Volatility is inevitable when it comes to investing. Gyrations in portfolio value and asset pricing is part of the game. However, while most investors can handle small waves, a full-on stormy sea is another matter. Big swings can reduce returns, not to mention create plenty of sleepless nights.

And with volatility and risks growing, investors have been having a lot of sleepless nights lately. But they potentially don’t have to.

Thanks to new defined outcome or buffered ETFs and mutual funds, investors now have a powerful tool to reduce volatility while still participating in much of the market’s upside. For those investors near or in retirement, these new products could be a huge lifesaver.

Downside Protection & Upside Caps

Over the long haul, time tends to heal old wounds. This is especially true when it comes to the stock market. Pull up any chart of the S&P 500 or Dow Jones Industrials and you’ll see several big craters—he Great Depression, Black Monday, the Credit Crisis, Dotcom bust, etc.—but the long-term chart is very upward sloping.

But what if you don’t have that much time to allow the market to recover? For investors in or near retirement, this is a painful fact. Big downturns just before or right at the beginning of retirement can create a huge sequence of withdrawal risks. For these investors, reducing drawdowns becomes a paramount issue.

That’s where new buffered ETFs and mutual funds can come in handy.

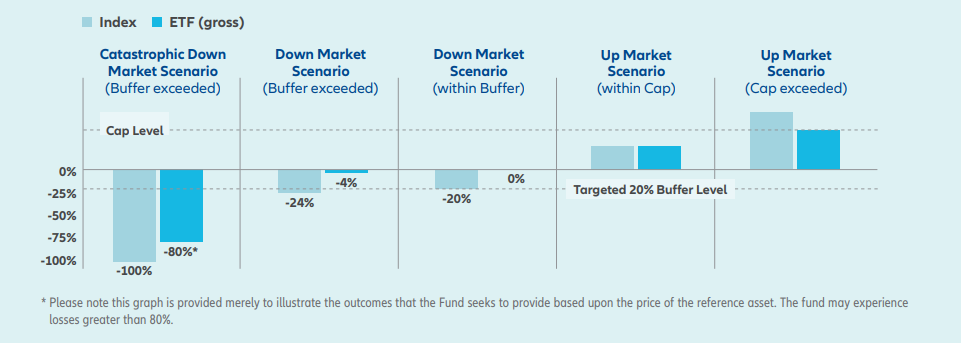

These funds are actively managed and, rather than buy bonds or stocks, they use derivatives contracts to gain the desired effect. Managers will buy options contracts to track the performance of their underlying indexes, while at the same time sell the call options tied to the same index. This creates a price floor for the fund that kicks in when the market has a drawdown below this amount. At the same time, the options contracts create a cap on gains.

This chart from Allianz highlights how the caps, loss prevention, and gains can work in various market scenarios.

Source: Allianz

The Opportunity for Buffered ETFs

For investors, this is a powerful tool and provides near guarantees when it comes to returns. They know this investment can produce gains or losses of X% for a certain period of time. Those near or in retirement having some upside, while protecting to the downside, are invaluable. Investors in this range often don’t have the time to recoup losses before they begin drawing from their portfolios.

Buffered funds may sound like another solution that’s been on the market for years: indexed annuities. And you’d be correct; indexed annuities function in much the same way.

However, using ETFs and mutual funds to accomplish the same goal could be the better option.

For one thing: costs. Annuities—even the best ones—tend to be expensive with plenty of fees, sales charges, and other costs. For a buffered ETF or mutual fund, expenses are simply the expense ratio of the fund. Second, with the creation of commission-free trading, some of these ETFs can be bought without commission.

Another win for buffered ETFs? They can be easy to get rid of. Annuities come with surrender charges and lock-up periods. But for buffer funds, you can easily sell as you need or as your strategy changes.

Using Buffered ETFs in a Portfolio

According to investment researcher Cerulli, nine out of ten investors have either a moderate or conservative risk tolerance. With that, buffered funds could be a top draw for many portfolios. Adding them is a snap.

All buffered products have two main numbers to consider: the drawdown amount and the time of the defined benefit. For example, the Innovator U.S. Equity Power Buffer ETF – November provides downward protection of 15% till November of this year, while the AllianzIM U.S. Large Cap Buffer10 Jul ETF provides 10% downside protection till July. These two numbers allow investors to plan accordingly to suit their needs and protection levels.

Investors can either use them for their entire equity position or use the funds to hedge money earmarked for living expenses while still having unprotected funds for growth. Remember upside is capped as well.

Currently, there are more than 100 different buffered ETFs with three issuers— Innovator, First Trust, and Allianz —accounting for all the assets. CboeVest also offers buffered strategies in a mutual fund wrapper.

A list of some top-performing buffered funds

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| AllianzIM U.S. Large Cap Buffer10 Jul ETF | JULT | ETF | Yes | $44 million | 9.5% | 0.74% |

| Innovator U.S. Equity Power Buffer ETF - November | PNOV | ETF | Yes | $788 million | 8.9% | 0.79% |

| Cboe Vest US Large Cap 10% Buffer Fund | BUMGX | Mutual Fund | Yes | $321 million | 8.7% | 1.2% |

| FT Cboe Vest U.S. Equity Deep Buffer ETF - Augus | DAUG | ETF | Yes | $609 million | 5.5% | 0.85% |

| Global X Dow 30® Covered Call ETF | DJIA | ETF | No | $52 million | 4.7% | 1.7% |

The Bottom Line

With volatility rising, investors near or in retirement have a major issue at hand. But buffered ETFs and mutual funds could provide plenty of downside support and help smooth out their rides. With low costs and ease of use, it’s no wonder why they are becoming a popular tool.