When it comes to active management, exploiting inefficiencies is the name of the game. Finding market segments or sectors that tend to be overlooked or lumped together as an easy allocation are ripe for active managers to prove their trade. And when it comes to being ‘lumped together’, international stocks take the cake.

For many investors, if they have any exposure to international stocks, it’s usually just a broad-based fund covering a region of the developed world.

But it may make sense to hire an active manager who can break out their passport and do some traveling. Going active with our international portfolios can be a real win on the returns front.

Underweight & Underexposed

For many investors, international stocks just aren’t on the menu. Overall, U.S. investors are generally underweight in international stocks—both developed and emerging markets—in their portfolios based on the size of the world’s market cap. All in all, non-U.S. stocks make up just over 40% of the world’s market cap. However, the average U.S. investor has only about 10% of their allocations in international equities, with many having a 0% weighting.

Moreover, if they have any weighting at all, they most likely use a broad index fund like the Vanguard Total International Stock ETF or iShares MSCI EAFE ETF to get their exposure. While there is nothing wrong with that approach—as broad indexing a core can be a great thing—it does paint international equities with a broad-brush stroke. Germany gets treated in the same way as Japan, as China or as Canada for that matter.

However, regional and country economies differ completely from one another. GDP growth rates, export/import values, consumer trends, and other factors differ vastly among nations. But investors looking broadly put all international stocks in one box.

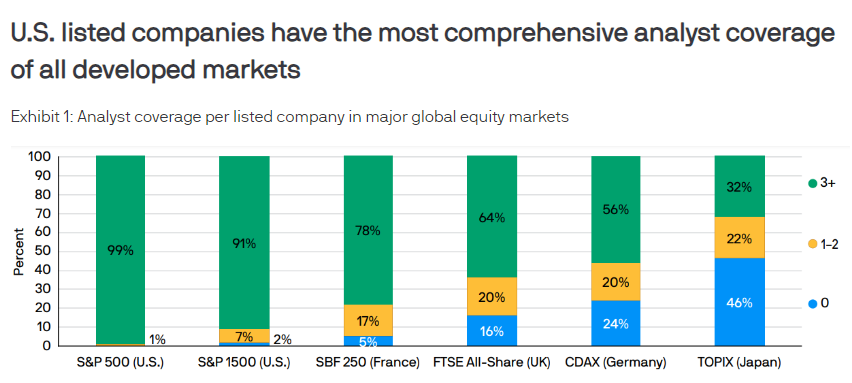

Second, international stocks are often ignored and have less analyst coverage than their U.S. counterparts. Looking at this chart from J.P. Morgan, we can see the S&P 500 and S&P 1500 (total U.S. stock market) vs. five major indices covering France, Japan, Germany, and the U.K. As you can see, the number of U.S. analysts covering these equities is much lower.

Source: J.P. Morgan

With less mainstream coverage, the ability of managers to seek out better deals, strong firms, and growing revenues is enhanced. Each day in the U.S., there are many articles covering Apple, its products, its growth potential, etc. Every bit of information is known and quickly disseminated by the market and investors. You can’t hide any news about Apple. This is not the case for Japan’s Itochu or Mexico’s Grupo Herdez. This unknown and uncovered factor can help managers seek out values just like the U.S. small-cap sector or bonds.

This is enhanced further when you realize the universe of international stocks is huge. Globally, there are about 58,000 listed companies. Kicking out the U.S., we are still left with more than 46,000. That is a lot of potential stocks to pick from.

This is just the type of inefficiencies that active management can exploit to drive better returns.

The Proof Is in the Pudding

And it looks like active managers do a good job of finding those inefficiencies. Looking at the latest Morningstar Active/Passive Barometer, 63% of those funds that focus on active management in international equities beat their passive peers over the last year and have a higher 10-year success rate than managers focused on active U.S. large-cap strategies. Digging in further, managers focusing on international value and international small-caps managed to crush their passive peers over the long haul as well. 1

ETFs Are Boosting This Performance Further

The interesting thing about Morningstar’s data is that those funds with the lowest costs have managed to beat their indexes on a more constant basis than those on the higher end of the fee scale. And that makes sense.

International funds are relatively expensive to operate. There are foreign exchange fees, trading often happens overnight given time zones, which leads to higher labor costs for the funds, and a host of other factors not including currency transactions/carrying costs. As such, international funds often cost more than their domestic counterparts, even when it comes to indexing.

But as we’ve seen with passive indexing and other areas of the market, ETFs have continued to reduce operating costs for fund sponsors and investors. With lower fee hurdles, it’s much easier for an active manager to outperform their benchmarks. But using an ETF structure, they can exploit these global inefficiencies and produce extra returns for their shareholders. Moreover, cash drag and foreign currency drag can be minimized. Capital gains—which occur more frequently in international stock funds—can also be eliminated with ETFs.

The end all, be all is that going active in international equities is a must and ETFs are the way to do it.

International Active ETFs

These funds were selected based on their low costs and sorted by year-to-date total return, which range from 7.8% to 12.2%. They have expenses between 0.18% to 0.55% and assets under management between $20M and $5.5B. They are currently yielding between 0.1% and 3.3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| JIRE | JPMorgan International Research Enhanced Equity ETF | $5.1B | 12.2% | 2.33% | 0.30% | ETF | Yes |

| OSEA | Harbor International Compounders ETF | $20.75M | 11.1% | 0.1% | 0.55% | ETF | Yes |

| AVEM | Avantis Emerging Markets Equity ETF | $3.9B | 10.3% | 2.66% | 0.33% | ETF | Yes |

| DFAI | Dimensional International Core Equity Market ETF | $4B | 9.5% | 2.69% | 0.18% | ETF | Yes |

| DFAX | Dimensional World ex U.S. Core Equity 2 ETF | $5.5B | 9.3% | 3.24% | 0.30% | ETF | Yes |

| DFIC | Dimensional International Core Equity 2 ETF | $4.1B | 9.3% | 2.75% | 0.23% | ETF | Yes |

| AVDE | Avantis International Equity ETF | $3.2B | 8.8% | 2.78% | 0.23% | ETF | Yes |

| CGXU | Capital Group International Focus Equity ETF | $1.5B | 8.4% | 1.16% | 0.54% | ETF | Yes |

| AVDV | Avantis International Small-Cap Value ETF | $3.8B | 7.8% | 3.31% | 0.36% | ETF | Yes |

Ultimately, the fact that investors ignore international stocks and treat them as one single entity provides plenty of inefficiencies for good managers to exploit. With their lower costs, ETFs have continued to help these managers find a footing and beat their benchmarks with ease.

The Bottom Line

Investors are underweight and under-exposed to international stocks. The way to boost that exposure could be active ETFs. Going active allows managers to dig into local markets and exploit the fact most global stocks are ignored. ETFs provide the necessary structure to win on fees and generate benchmark-beating returns.

1 Morningstar (June 2023). Morningstar’s U.S. Active/Passive Barometer