Inflation may be easing from a high of over 9% in June to 6.5% in December 2022, but it’s still well above the Federal Reserve’s 2% target rate. At the same time, the central bank’s aggressive tightening is already taking a toll on the bond market and slowing economic growth. As a result, investors have few options for safe yields.

Let’s examine why preferred stocks could be attractive in today’s environment and why investors might want to consider PIMCO’s new ETF for active exposure rather than investing in passive funds.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Why Preferred Stock?

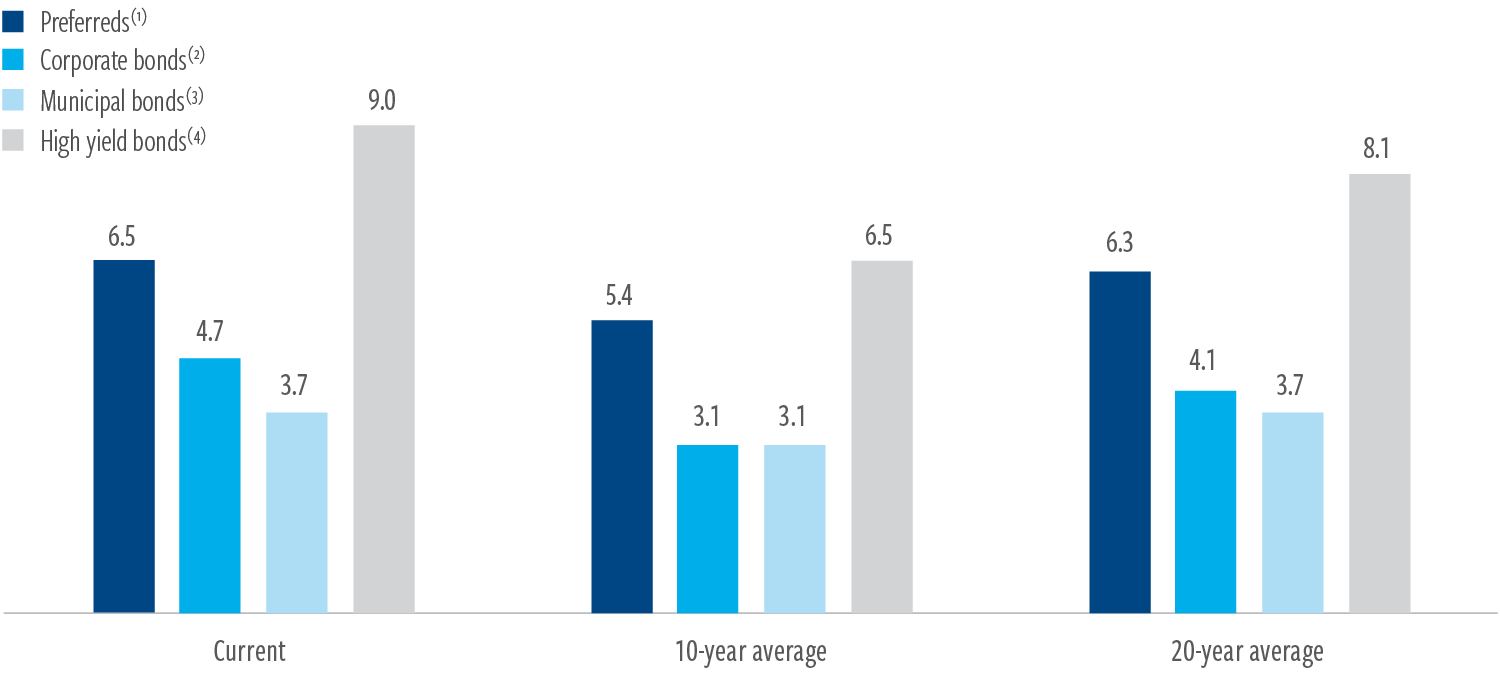

Preferred stocks offer a higher yield than other investment-grade fixed-income securities, such as corporate or municipal bonds. These higher yields help cushion the impact of rising interest rates on total returns. Many preferred stocks also offer fixed-to-reset or fixed-to-float coupons that adjust to higher interest rates after a set period.

Comparison of preferred stocks versus bonds returns. Source: Cohen & Steers

In addition, preferred stocks could offer better credit quality during the economic downturn since banks are their primary issuers. Rising interest rates typically help banks’ net interest margins. Meanwhile, core capital ratios remain close to 11% in the U.S., which is well above the required minimums and significantly higher than in past crises.

Finally, preferred stock dividends are usually qualified dividends, providing tax advantages. In particular, qualified dividends are taxed at 0%, 15%, or 20% rates, depending on the taxpayer’s taxable income and filing status. These rates are significantly lower than the ordinary income tax rates affecting most fixed-income sources.

PIMCO’s New Fund

Investors can invest in preferred stocks directly or through more than 15 preferred stock ETFs. Of course, ETFs offer the added benefit of built-in diversification without having to manage and rebalance an entire portfolio of positions. They also offer tax and liquidity advantages over mutual funds specializing in preferred stocks.

The largest preferred stock ETFs include:

| Ticker | Name | AUM | Expense Ratio | TTM Yield |

| PFF | iShares Preferred & Income Securities ETF | $14.1 billion | 0.45% | 6.04% |

| FPE | First Trust Preferred Sec & Inc ETF | $6.1 billion | 0.85% | 5.65% |

| PGX | Invesco Preferred ETF | $5 billion | 0.50% | 6.28% |

| PFFD | Global X US Preferred ETF | $2.4 billion | 0.23% | 6.67% |

| PGF | Invesco Financial Preferred ETF | $1.2 billion | 0.57% | 5.96% |

Most preferred stock ETFs are passively managed, investing in a market-cap-weighted portfolio. But, in today’s environment, investors may be better off holding specific sectors, such as banking. After all, the banking sector will be one of the few beneficiaries of higher interest rates, mitigating credit risks and potentially improving returns.

Earlier this year, PIMCO launched the PIMCO Preferred and Capital Securities Active ETF (PRFD), providing investors with active exposure to preferred stock for income and total return. The fund managers aim to find compelling opportunities where investments may offer equity-like total returns with significantly less volatility and qualified dividends.

Currently, the fund holds a portfolio of 76 preferred stocks with a 4.39-year effective maturity and a 3.77-year duration. The largest holdings include financial institutions like JPMorgan, Bank of America, Barclays, Ally Financial, PNC Financial, and others. And its 0.69% net expense ratio translates to relatively affordable exposure for an active fund.

The Bottom Line

Investors seeking a combination of income and yield during today’s rising rate environment may want to consider preferred stocks with higher yields, better outlooks, and tax-efficient dividends. And while there are many passively-managed ETF options, PIMCO’s new active fund could help maximize risk-adjusted returns by cherry-picking the best stocks.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.