Active or passive? It’s the oldest and perhaps fiercest debate in investment management. Numerous studies have given passive the edge when it comes to long-term returns. This has been exacerbated since the creation of exchange traded funds (ETFs). Now trillions of dollars sit in passive and indexed vehicles.

But investors may not want to be so quick to cast away active management, particularly when it comes to fixed income.

A recent study by asset manager Nuveen highlights how active can and does beat passive in bond investing. For our portfolios, it’s a definitive answer to the debate and reason why we should get active with our fixed income allocations.

Risk-Adjusted Returns

When John Bogle created Vanguard and launched the world’s first index fund, it set off a revolution that is still reverberating to this day. Index funds are a simple idea: Why own just a few stocks or bonds when you can own them all? It’s difficult to pick winners, so why try? Matching the market produces wonderful long-term returns. Since Bogle’s creation, index funds and passive management have taken the investment world by storm. The creation of the ETF has only pushed passive/index management further ahead. These days, there are trillions of dollars tucked away in passive and index vehicles.

But maybe some of that should be going toward active management.

When it comes to bonds, it turns out that active beats passive on a number of fronts. That’s the gist according to a recent report by asset manager Nuveen. The TIAA subsidiary, which specializes in fixed income and municipal bonds, recently reported that when it comes to risk-adjusted returns, active beats passive.

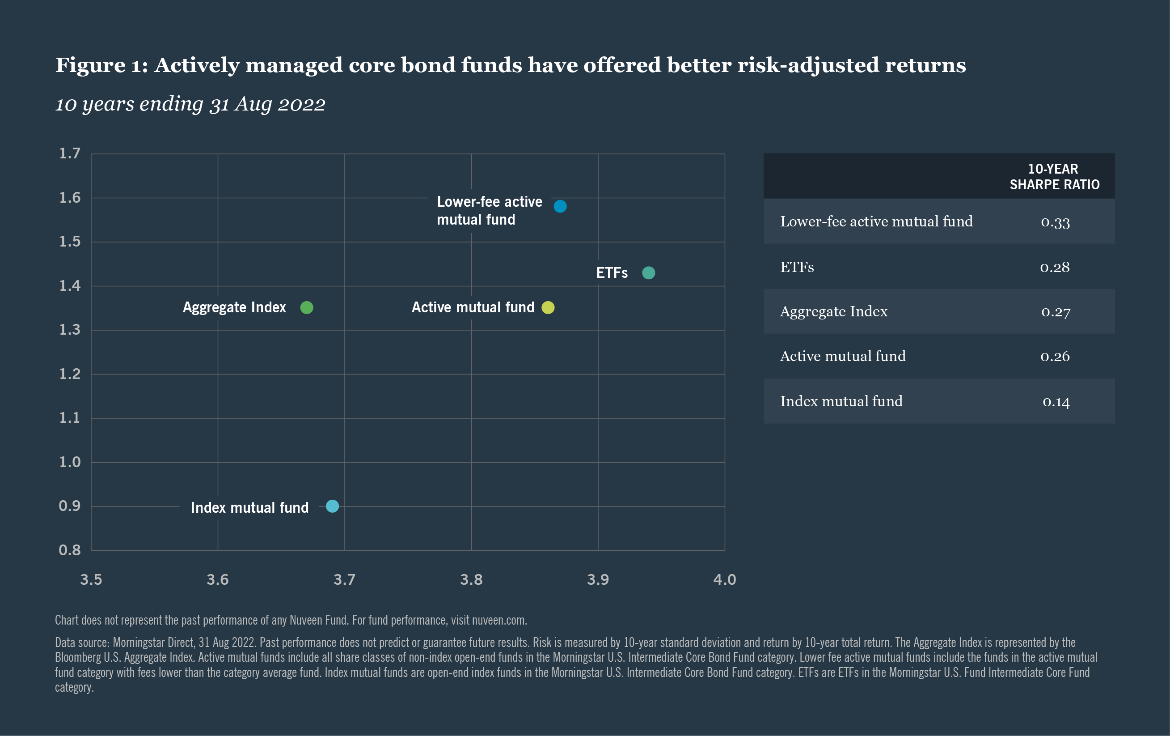

Digging into the data, Nuveen shows that index mutual funds in the bond space don’t actually match the risk and return characteristics of their benchmarks. Index bond ETFs match the returns, but actually have higher volatility than their benchmarks.

However, it’s a different story for active bond mutual funds. Here, data shows that they have a similar risk/reward profile as their benchmarks, while low-fee active bond funds outperform their benchmarks while only modestly increasing risk (Sharpe). Nuveen defines lower fee funds as those in the bottom half of the universe.

This chart sums up their data.

Source: Nuveen

The “Why?”

Nuveen’s study essentially shows that active produces better returns without increasing risk above the benchmark. The question is: Why does this work? The asset manager has several ideas.

One is index construction. Broad indexes often aren’t as broad as they could be. For example, the Bloomberg U.S. Aggregate Index contains more than 10,000 securities. Globally, the bond market is 25x larger than the global equities marketplace. Even if an index holds all the bonds, most funds simply can’t buy everything. Second, how indexes are weighted makes a big difference in the bond world. Those firms with the most debt outstanding often get higher placement at the top of the index. In the case of U.S. bond indexes, that’s often U.S. government debt.

Active, however, avoids these issues with construction.

Looking at the Agg, its focus is on U.S. Treasury debt, which is often the lowest yield of all bonds. Simply tweaking and holding slightly more corporate bonds can skew yield without increasing risk by a substantial amount.

Moreover, credit analysis is a key edge for being active. When it comes to returns, a portfolio can be hurt more by a bond not repaying its principal vs. being helped by a bond repaying principal plus interest. Downside risk management is critical.

Additionally, managing interest rate risk is another win for active management. Last year, we saw what happens when the Fed changes its tune. Passive funds were hit hard as they were faced with rising rates. These negative returns were enhanced by the fact that the overall duration of the AGG has nearly doubled over the last decade as more longer-term bonds were issued. Active funds fared better overall in last year’s bond rout.

Focusing on Low-Cost Active Bonds

For investors, the win in active reflips the script with regard to portfolio allocations/management. Going active may provide the best benefits with regard to a bond portfolio. The key to Nuveen’s study is to focus on low-cost funds. Here, investors get the market-beating returns and low risk that the research underscores.

How do we do that? Luckily, the growth of active ETFs has helped on that front. These days, investors can score active management for less than some passive funds. Buying any of these could help generate better returns than indexes and boost yields.

Active Bond ETFs

These funds were selected based on their low-cost exposure to active bond management. They are sorted by their YTD total returns, which range from 3.1% to 8.8%. They have expenses between 0.18% and 0.70%, and assets between $3B and $23B. They are currently yielding between 4.3% and 9.2%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $4.36B | 8.8% | 9.2% | 0.70% | ETF | Yes |

| FBND | Fidelity Total Bond ETF | $5.1B | 6.2% | 4.4% | 0.36% | ETF | Yes |

| FIXD | First Trust TCW Opportunistic Fixed Income ETF | $4.4B | 5.1% | 4.4% | 0.65% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $9.7B | 5% | 5.5% | 0.35% | ETF | Yes |

| DFCF | Dimensional Core Fixed Income ETF | $3.35B | 4.5% | 4.56% | 0.19% | ETF | Yes |

| BOND | PIMCO Active Bond ETF | $3.5B | 4.3% | 4.3% | 0.58% | ETF | Yes |

| JPST | JPMorgan Ultra Short Income ETF | $22.8B | 3.8% | 5.3% | 0.18% | ETF | Yes |

| TOTL | SPDR DoubleLine Total Return Tactical ETF | $3.1B | 3.1% | 4.9% | 0.55% | ETF | Yes |

Ultimately, active management in the fixed income space eliminates many of the issues with indexing. Credit analysis, duration risks, and yield are all taken care of with active management. And that’s a good thing for portfolios.

The Bottom Line

Active and passive management have been in a struggle of supremacy ever since John Bogle created the first index fund. However, it looks like many are winning the war in bonds. A recent study by Nuveen highlights active’s better returns at lower risk. For investors, they just may want to switch over to the management style for their fixed income assets.

1 Nuveen (October 2023). Fixed income investing: the active advantage