Cathy Wood’s Ark Innovation ETF (ARKK) was the darling of Wall Street between 2020 and 2021, tripling in price thanks to its speculative technology bets. In some ways, the fund’s success helped renew interest in active ETFs, where managers pick individual stocks rather than using an underlying market capitalization-weighted index.

According to Morningstar data, active ETF net inflows rose from about $60 billion in 2020 to over $75 billion in 2021, with over 200 new active ETF launches throughout the year. And in total, active ETF assets under management surpassed $300 billion last year, including a rise in thematic funds (like ARKK) and mutual fund conversions.

This article will examine whether active ETFs are worth the extra cost or whether investors would be better off with passive ETFs.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Passive vs. Active Debate

The Morningstar Active/Passive Barometer is a semiannual report that pits active managers against their passive counterparts across multiple categories. With data from nearly 4,000 unique funds representing $17.4 trillion in assets, the study covers about 65% of the U.S. fund market, making it a high-quality measure of performance.

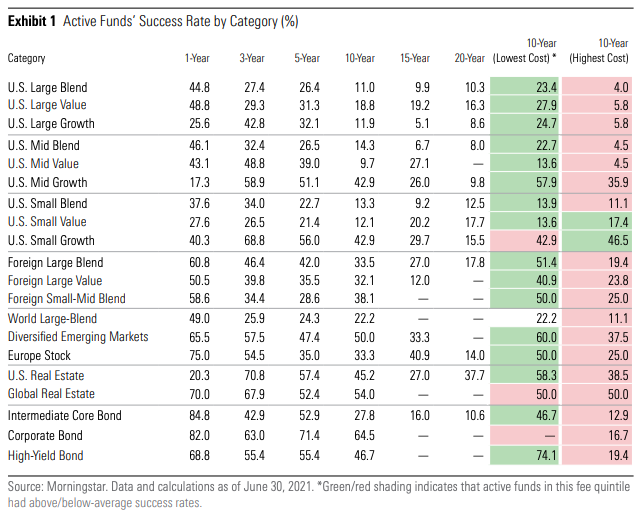

The latest October 2021 report confirms active managers generally fail to survive and beat their passive peers, especially over long time horizons. For example, only 25% of all active funds topped their passive rivals over the 10 years ended June 2021. And just 4% of active high-cost U.S. large-cap blend funds beat their benchmarks!

While the macro comparison is bleak, there are pockets of the market where active funds outperform. For example, long-term success rates were exceptionally high among foreign stocks, real estate, and bond funds, where active management plays a critical role. Conversely, success rates were meager among U.S. large-cap funds.

Price Plays a Critical Role

Most investors know that actively-managed funds tend to cost more than passively-managed funds. According to ETF.com, actively-managed ETFs charge an average expense ratio of 0.69% compared to 0.18% for equity index ETFs. There’s also a significant variance in the expense ratios charged by each fund—and high expenses can take a bite out of returns.

Morningstar found the cheapest funds succeeded about twice as often as the priciest ones in beating their benchmarks (35% vs. 17%) over the 10 years ended June 2021. In addition to cost advantages, 66% of the cheapest funds survived compared to 59% of the most expensive funds, suggesting multiple reasons for the outperformance.

While Morningstar didn’t split the data, active ETFs tend to be significantly cheaper than active open-ended mutual funds, meaning active ETFs likely accounted for better performance. While the performance remains lower than passive ETFs in most categories, it’s a relative improvement over open-ended mutual funds.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

When to Use Active ETFs

Morningstar’s research suggests low-cost active ETFs might be a suitable alternative to passive ETFs in certain corners of the market. For example, investors might want to consider low-cost active ETFs for foreign stocks, real estate, and bond funds while still using passive ETFs for U.S. equities and most other corners of the market.

In addition, there are times when actively-managed funds could naturally outperform passively-managed funds by design. For example, active foreign funds performed exceptionally well during the height of the COVID-19 pandemic (2019-2021) because active managers had a lot more flexibility in adjusting their portfolios to avoid risk.

Finally, investors might only have access to active ETFs in some corners of the market. Many funds that seek to lower volatility or invest in specific themes tend to be actively managed because indexing is complex. That said, investors might want to consider the risk/reward profile of the investment relative to similar passive strategies.

The Bottom Line

Active ETFs have become increasingly popular thanks to the success of Cathy Woods’ Ark Innovation Fund. However, the fund’s recent downfall underscores the mixed track record of active managers. Morningstar data highlights how low-cost active ETFs might make sense in certain corners of the market, but passive ETFs still outperform on the whole.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.