A growing number of active ETFs employ hedge fund-like strategies to help investors achieve various outcomes. While some of these funds target specific strategies or market conditions, absolute return funds simply seek a positive return in any environment using short selling, futures, options, derivatives, and other techniques.

The Noble Absolute Return ETF (NOPE) is one of the few funds offering an actively-managed, long-short, absolute return strategy that captures investment opportunities over global market cycles and across regions, sectors, and factors. Using hedge fund-like strategies, the fund offers institutional-level access to everyday investors.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

A Unique Long-Short Strategy

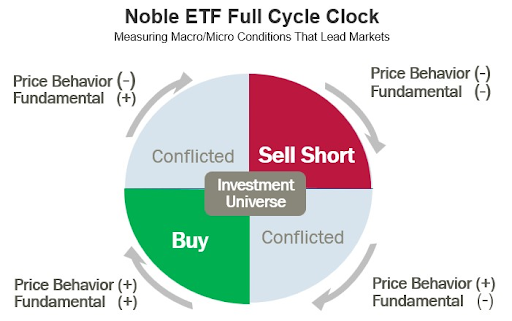

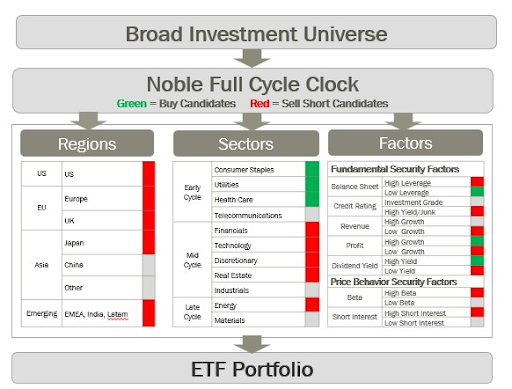

The Noble Absolute Return ETF’s portfolio consists of long and short positions selected based on the Noble Full Cycle Clock. After looking at price behavior and fundamentals on a macro scale, the team takes long and short positions based on sector rotation and equity factors (e.g., buying utilities early cycle or selling high-leverage stocks late cycle).

The fund holds primarily mid- to large-cap equities but may use liquid options to fine-tune positions and hedge risk. With its flexible long-short approach, the managers project a 150% maximum long exposure and a -100% maximum short exposure. The fund may also offer a yield in some market conditions (e.g., it currently has a 3% 30-day SEC yield).

Currently, the fund’s top non-cash holdings include:

- ProShares UltraShort QQQ

- ProShares Short Bitcoin

- Tesla Put Options

- Exxon Mobil Corp.

- Devon Energy Corp.

In terms of expenses, the fund charges a 0.98% management fee and anticipates paying about 0.84% in dividends on short sales, yielding a total expense ratio of 1.82%. While that’s higher than many other active ETFs, it’s significantly less than the 2-and-20 management fee structure comparable hedge funds charge their shareholders.

Alternatives to Consider

The Noble Absolute Return ETF is one of several actively-managed, long-short, absolute return ETFs available to investors.

For example, the First Trust Long/Short Equity ETF (FTLS) takes a similar long-short approach using commodity futures.

Other activel ETFs to consider include:

| Name | Ticker | AUM | Expense Ratio |

| Franklin Systemic Style Premia ETF | FLSP | $98.1 million | 0.65% |

| Leatherback Long/Short Alternative Yield ETF | LBAY | $56.6 million | 1.43% |

| LHA Market State Alpha Seeker ETF | MSVX | $44.6 million | 1.42% |

| Discipline Fund ETF | DSCF | $31.3 million | 0.39% |

| Convergence Long/Short Equity ETF | CLSE | $23.5 million | 1.56% |

Data as of November 2, 2022

The Bottom Line

Noble-Impact Capital’s George Noble manages the Noble Absolute Return ETF. With over 40 years of asset management experience, he worked closely with legendary fund manager Peter Lynch in the 1980s at Fidelity Investments. After heading Fidelity’s International Equity Group, he managed two separate $1+ billion hedge funds.

Drawing on this experience, the Noble Absolute Return ETF offers investors a unique hedge fund-like opportunity under an ETF umbrella. With its flexible long-short strategy, the absolute return fund aims to achieve positive returns during any market conditions, making it a compelling choice in today’s market environment.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.