Russia’s invasion of Ukraine, rising global inflation, and ongoing supply chain disruptions are creating significant risks for investors. Over the past month, the S&P 500 index fell more than four percent, while year-to-date losses are already over eight percent. Fortunately, there are some strategies investors can use to hedge against these risks.

Let’s take a look at how long-short equity ETFs can help reduce market exposure and protect investor portfolios.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

What Are Long-Short ETFs?

Long-short equity strategies take long and short stock positions to profit from market cycles and minimize market exposure. Since short positions balance out some of the long positions, macro market movements don’t impact the portfolio as much. Instead, the strategies succeed when the long stock positions gain value and/or the short positions lose value.

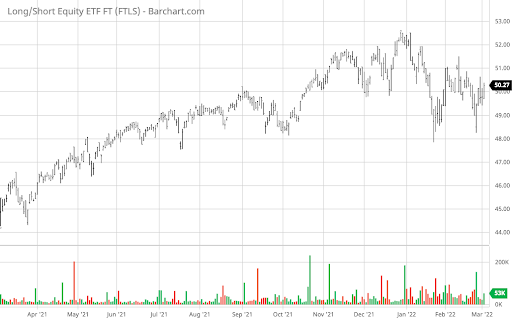

For example, First Trust Long/Short Equity ETF (FTLS) is an actively managed fund that’s currently 93.27% long and 37.11% short, resulting in a 56.16% net exposure to the market. In other words, a broad 10% market contraction would only result in a 5.62% contraction for the long-short equity fund, assuming the contraction is spread evenly across holdings.

First Trust Long/Short Equity ETF Chart – Source: Barchart.com

In addition to less market exposure, long-short equity funds attempt to capitalize on market dynamics. For instance, FTLS has a 14.02% long position and only a 0.63% short position in the Materials sector. As a result, the overall portfolio is overweight materials. And digging into specific holdings provides further insight into exposure levels.

Active and Passive Long-Short ETFs

The First Trust Long/Short Equity ETF (FTLS) is one of the most popular actively managed long-short equity funds. According to its prospectus, the fund aims to invest 80% to 100% of its portfolio in long positions and 0% to 50% in short positions. And despite a lofty 1.55% expense ratio, the fund has drawn in more than $450 million in total assets.

LHA Market State Alpha Seeker ETF (MSVX) – Source: Barchart.com

While FTLS uses fundamental and technical analysis, the actively managed LHA Market State Alpha Seeker ETF (MSVX) takes a quantitative approach to build its portfolio. The rules-based system makes tactical long-short allocations to equity futures and options, volatility index (VIX) futures and options, and ETFs, with a 1.5% expense ratio and nearly $40 million in assets.

In addition to active ETFs, there are several passive long-short ETFs:

| Name | Ticker | Assets | Expense Ratio |

|---|---|---|---|

| ProShares Large Cap Core Plus | CSM | $513M | 0.45% |

| IQ Hedge Long/Short Tracker ETF | QLS | $20M | 0.59% |

| ProShares RAFI Long/Short ETF | RALS | $4M | 0.95% |

Source: Morningstar.com (as of March 1, 2022)

In addition to traditional long-short equity funds, some ETFs use options and other derivatives for downside protection. For instance, the actively managed Simplify U.S. Equity PLUS Downside Convexity ETF (SPD) uses systematic option overlays to boost performance during extreme market moves down by creating a convex equity payoff on the downside.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

The Bottom Line

Long-short equity strategies reduce market exposure and protect investors from systemic downside risk. In addition, actively managed long-short equity ETFs enable investors to profit from bearish movements rather than waiting for a market recovery. As a result, they may deserve a spot in some investment portfolios, given the current investment climate.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.