who hold concentrated portfolios may actually have less risk and drive better returns than those who hold too many. A recent study in the Journal of Portfolio Management shows that, “increasing concentration has a pronounced positive impact on performance for outperforming funds.”

Focusing on the Best Ideas

The reasons for the outperformance are varied. One major point is the idea of focusing on the best ideas. Concentrated portfolios often hold just 10 to 20 stocks. Here, managers put their proverbial eggs in just a few baskets. As such, these managers are forced to rely on deeper research than other managers holding up to 100 stocks. As such, high conviction picks are made with more certainty.

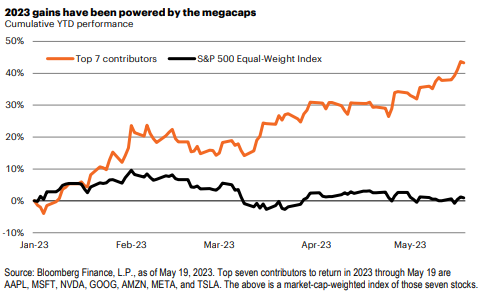

The end result is that these stocks drive returns. For example, while looking at this chart from FS Investment, focus on the S&P 500 Equal-Weight Index versus the top 7 contributors to cumulative performance last year.

As you can see, the broader index was roughly flat throughout the year, but the cream of the crop managed to outperform by a wide margin. In fact, those 7 stocks managed to drive 88% of the S&P 500’s return over the year.

Source: FS Investments

This isn’t a one- or two-year phenomenon. A University of Technology Sydney paper showed that over rolling 10-year periods, a portfolio manager’s 10 or 20 best ideas greatly outperform the rest of their portfolios. 1

The second reason could come down to bloat, and what managers are forced to hold. One of the issues with asset management is that fees are charged as a percentage of assets. For fund companies, it pays to get big – the more assets you have under management, the more money you make. The end result is that many fund managers are hesitant to close a top-performing fund to new assets. Ironically, top performance tends to bring new money into the fund from performance-chasing investors.

That’s a problem when it comes to concentration and outperformance.

If you are only to hold 15 stocks, at some point, the holdings get too big for new money. Funds placing too much money into a stock all at once can cause the share price to surge. Moreover, frontrunning can occur. This is why Warren Buffett/Berkshire Hathaway and a few other very large fund companies get special SEC permission when it comes to hiding their holdings while they are buying new positions.

For many managers, too much money causes them to move down to their second- or even third-best ideas. This hits performance, as we’ve illustrated in the chart above. At the same time, larger funds start to look like the index. There are only so many places that a fund manager can place large sums of new money. Here, active’s larger fee hurdles zap investor gains and cause underperformance vs. an index.

Active ETFs to the Rescue

Concentration can play a vital role in outperformance and unlocking actual returns from active management. The issues come down to bloat and being able to effectively stay concentrated. So, how do investors and fund sponsors effectively balance the two? Active ETFs could be a major win on the concentration front.

For starters, the structure of ETFs can help eliminate bloat and keep funds from getting too big. That’s because of ETFs’ dual ownership structure. Regular investors can buy ETFs on the secondary market. However, ETFs are created by authorized participants (APs). These APs are key to the creation and redemption mechanism. APs exchange assets or cash to physically start the ETF shares. Likewise, they accept assets back from the funds. This helps solve the bloat issue and keep funds concentrated. New money entering the fund can be in shares of stock. Better still is that active ETFs are fully invested, eliminating any cash drag.

Secondly, ETFs already feature lower expense ratios than other active vehicles. This helps reduce the fee hurdle and allows active ETFs to shine when it comes to active management. That outperformance can be enhanced when it comes to concentrated portfolios. Those funds that tend to be more concentrated often charge more than lower concentrated funds according to Morningstar data.

With this in mind, investors looking to complement their core and indexed stock holdings should consider going active and focusing on a concentrated active ETF. By doing so, they can get the best of what active has to offer as well as exploiting that fact in a low-cost, non-bloated package.

Concentrated Active Stock ETFs

These funds are selected based on exposure to U.S. equities with a concentrated tilt as well as assets under management. They are sorted by their 1-year total returns, which range from 4% to 45%. They have expenses between 0.17% to 0.55% and assets under management between $2.8B and $21B. They are currently yielding between 0.17% and 4.8%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NUGO | Nuveen Growth Opportunities ETF | $2.5B | 45.1% | 0.17% | 0.55% | ETF | Yes |

| CGGR | Capital Group Growth ETF | $2.7B | 31.4% | 0.39% | 0.39% | ETF | Yes |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $20.9B | 14.4% | 1.4% | 0.17% | ETF | Yes |

| DIVO | Amplify CWP Enhanced Dividend Income ETF | $2.8B | 9.8% | 4.8% | 0.55% | ETF | Yes |

| DFUV | Dimensional US Marketwide Value ETF | $8.5B | 7.8% | 1.5% | 0.22% | ETF | Yes |

| AVUV | Avantis U.S. Small-Cap Value ETF | $6.76B | 5.8% | 2% | 0.25% | ETF | Yes |

| DFAT | Dimensional U.S. Targeted Value ETF | $8.2B | 4% | 1.6% | 0.28% | ETF | Yes |

Overall, investors should consider getting concentrated with their stock holdings and active ETFs are the best way to do just that. Their low-costs and ability to fight asset bloat make them powerful tools for enhancing the best of active management. Using them as a portfolio tool could offer better long-term returns.

The Bottom Line

Diversification is great for reducing risk, but concentrated portfolios are great for building wealth. Data supports higher returns over the long run. Active ETFs help overcome many of the issues with other active vehicles and make concentrated bets for portfolios.

1 University of Technology Sydney. Diversification versus Concentration . . . and the Winner is?