When you purchase a used automobile, in general, you want to look under the hood, kick the tires, and give it a test drive. When it comes to building a portfolio, it turns out investors like to do the same thing. This has become particularly true in the world of active ETFs.

Despite the promises of shielding a portfolio manager’s special sauce, investors haven’t been drawn to so-called semi-transparent or non-transparent structures. They tend to pass them over for ETFs that disclose their holdings daily. And there are plenty of reasons why.

With a lack of assets and investors preferring the transparent structure, the days of semi-transparent ETFs could be waning.

Transparent, Semi-transparent, and Non-transparent?

Like an award-winning BBQ pitmaster, the secret to active management is in the recipe. Top actively managed funds thrive based on their managers’ skills and acumen in picking bonds, stocks, and other asset classes. That’s not a big deal when it comes to mutual funds. However, for ETFs it is a slight problem.

Because of their daily trading ability and market-maker requirements, ETFs were initially required to list their holdings daily. Authorized participants need to know what they are buying when they create/redeem shares. Market makers need to know what the fund holds to keep shares tied to holdings. For the first round of ETFs, this wasn’t a big deal. After all, if you’re tracking the S&P 500 Index, everyone knows you’re holding Microsoft stock.

But for those managers wanting to not track an index, this leaves their secret recipe out in the open for anyone to see. This creates potentially two issues. The first is so-called front-running. Anyone can see what a manager is buying and therefore can snag shares before a manager could potentially get a full position. This would reduce a manager’s ability to generate strong returns. Second, there would be no need to invest with the manager in the first place. You could just replicate the fund and buy all the holdings as you see fit.

With some managers complaining, the SEC listened and allowed several semi-transparent structures that provide relief from the Investment Company Act of 1940. This would allow fund disclosures on a quarterly or semi-annual basis, potentially eliminating the front-running issue. Some use a middleman for the authorized participant in the fund. Others use ‘like’ baskets of assets to keep what is actually in the fund hidden.

Investors Want Transparency

It turns out investors want to see what they are buying and owning. After an initial surge of launch activity, the number of semi-transparent ETF launches and asset gathering has crawled to a trickle.

When the SEC approved the various structures, at the end of 2019, semi-transparent ETFs flourished. According to data from the Financial Times, from the end of 2019 to the end of 2021, assets in active semi-transparent ETFs jumped from just $20 million across three ETFs to $5.6 billion across 45 ETFs.

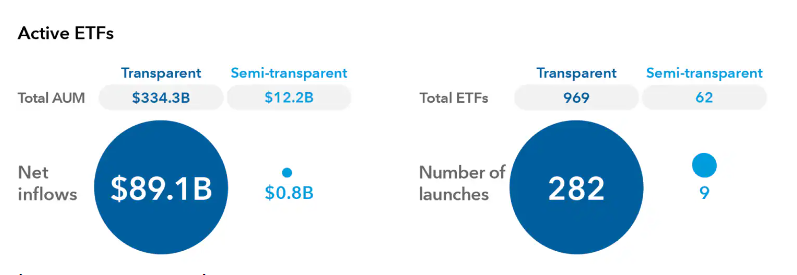

However, since then, active ETFs have taken the investment world by storm. But they were not led by semi-transparent ETFs. This chart from Capital Group shows just how far transparent funds have pulled away.

Source: Capital Group

However, this chart is a bit misleading. Since it was published in May 2023, we’ve seen a few closures. Moreover, over 35% of all the assets in semi-transparent ETFs sits in the Nuveen Growth Opportunities ETF. Those $2.5 billion or so in assets were a bring-your-own-assets situation from Nuveen parent TIAA.

The reasons come down to the ETF structure, daily trading, and wide bid/ask spreads. Good ETFs work because market makers are able to keep trading at a price very close to the fund’s NAV. The SPDR S&P 500 ETF Trust is a perfect example of this. The liquidity of the ETF allows for near-exact trades at its NAV/Price. But that doesn’t always happen. And in the case of semi-transparent ETFs, it happens more often than not. For many investors, this is an issue, leading to overpaying for assets.

Moreover, taxes are a surprise issue for many semi-transparent ETFs. The ETF structure is known for its ability to prevent capital gains taxes. However, semi-transparent ETFs aren’t always so lucky. For example, 10 of 19 semi-transparent active ETFs listed in 2021 made year-end capital gains distributions.

Betting Big on Transparent ETFs

Clearly assets, trading volume, and investor demand are in favor of transparent ETFs. Asset managers seem to get the picture. T. Rowe Price recently launched five new active funds under the fully transparent structure. Its previous suite of ETFs were semi-transparent. Franklin Templeton recently converted its only semi-transparent fund into a transparent one. Likewise, launch activity of semi-transparent ETFs has dried up, with just four funds launching so far this year.

There may be some instances where semi-transparent active ETFs make sense, such as small-caps for example. Here, a portfolio under the cloak of darkness makes a ton of sense. Front-running is a real problem. One of the four launches this year—the JPMorgan Active Small Cap Value ETF—plays in this sandbox.

However, given the negatives and the lack of investor demand, we may be witnessing the end of the semi-transparent structure. For investors, that could mean getting active management exposure from transparent ETFs. Issues such as the wide bid/ask spreads are eliminated with transparent ETFs. Because they know exactly what’s in the fund, market makers can keep spreads tight on prices and net asset values. At the same time, authorized participants feel comfortable with owning the funds. Therefore, this boosts assets, which in turn, helps the market makers. For retail investors and those in the secondary market, this is a win-win.

Second, by using transparent ETFs, investors aren’t treated to nasty tax surprises. Capital gains are truly realized when investors want, not because the manager sold a stock inside the ETF.

With these reasons in tow, investors may want to avoid the few semi-transparent ETFs on the market—except for maybe some of the largest or niche funds—and stick to fully transparent ones

Top-Performing Transparent Active ETFs This Year

These transparent funds were selected based on their YTD total return, which range from 2.5% to 23%. They have expenses between 0.09% to 0.75% and have AUM between $6.5B and $29B. They are yielding between 0% and 8.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ARKK | ARK Innovation ETF | $9.3B | 23.2% | 0% | 0.75% | ETF | Yes |

| DFUS | Dimensional U S Equity ETF | $6.97B | 15.1% | 1.4% | 0.09% | ETF | Yes |

| DFAC | Dimensional U S Core Equity 2 ETF | $21.8B | 10.2% | 1.5% | 0.17% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active Exch Tr | $9.22B | 5.7% | 5.4% | 0.36% | ETF | Yes |

| AVUV | Avantis US Small Cap Value ETF | $6.88B | 5.6% | 1.8% | 0.25% | ETF | Yes |

| JEPI | JPMorgan Equity Premium Income ETF | $28.95B | 5.13% | 8.1% | 0.35% | ETF | Yes |

| DFAT | Dimensional U S Targeted Value ETF | $8.81B | 4.5% | 1.5% | 0.28% | ETF | Yes |

| JPST | JPMorgan Ultra-Short Income ETF | $23.6B | 4% | 5.1% | 0.18% | ETF | Yes |

| FTSM | First Trust Enhanced Short Maturity ETF | $7.66B | 3.6% | 5% | 0.45% | ETF | Yes |

| DFUV | DFA Dimensional US Marketwide Value ETF | $9.08B | 2.6% | 2.1% | 0.22% | ETF | Yes |

Top-Performing Semi-Transparent ETFs

These semi-transparent funds were selected based on their YTD total return, which range from -2% to 42%. They have expenses between 0.39% to 0.65% and have assets under management between $80M to $2.5B. They are yielding between 0% and 2.8%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FBCG | Fidelity Blue Chip Growth ETF | $769M | 42.2% | 0% | 0.59% | ETF | Yes |

| TCHP | T Rowe Price Blue Chip Growth ETF | $377M | 37.2% | 0% | 0.57% | ETF | Yes |

| FGRO | Fidelity Growth Opportunities ETF | $182M | 34% | 0% | 0.59% | ETF | Yes |

| NUGO | Nuveen Growth Opportunities ETF | $2.5B | 32.1% | 0.2% | 0.55% | ETF | Yes |

| HFGO | Hartford Large Cap Growth ETF | $88M | 27% | 0% | 0.59% | ETF | Yes |

| FDG | American Century Focused Dynamic Growth ETF | $174M | 25.2% | 0% | 0.45% | ETF | Yes |

| CAPE | DoubleLine Shiller CAPE US Equities ETF | $283M | 14.4% | 2.8% | 0.65% | ETF | Yes |

| ESGA | American Century Sustainable Equity ETF | $152M | 13.9% | 1.2% | 0.39% | ETF | Yes |

| TSME | Thrivent Small-Mid Cap ESG ETF | $133M | 5.8% | 0.1% | 0.65% | ETF | Yes |

| FLV | American Century Focused Large Cap Value ETF | $211M | -2.1% | 2.4% | 0.42% | ETF | Yes |

The Bottom Line

While heralded, semi-transparent ETFs have left investors cold. Aside from a few major funds, assets, launches, and investor interest in the structure have been dwindling. This highlights the issues with the structure. With that in mind, choosing transparent ETFs could be the best bet for their portfolios. Many of the semi-transparent headwinds are eliminated.