The S&P 500 index is down nearly 20% since the beginning of the year, but not all countries are suffering the same fate as the United States. For example, the MSCI indices covering Turkey, Indonesia, Saudi Arabia, India, Thailand, Mexico, and Australia are all green this year. As a result, investors may want to take a closer look at international funds.

Harbor Capital launched the Harbor International Compounders ETF (OSEA) earlier this month as an actively-managed strategy seeking long-term capital growth in non-U.S. markets.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Who's Behind the ETF?

C WorldWide Asset management is responsible for managing the Harbor International Compounders ETF. With a track record dating back to 1986, the asset manager has vast experience with ‘trend-based stock picking’ in global markets. The company also incorporates sustainability and ESG factors into its approaches.

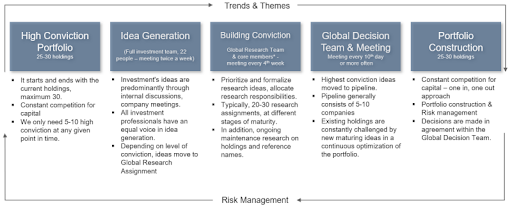

The fund managers aim to exploit market inefficiencies by investing in companies with under-appreciated, multi-year, structural growth opportunities. As seen below, after identifying global themes, the team selects companies based on their strategy and culture, as well as their recurring revenue, free cash flow, and return on capital.

“Part of the research process also incorporates long-term top-down themes into stock selection such as deglobalization, climate change, and infrastructure spending,” the firm said in a statement. “These forward-thinking themes often don’t fit neatly into a benchmark or short-term market environment and require a patient approach.”

What's in the ETF?

The Harbor International Compounders ETF maintains a concentrated portfolio of 27 equities in Japan (14.2%), Sweden (12.7%), Germany (10.9%), India (7.9%), and a handful of other countries. As a result, the fund provides investors with an excellent way to add international diversification to their portfolios.

The fund’s top holdings include:

- HDFC Bank Ltd. – 7.9%

- Swedish Match AB – 7.6%

- Novo Nordisk – 6.3%

- ASML Holdings – 4.8%

- Sony Group – 4.4%

In terms of liquidity and expenses, the fund offers a modest expense ratio of 0.55%, which is par for the course for actively-managed funds. However, the ETF has raked in just $6.4 million in assets since its launch on September 8, 2022, and doesn’t have significant liquidity yet, adding some liquidity risks for frequent traders.

The Bottom Line

OSEA offers investors a unique way to add international diversification to their portfolios. Rather than investing in a generic all-world index, investors can access a concentrated portfolio of companies well-positioned to benefit from structural themes playing out worldwide.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.