The S&P 500 index is down nearly 17% since the beginning of the year, as red-hot inflation has put the Federal Reserve in a challenging position. With interest rates rising, many investors worry that the central bank’s aggression will spark a recession. And, even without a recession, there’s a worry that inflation could hit consumer spending.

But, of course, not everyone is suffering during the bear market. In this article, we’ll look at three top-performing active ETFs and the strategies that they’re using to beat the broad market indexes.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Managed Futures

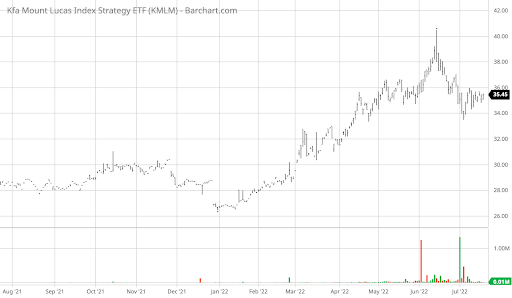

The KFA Mount Lucas Index Strategy ETF (KMLM) is up 32% since the beginning of the year. After providing alternative strategies to institutions and high-net-worth individuals since 1986, Mount Lucas Management began offering access to managed futures through a liquid and low-cost ETF structure, enabling investors to hedge on equity and bond risk.

The fund’s outperformance comes from its exposure to commodity futures like natural gas and short foreign currency positions. With the energy markets and the dollar’s valuation on the rise, managed futures have become a successful subset of the actively-managed ETF space and a valuable hedge against broad market declines.

Hedge Fund Strategies

The iMGP DBi Managed Futures Strategy ETF (DBMF) is trading up nearly 25% since the beginning of the year. While the fund’s strategy is similar to KMLM, the fund managers look beyond futures toward equities, fixed-income, currencies, and commodities. And, with a 0.95% expense ratio, it’s much cheaper to own than a hedge fund.

The fund holds significant short positions in foreign currency futures and a 9.71% long position in crude oil, paving the way for its short-term successes. However, it also has short positions in EAFE and S&P 500 futures, as well as gold futures, setting it apart from KMLM’s focus on commodities and currencies.

Market Neutral Strategies

The AGFiQ US Market Neutral Anti-Beta Fund (BTAL) is up more than 14% since the beginning of the year. Unlike the two managed futures ETFs discussed thus far, the fund provides a consistent negative beta exposure to the U.S. equity market by investing in long positions in low-beta stocks and short positions in high-beta stocks on a dollar-neutral basis.

The fund exposes the spread return between low- and high-beta stocks to lower portfolio volatility, providing an alternative to buying Treasuries or other low-performing fixed-income asset classes. But, as an added benefit, the fund ends up shorting growth stocks and going long on stable blue chip stocks, leading to its recent upside volatility!

The Bottom Line

Many passive and active ETFs are trading in the red following a sharp stock market sell-off. That said, a handful of outliers use managed futures and other strategies to outperform the broad market. As a result, investors may want to consider these funds as a way to hedge their portfolios, lower volatility, and protect their portfolios.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.