Cathy Woods’ success with the ARK Innovation ETF (ARK) spurred a lot of interest in actively managed exchange-traded funds (ETFs). In addition, many mutual funds have begun transitioning their active strategies to more tax-efficient ETF vehicles. With inflation on the rise, many investors are starting to seek out active fixed-income ETFs to manage risk.

Let’s look at how investors can hedge against interest rate risk with active ETFs, and some of the best options to consider.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Rising Inflation Sparks Concern

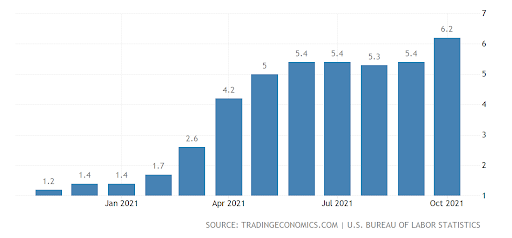

Consumer prices posted their biggest annual gain in more than 30 years in November, moving up 6.2% over the trailing 12-month period, thanks to surges in the cost of gasoline and other goods. Despite rising inflation levels, fixed-income assets continue to offer low interest rates, putting pressure on investors who require consistent income.

While the central bank argues that the spike is temporary, primarily due to supply chain disruptions, senior banking executives are less convinced. Goldman Sachs CEO John Waldron said inflation was the biggest risk that could derail the global economy and stock markets, while JPMorgan CEO Jamie Dimon told analysts last month that bankers should be worried.

Higher interest rates have a bearish effect on the price of bonds and other fixed-income investments since they erode the value of current coupon rates. As a result, many traders are moving into Treasury Inflation-Protected Securities (TIPS) and derivatives that offer inflation protection, such as zero-coupon inflation swaps.

Use the Dividend Screener to find high-quality dividend stocks.

Challenges with Conventional ETFs

Many long-term investors hold a portion of their portfolio in fixed-income investments. Conventional bond ETFs provide broad exposure to fixed-income across different issuers, maturities, and ratings, but they tend to favor the largest and most indebted issuers. As a result, they may have higher default risks and lower interest rates than alternatives.

Smart beta ETFs offer a more nuanced approach, enabling investors to optimize certain factors. For example, a smart beta fund might target bonds with a duration below a certain threshold, meaning they have less interest rate risk. Investors can use these funds to retain fixed-income exposure while mitigating near-term interest rate risk.

Of course, smart-beta funds ultimately track an index that follows a specific set of rules. The fund managers cannot shift gears when marketing conditions change, meaning that the onus is on investors to move capital into different funds. The good news is that there’s a growing crop of active fixed-income ETFs with greater flexibility.

Active ETFs Provide a Better Alternative

According to ETF Trends, actively-managed fixed-income ETFs attracted 16% of the category’s net ETF inflows despite having just an 11% share of the market. These funds have more flexibility than conventional or smart-beta funds, with a team of experts sorting through different opportunities to capitalize on current market conditions.

Many investors have sought out active fixed-income ETFs focused on maximizing income and minimizing interest rate risk. For example, the JPMorgan Ultra-Short Income ETF (JPST) is a popular fund that seeks to maximize current income while managing risk, even in challenging low-yield and inflationary environments.

Other popular active fixed-income funds include:

- Vanguard Ultra-Short Bond ETF (VUSB)

- Quadratic Interest Rate Volatility & Inflation ETF (IVOL)

- First Trust TCW Opportunistic Fixed Income ETF (FIXD)

John Hancock also recently launched the John Hancock Corporate Bond ETF (JHCB) and the John Hancock Mortgage-backed Securities ETF (JHMB), augmenting its existing conventional and smart beta ETFs in the fixed-income space. All in all, there are more than 150 active fixed-income ETFs spread across dozens of issuers.

The Bottom Line

Active ETFs have become increasingly popular following the success of the ARK Innovation ETF and the transition from mutual funds to tax-efficient ETF structures. With rising inflation, many investors are seeking active fixed-income ETFs to better manage risk relative to conventional and smart beta fixed-income funds.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.