Mutual fund-to-ETF conversions have been gaining traction over the past few years after the SEC eliminated the need to obtain exemptive relief in the so-called ETF Rule (6c-11). Last year, Dimensional Fund Advisors converted four mutual funds with nearly $30 billion in assets into active ETFs, and JP Morgan followed suit this year with $8.7 billion worth of conversions.

ETFs offer shareholders significant cost, tax, and liquidity advantages compared to mutual funds. In addition, for fund managers, ETFs have a much simpler structure, target a broader investment audience, and offer the opportunity for better returns since there’s no need to maintain a cash balance. As a result, these growth rates shouldn’t come as a surprise.

The Neuberger Berman Commodity Strategy ETF (NBCM) is the latest mutual fund to undergo conversion into an active ETF. With about $200 million in assets, the fund invests in commodity-linked derivatives with an active risk-balanced, diversified approach that seeks to minimize the effects of market volatility in commodity markets.

In this article, we’ll take a closer look at what’s in the active ETF and why investors may want to consider it for their portfolios.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

What’s in the Fund?

As its name suggests, the Neuberger Berman Commodity Strategy ETF invests in various commodities, including energy (35%), agriculture (21%), precious metals (20%), and industrial metals (19%), among others. These holdings are primarily in the United States (83%), with some exposure to the United Kingdom’s (24%) derivatives market.

The fund’s top commodity holdings include:

- Gold (14.5%)

- Gasoline (7.62%)

- Corn (7.26%)

- Copper (6.86%)

- Heating oil (6.74%)

The portfolio managers seek to build a risk-balanced portfolio with tactical exposure adjustments and optimized derivate contract selection to enhance returns. In addition, the portfolio provides exposure to global growth while mitigating the effects of inflation. The net expense ratio is 0.65%, which is lower than many comparable active ETFs.

Why Invest in the Fund?

Commodities have become a valuable tool to help mitigate inflation risk. While the U.S. inflation rate decelerated to 7.7% in October, the readings remain well above the Federal Reserve’s 2% target rate. As a result, the CME FedWatch tool projects that the central bank will continue hiking interest rates well into next year, potentially hurting asset valuations.

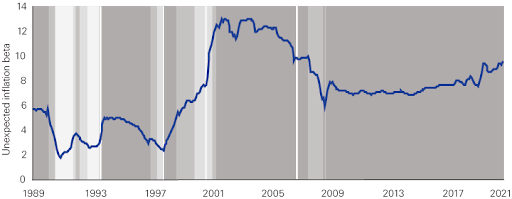

Vanguard research (above) shows that commodities have had a statistically significant and broadly consistent positive inflation beta over the past three decades. On the other hand, nominal bonds must move lower when inflation rises, and stocks tend to underperform during inflationary environments, particularly growth stocks.

NBCM seeks to provide targeted exposure to commodity markets while minimizing volatility, creating an ideal opportunity for investors concerned about inflation. For example, the fund isn’t over-exposed to volatile energy markets like many passive index commodity funds.

The Bottom Line

NBCM is the latest mutual fund to ETF conversion, offering investors a way to hedge against inflation through targeted commodity exposure. With about $200 million in assets and a modest expense ratio, the active ETF is already starting to gain traction following its launch as investors take notice.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.