One of the world’s greatest growth stories has been the rise of China. A once agrarian society has turned into a modern technology-based, consumer powerhouse that rivals many developed nations. The question for investors is how to find the ‘next’ China or those nations just beginning their economic journeys.

It turns out that active management over indexing is the way to find growth in these frontier markets.

With a recent switch from tracking a passive index to an active strategy, asset manager BlackRock has put the stamp of approval on active management in frontier markets. And investors just may want to follow suit in the sector.

‘Emerging’ Emerging Markets

Emerging markets are categorized by their fast-moving economies, newfound growth, commodity wealth, and surging middle classes. Nations like China and India have impressive growth stories and investors have prospered. The trick is finding those nations that are like China or India 20 or 30 years ago.

Investors have dubbed these nations frontier markets. And the best way to think of them is to consider them like ‘emerging’ emerging markets. We have nations just beginning their economic journeys. Capital markets are beginning to form, while consumers are just starting to experience their first taste of capitalism. This puts them ahead of UN-characterized lesser developed countries (LDCs). Risks for frontier markets include political instability, poor liquidity, inadequate regulation, substandard financial reporting, and large currency fluctuations.

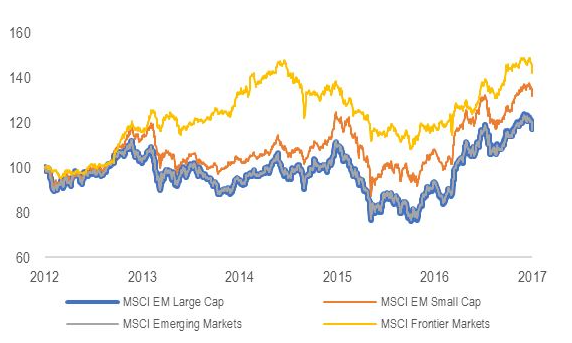

But in exchange for those risks, the rewards can be great. Frontier markets make up about 36% of the world’s population and 15% of its GDP. And yet they only account for less than 1% of its market capitalization. That’s a lot of untapped potential. At the same time, frontier markets have performed better than broader emerging markets, with the MSCI Frontier Markets Index returning about 6.15% annually since 2002. They’ve yielded more too, with a current yield of 4.48%. 1

Active Management Wins on the Frontier

The problem is lumping all frontier markets and companies together doesn’t make sense. After all, Vietnam is much different than Estonia, which is much different than Nigeria. Local economies, government types, consumerism, and technological advancement are all different. As such, the frontier is a perfect place for active management. Under-followed companies and nations lead to market inefficiencies. And smart managers can exploit those inefficacies to gain bigger returns.

The proof is in the pudding. According to a recent study from Skagen, active managers with high active share managed to outperform broader emerging market indices. This is true for frontier market-focused funds. This chart from Skagen highlights this fact.

Source: Skagen

BlackRock Makes the Switch

This fact of active’s outperformance in frontier markets could help explain why BlackRock recently made the switch to one of its popular ETFs. Over the spring, BlackRock announced that it was turning the $590 million iShares Frontier and Select EM ETF from a passive vehicle tracking the MSCI Frontier Markets Index into an active strategy. The change officially took place in June.

In a note to investors, BlackRock mentioned that the switch will “allow greater flexibility and liquidity in various market conditions.”

This means that BlackRock’s emerging market team will be able to exploit the various differences between frontier markets to the investors’ benefit. Since its debut in 2012, FM has only managed to eke out a slight 2.2% gain by tracking the index. However, over the last six months—tying into the change to active in June—the fund is up by nearly 6%. That’s better than the slight loss for the index during that time. Clearly, active management is making the difference.

What’s also interesting is that, typically, the shift in management style flows the other way: from active to passive. But BlackRock’s change underscores how ETFs and their lower costs have flipped the script and made active a real choice for managers, particularly in these inefficient markets and sectors.

Frontier Market ETFs

These funds were selected based on their ability to provide exposure to frontier markets and are sorted by their YTD total return, which ranges from -13% to 15%. They have expenses of 0.49% to 0.98% and have assets under management of $29M to $590M. They currently yield between 0.84% and 16.5%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NGE | Global X MSCI Nigeria ETF | $29.8M | 14.8% | 16.5% | 0.83% | ETF | No |

| VNM | VanEck Vietnam ETF | $575M | 12% | 0.84% | 0.66% | ETF | No |

| FM | iShares Frontier & Select EM ETF | $590M | 6.5% | 3.2% | 0.80% | ETF | Yes |

| GMF | SPDR S&P Emerging Asia Pacific ETF | $338M | 4.9% | 1.7% | 0.49% | ETF | No |

| AFK | VanEck Africa Index ETF | $44M | -13% | 4.12% | 0.98% | ETF | No |

The Bottom Line

Active management and active ETFs make sense for a variety of inefficient markets. And you can’t get more inefficient than the frontier. It’s no wonder BlackRock recently switched its frontier market ETF to an active strategy. The proof is in its stronger returns.

1 MSCI (November 2023). MSCI Frontier Markets Index