Everyone loves when their portfolio’s value go up, but there has been a downside to gains in recent years. Only a handful of stocks have been driving returns. Moreover, those returns have come from just a few key sectors. As those returns have occurred, it creates a new variety of risk for investors.

We’re talking about concentration risk. With tech stocks dominating the broader indexes, investors are exposed to looming problems.

The answer may lie within active management and active ETFs. Ultimately, by not looking at the market, active managers can have a leg-up on concentration risk issues. That fact could be very valuable in the quarters ahead.

Technology Is King

For investors, the rebound this year has been a welcome sign. After last year’s interest rate-induced rout, the S&P 500 is up around 19% this year. The NASDAQ Composite is up around 36%. Those are some big rebounds and certainly go a long way to wealth. But digging deeper into those returns, investors may see some worrisome signs.

Only a handful of stocks – and one sector in particular – are driving all the gains.

The technology sector has contributed most of the gains this year. And in fact, just seven stocks are responsible for all the returns. Apple, Meta, Microsoft, NVIDIA, Amazon, Alphabet and Tesla have driven the broader indices higher. Apple has been responsible for nearly 18% of the S&P 500’s return. Microsoft? 14%. Even Tesla has managed to prop up the broader index by 6.7%.

Top-Performing Tech Stocks This Year-to-Date

These stocks are selected based on their YTD total returns, which ranges from 46% to 211%. They have market capitalizations between $750B and $3,000B, and are currently yielding between 0% and 0.81%.

| Ticker | Name | Market Capitalization | YTD Total Ret (%) | Yield (%) |

|---|---|---|---|---|

| NVDA | NVIDIA | $1155B | 211% | 0.03% |

| META | Meta Platforms | $834B | 165% | 0% |

| TSLA | Tesla | $759B | 91% | 0% |

| AMZN | Amazon | $1519B | 72% | 0% |

| MSFT | Microsoft | $2783B | 55% | 0.81% |

| GOOG | Alphabet | $1668B | 47% | 0% |

| AAPL | Apple | $2974B | 46% | 0.50% |

The issue is that it is a self-fulfilling prophecy. As Apple gains, it drives a bigger placement in the index and a larger market cap. It then has more pull on the index. Rinse and repeat. The issue is that we are now seeing the top stocks in the index become, perhaps, too top-heavy. We’ve never been this top-heavy in nearly four decades.

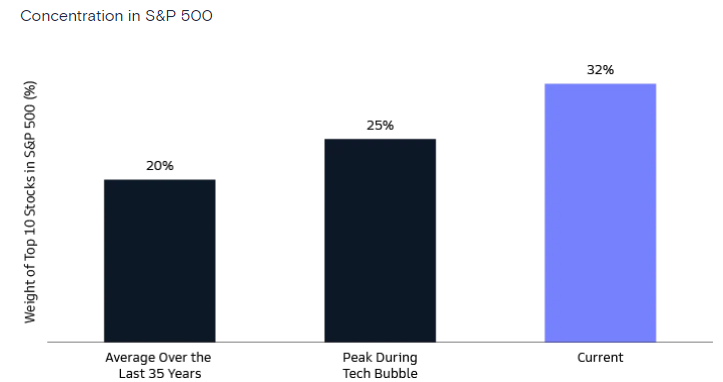

According to Goldman Sachs, the average weight of the top 10 stocks in the S&P 500 Index over the last 35 years has been 20%. Today, that number sits at 32%, eclipsing the previous record of 25% achieved during the dot-com boom. 1

Source: Goldman Sachs

The top-heaviness of these seven big-name tech stocks caused the Nasdaq 100 Index to undergo a “special rebalance” to avoid Securities and Exchange Commission (SEC) rules on fund diversification. This was only the third time in history that the index needed to do that.

Welcome Concentration Risk

This problem is known as concentration risk – and it’s a huge issue in the current market. While the gains are nice, the large positions of these firms put investors at increased downside risk. One bad quarter at NVDA or a piece of less-than-ideal news from GOOG and the index will fall by a lot.

Secondly, as we move through economic cycles, having too much concentration in one industry – in this case, tech – isn’t great either, as the natural progression supports different sectors at different times.

Moreover, diversification benefits are limited. While investors think they own 500 different firms, the reality is that those in the middle and bottom of the pack have limited pull on the index. In the case of today, it’s only about 26% of the returns.

Active Could be the Key

Given that concentration risk is a huge problem and exposes portfolios to unseen issues and risks, fighting it is key. The answer may be to go active with your approach to equities. Active managers don’t have to function like the index or hold stocks in proportion. This gives them total control. At the same time, they can pick and choose sectors as they see fit. This can include underweighting overpriced sectors and buying those that are cheaper.

Active managers can sell positions as they see fit. This can help limit losses. As a stock or sector gets too big, it can book gains before the downturn happens. Index funds continue to hold the stocks and we get the self-fulfilling machine. Moreover, this selling allows active managers to right-size positions for assets under management and future returns expectations.

The best part is when you place active management in an ETF. All the benefits of eliminating concentration risk come without many of the tax headaches. The creation/redemption mechanism of ETFs allows managers to freely buy/sell and prevent concentration risks without incurring capital gains taxes for their shareholders.

The key for investors is to find those funds that aren’t just index huggers. For example, the Dimensional U.S. Core Equity 2 ETF has lower weightings for the previously mentioned stocks and includes others such as ExxonMobil in its top ten. Likewise, the Avantis U.S. Equity ETF weights these stocks differently, while the growth-focused Capital Group Growth ETF doesn’t even include some of the over-concentrated names.

Active Large-Cap Equity ETFs

These ETFs were selected based on their lower concentration risks to the broader S&P 500 and are sorted by their YTD total returns, which range from 16% to 51%. They have expenses between 0.15% and 0.59% and AUM between $760M and $21B. They are currently yielding between 0% and 1.45%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FBCG | Fidelity Blue Chip Growth ETF | $764M | 50.5% | 0% | 0.59% | ETF | Yes |

| CGGR | Capital Group Growth ETF | $2.84B | 34.5% | 0.38% | 0.39% | ETF | Yes |

| CGUS | Capital Group Core Equity ETF | $1.32B | 22% | 1.24% | 0.33% | ETF | Yes |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $20.45B | 16% | 1.34% | 0.17% | ETF | Yes |

| AVUS | Avantis U.S. Equity ETF | $4.53B | 16% | 1.45% | 0.15% | ETF | Yes |

Ultimately, the idea is that active managers cannot look like the broader indices and avoid many of the concentration risks that they currently have. By being flexible in their approaches and holdings, their portfolios will look different. This could be a winning move as the tech sector’s dominance gets out of hand and a few key stocks drive the indices’ movements.

The Bottom Line

With only a handful of key stocks driving returns for the broader indices, investors are now in the crosshairs of concentration risk. But active management and ETFs could save the day. By not looking like or following an index, active managers can help reduce concentration risk and help investors limit volatility and downside risk.

1 Goldman Sachs (November 2023). Equity Index Concentration And Portfolio Implications