Thanks to the COVID-19 crisis, many investors are looking for ways to reduce their risk and hedge their portfolios from continued market crashes. This has become especially prevalent now that bonds aren’t yielding what they used to. To that end, annuities are once again getting attention from investors.

But exchange-traded funds (ETFs) may be giving annuities a run for their money.

Thanks to the creation of active-defined return ETFs and new buffer funds, ETFs are able to function similar to annuities for investors – all without the negatives of owning annuities, such as high costs and sales loads.

For investors who are looking for stability and considering annuities, these new ETFs could give annuities a run for its money.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Annuities Get Some Competition

Essentially, an annuity is a contract between an investor and an insurance company designed to provide you with income or a return over the long haul. There are numerous varieties, each with their own set of standard rules on how to get that return. In recent months – mostly due to the downturn surrounding the COVID-19 crisis – indexed annuities have once again received plenty of investor attention. According to industry group LIMRA, fixed annuity sales clocked in at $28.4 billion for the first three quarters of 2021 alone, which was an 81% increase versus the year earlier.

Indexed or fixed-indexed annuities were created in the 1990s, but they still have a lot of appeal for investors. The idea behind these annuities is that they offer a minimum guaranteed interest rate. Some combine this fixed rate of return with an equity kicker and are tied to the performance of an underlying stock index. Therefore, investors get a fixed rate of return and are cushioned from losses in the stock market. They’re preferable to a certificate of deposit since they also have the potential to provide equity exposure.

But investors looking at fixed or index-linked annuities may want to give active ETFs a go.

Thanks to the exchange-traded fund sector’s innovation, there are now ETFs that play in the same sandbox as fixed/indexed annuities. Buffer or defined outcome ETFs seek to function in a similar manner as their annuity twins.

These funds, instead of owning stocks and bonds, use options contracts to track the performance of their underlying indexes. The active management comes in from the buying of put options and then selling the call options tied to the underlying index. This puts a price floor under the fund to limit losses, but it also caps some of the upside. The end result is a smooth ride for portfolios that operate similar to an indexed annuity. And like an indexed annuity, this protection is only offered for a set period of time, making it easy for investors to plan returns for their desired outcome.

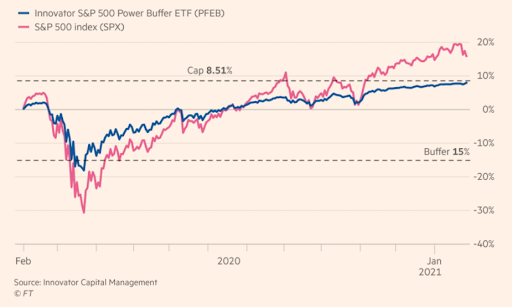

The best part is that the ETFs work. This chart from the Financial Times shows the S&P 500 versus the Innovator S&P 500 Power Buffer ETF (PJAN) in action.

Source: FT.com

Investors were still able to get good returns, albeit capped, while reducing their losses versus the bread & butter index. This is exactly how a fixed/indexed annuity should work.

Why Pick the Buffered Product?

With the products essentially performing the same, buffer ETFs could start to eat annuities’ lunch for many investors. For one thing, they could be cheaper to own.

One of the biggest criticisms about annuities is how they are bought. They are a “sold” product. Historically, this meant huge commissions and sales loads for brokers. Meanwhile, many annuities were loaded with hefty annual fees and sales restrictions. The industry has cleaned up its act in a big way over the last decade or so, but they can still be an expensive product to own for portfolios.

Here’s where buffer ETFs can win. Just like any other ETF or stock, defined outcome ETFs can be had for $0 commissions. Moreover, the average expense ratio for these funds is around 0.8%, or $80 per $10,000 invested. Fees for annuities can range as high as 3% per year. Plus, every rider you add to the policy adds additional expenses.

Also, it takes a hefty sum to initially buy annuity – often in the $5,000 to $10,000 range. This makes them out of reach for many smaller investors. But you can get started with a buffer ETF for the cost of one share. Additionally, adding to an annuity is sometimes impossible depending on the product purchased, which is not so with an ETF.

And what about getting your money out? Here again, annuities feature escape clauses, but they often come with hefty fees. With a quick click of the mouse, you can sell the ETF. This could help investors deal with emergencies or other cash needs when they arise rather than having a set schedule.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

Buffer ETFs Are a Big Win

While there are benefits to going with an annuity rather than a buffer ETF (such as the ability to turn it into guaranteed income or potential tax deferrals), for most investors, the lower costs and ease of use make the defined outcome ETF a great portfolio choice.

And now with several managers – Allianz, First Trust & Innovator – offering whole suites of these products, investors have the ability to add stability and returns potential to their portfolio. In the end, these active ETFs are giving annuities a run for their money.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.