The debate between active and passive seems to be going toward active management, at least when it comes to bonds. Thanks to a plethora of reasons, active management in the fixed income sector can truly lead to benchmark betting returns. That fact hasn’t been lost on institutional investors. Fund flows into active bond vehicles from big investors have surged over the last year.

Increasingly, those flows have gone to active bond ETFs.

Driven by liquidity and better returns, institutional investors are increasingly making big bets on active fixed income ETFs. All in all, that is a big win for investors of all sizes and ultimately supports the fund structure for bonds.

Following the Fund Flows

ETFs gained popularity for their lower costs and index-hugging abilities. Institutional investors have found it easy to switch up allocations and quickly add asset classes by using ETFs in their portfolios just like regular people. Now, many endowments, pension funds, and the like are choosing ETFs for their active management as well, specifically for bond and fixed income sleeves.

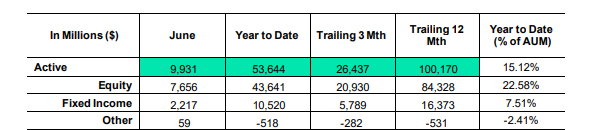

According to State Street, fund flows into active ETFs have surged this year. Looking at data for June, active fixed income ETFs added more than $2.2 billion in new cash. This follows May’s $2 billion worth of inflows. Year-to date, big investors have poured over $10 billion into active bond ETFs for a gain of 7.51% in total assets. This chart shows the flows into active funds of all types for the month and 2023. 1

Source: State Street

Digging into the data further, it appears that big investors aren’t selling their passive bond ETFs, but moving out of cash and money market funds into active fixed income funds. And it’s easy to see why.

Active Beats Passive When it Comes to Bonds

For one thing, active management can make a real difference in the returns department. Many passive benchmarks like the Bloomberg U.S. Aggregate Bond Index (Agg) are rather poorly constructed . Firms with the most debt get a higher place in the index. Therefore, those biggest debtors have more pull on the index. The Agg also has some other pretty glaring construction flaws as well, such as capturing only about 50% of the total U.S. bond market and being very overweight in U.S. Treasury/MBS debt.

By going active, managers can overweight/underweight different portions of the market, use credit analysis to find better deals/bargains, and change durations to fit market conditions. The illiquidity of the overall bond market also provides the potential to deliver additional alpha.

Institutional investors have long known this and have sought specialty managers for their fixed income portfolios. The reason for rising active ETF usage over other active vehicles comes down to one huge factor: liquidity.

Because of ETFs’ supply/demand mechanism, illiquid assets—like leveraged loans, corporate bonds, and other fixed income assets—can quickly become liquid. Large ETFs trade millions of shares each day and offer institutional investors the ability to buy/sell as they see fit. Moreover, those that do get to participate in the creation/redemption of ETFs have ways to pass these assets off to other investors through the process of creating or removing ETF shares from the market. This liquidity is a win for those investors. Active ETFs allow them to participate in the best parts of the fixed income market while still maintaining the illiquidity of passive vehicles.

Active ETFs Work Great for Regular Investors as Well

With liquidity and higher returns, it’s easy to see why pension funds, endowments, and other large investors have started to look toward active ETFs for their fixed income assets. Fund flows confirm that they are choosing them more and more.

The best part is that active fixed income ETFs can work wonders for regular retail investors as well.

Just like big investors, retail investors can achieve higher and benchmark returns from choosing active management for their fixed income sleeves. Because of how ETFs are structured, retail investors are literally investing side-by-side with institutional investors in these portfolios. Additionally, investors can benefit from the illiquidity of ETFs as well. For any reason, at any time, investors can buy or sell active ETFs with a simple mouse click.

And thanks to recent fund launches, mutual fund-to-ETF conversions, and the adoption of ETFs as a share class, the number of active ETF choices available for retail and institutional investors in fixed income has surged. Building an active portfolio has never been easier.

Active Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| BOND | PIMCO Active Bond Exchange-Traded Fund | $3.479B | -100% | 0.55% | ETF | Yes |

| FCOR | Fidelity Corporate Bond ETF | $159.2M | -100% | 0.36% | ETF | Yes |

| TOTL | SPDR DoubleLine Total Return Tactical ETF | $2.985B | -100% | 0.55% | ETF | Yes |

| UCON | First Trust TCW Unconstrained Plus Bond ETF | $1.456B | -100% | 0.75% | ETF | Yes |

| JCPB | JPMorgan Core Plus Bond ETF | $1.125B | -100% | 0.39% | ETF | Yes |

| AVIG | Avantis Core Fixed Income ETF | $466.6M | -100% | 0.15% | ETF | Yes |

| TOTR | T Rowe Price Total Return ETF | $28.5M | -100% | 0.31% | ETF | Yes |

| DFCF | DFA Dimensional Core Fixed Income ETF | $3.101B | -100% | 0.19% | ETF | Yes |

| NEAR | BlackRock Short Maturity Bond ETF | $3.705B | -100% | 0.25% | ETF | Yes |

Ultimately, investors have plenty of choice across a variety of fixed income asset classes.

The Bottom Line

Active management has played a big role in fixed income assets in driving excess returns. Active ETFs have only enhanced this ability. Institutional investors have caught wind of that fact. With excess liquidity and better returns, fund flows show that they are choosing active ETFs for their bond holdings. Regular retail investors can enjoy the same benefits.

1 State Street (June 2023). Investors Jump Back into the Market