With the Fed potentially pausing its path of rate hikes, growth is once again on the menu. Investors have started to plow some hefty dollars into various growth sectors like technology and healthcare. However, it might be too much too soon. Valuations could already be getting stretched given the economic outlook.

But that doesn’t mean investors should abandon growth.

What they should do is have an active touch. It turns out active management can enhance growth stock investing, allowing investors to find better returns and avoid potential blow-ups. With the pivot potentially occurring as well as uncertainty growing, active management could be the answer to getting strong returns amid growth stocks.

Growth Is Back…

With economic data starting to slip and inflation beginning to decline, the idea that the Fed may be ready to pause its path of rate hikes is growing. With that, investors have once again gone gaga for growth and started buying tech, healthcare, and other growth-focused sectors in a big way. The Russell 1000 Growth Index—which includes large- and mid-cap stocks—is up a staggering 27% so far this year. Compare this to the broader Russell 1000 return of just 15% year-to-date. Some individual growth stocks like Nvidia and Meta are up by triple digits on a year-to-date basis.

But in that rush for growth, investors may be setting themselves up for failure.

Valuations for growth stocks have now started to climb to numbers that would indicate they are very overvalued. Both the forward P/E and the Shiller PE (CAPE) for the NASDAQ are above historic norms.

At the same time, uncertainty is rising. The Fed hasn’t officially announced that they are done raising rates in any capacity. And, in fact, they have expressed there is still room for higher rates as inflation remains stubbornly strong. Meanwhile, recessionary risks continue to get pushed further out on the timeline. Earnings revisions continue to come in, pushing valuations up further.

None of these things are necessarily bullish for growth in the short term.

Active Can Play a Crucial Role

The potential to pause interest rate hikes is growing and there is still plenty to like about growth stocks in the current environment. This sort of slow, tepid economic grind higher was exactly the environment of the last decade after the Great Recession. Here, firms that featured high margins—such as tech—were able to make the most out of mixed economic growth. So, there can be something said for considering growth stocks these days.

Investors have to be careful with how they do it. This is where active management can come in.

There are two problems with indexing when it comes to growth stocks. For starters, growth indexes like the previously mentioned Russell include a lot of all-revenue, no-profit firms. These are the types of firms that will suffer and have historically suffered when things have gotten bad. Generally, startups and the like simply don’t have the ability to survive economic shocks, while high rates hurt their ability to borrow funds.

The other issue is that concentration risk of the big names is a problem. According to (ironically) Russell Investments, 96% of the Russell 1000 Index’s year-to-date return comes from just seven growth stocks. Kick out these seven—which include firms like Nvidia, Apple, and *Tesla*—and the index’s return would be just a paltry 0.34%. 1

Active managers don’t have to look like the index. In growth investing, this means overweighting or underweighting certain firms as well as finding values. Nvidia, for example, currently has a P/E of 120 and Tesla 75. A lot of expansion has already been baked into many growth stocks. By buying cheaper growth stocks, managers can get a bit of safety with their portfolios.

Finally, managers can flee to cash and avoid losses when the bubble pops and investors sell growth stocks. This isn’t the case with index funds.

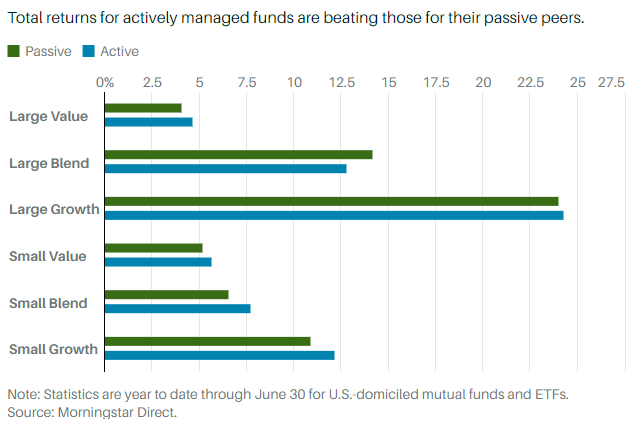

The proof is in the pudding. According to Morningstar, from 2000 to 2010, 60% of growth managers often beat the index over a given five-year period. The last decade has been a mixed bag, but there has been a resurgence of active winning in the category across both large- and small-cap companies. This is depicted in the chart shown below.

Source: Barron’s

Part of the resurgence comes from the advent of low-cost ETFs. Again, with fee hurdles lower, active managers can provide alpha that investors can see in their bottom lines. This helps drive their return outperformance and should allow investors to benefit from active management over the long haul.

Getting Active With Growth

Given the high valuations and active’s ability to not look like an index, investors may want to consider going active with their growth allocations. ETFs are the way to do it. Their low costs allow investors to get the most out of active management. Luckily, there have been plenty of new active ETF launches covering growth stocks.

The key is to look under the hood and dig into strategy. Every manager and fund has their own secret sauce. For example, the famed ARK Innovation ETF looks to focus specifically on game-changing growth firms. Because of this, investors need to align their needs to the fund they are picking. Moreover, it might make sense to divide and conquer by pairing a few different growth strategies or using a passive vehicle along with an active growth ETF.

Active Growth ETFs

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| ARKK | ARK Innovation ETF | $9.3B | 39.6% | 0.75% | ETF | Yes |

| TGRW | T Rowe Price Growth Stock ETF | $0.05B | 38.62% | 0.52% | ETF | Yes |

| FGRO | Fidelity Growth Opportunities ETF | $0.2B | 36.23% | 0.59% | ETF | Yes |

| CGGR | Capital Group Growth ETF | $2.56B | 29.21% | 0.39% | ETF | Yes |

| JGRO | JPMorgan Active Growth ETF | $0.41B | 28.03% | 0.44% | ETF | Yes |

| QGRO | American Century US Quality Growth ETF | $652.5M | 21.95% | 0.29% | ETF | Yes |

No matter how investors choose to get their growth fix, the choice is clear that active can play a significant role in helping to boost returns and create better outcomes.

The Bottom Line

Growth has soared in recent weeks. However, investors may be putting themselves at risk. Active ETFs can help downplay that risk and boost returns over the long haul. By using active ETFs on their own or with passive funds, investors can craft growth allocations that can thrive over the long term.

1 Russell Investments (June 2023). Why hiring a skilled active manager is critical during today’s highly concentrated stock market