We’ve all heard the saying “Cash is king.” These days, that saying has more weight. With volatility increasing and the threat of rising interest rates on the horizon, holding cash as part of a portfolio’s asset allocation seems prudent. Even without a crisis, holding some cash is a good idea for investors of any age.

The only problem is cash’s low return.

But it doesn’t have to be that way. Thanks to the growth of active ETFs, the number of money market and cash alternative ETFs has exploded over the last few years. And in that, investors have an opportunity to grab a little more yield without taking on too much more risk. With the new ETFs, investors can finally use cash strategically in their portfolios.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Cash Is Good, but Low Yielding

Regardless of your age, cash can play an important role in your portfolio’s allocation. Cash can serve as a means for short-term liquidity, such as daily spending plans, or provide a way to save for goals in the near term. Meanwhile, cash can be the ultimate capital preservation tool and allow investors to tone down rising market volatility. Having a segment of cash is vital for older investors in retirement. Even younger investors can use cash strategically to take advantage of buying opportunities in the market.

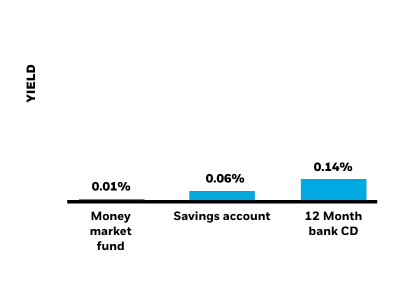

The problem is, most people keep their cash in traditional instruments like CDs, savings accounts or brokerage account sweep plans. With interest rates being next to zero for roughly a decade, these types of options have been paying next to nothing. That’s a problem when accounting for inflation and other market forces. This chart from BlackRock highlights the low and non-existent rates that traditional cash products like CDs, money markets, and similar investment vehicles are currently paying.

Source: BlackRock

Those rates are terrible. Locking up $1 million in a CD at those rates would only net $1,400 before inflation and taxes.

Active ETFs to the Rescue

Investors don’t have to settle for those poor rates. And that’s due to the growth in active ETFs.

One of the earliest and largest segments of the active ETF market is the growth of cash management and cash alternative ETFs. These funds invest in cash equivalents or highly-rated securities with very short-term maturities. This can include commercial paper, Treasury bills, and short-term government bonds with maturity dates of three months or less. Additionally, some cash management ETFs invest a portion of their holdings in slightly longer-termed or lower-rated securities to add yield to their portfolios.

The win for investors is three-fold.

For starters, the slightly different portfolio compositions provide a better yield than traditional cash instruments. In many cases, it’s more than double the yield on CDs and money-market funds. While that may not seem like much, every additional bit of return helps, especially when inflation is returning to normal.

Secondly, these ETFs can help protect against rising rates. Because of their shorter maturity profiles, they are able to roll over their portfolios to higher yielding bonds when rates rise. This reduces their durations and allows them to increase their yields more quickly. It also prevents capital losses. Bonds fall when rates rise. But those bonds with shorter durations fall by less, and in the case of these short-term securities, sometimes not at all.

This factor also plays into their stability. Most cash management ETFs feature share prices that hover between tight ranges and feature low volatility. This makes them perfect substitutes for a savings account, CD or other traditional cash product.

Investors seem to have caught on to their appeal. According to Bloomberg, billions of dollars have flowed into these active cash ETFs since the start of the year. For example, the PIMCO Enhanced Short Maturity Active ETF (MINT) recently had inflows of more than $900 million, its best inflow since it started trading in 2009.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

How to Use Them

Given the higher yields and liquidity of cash management ETFs, investors should consider using them for their cash management strategies. And one such way could be to layer your cash holdings. In this strategy, investors break out their cash needs into various buckets: 0-3 months, 3-6 months, 6-18 months, etc.

For daily expenses or for the next few months, checking or savings accounts should still be implemented given their zero risk and instant liquidity. However, looking beyond the three-month window, investors can move out a bit with their cash holdings.

For the next bucket, ETFs like the BlackRock Ultra Short-Term Bond ETF (ICSH) or previously mentioned MINT can be used to get a bit more yield, while only moving a tad further out on the maturity window. Investors can segment further for the next bucket using active ETFs in the short-term/limited duration category like the JPMorgan Ultra-Short Income ETF (JPST). Beyond that bucket, traditional bonds can be used.

The basic idea is that investors can layer their cash needs and these active ETFs can deliver on higher yields without much more risk. This only serves to enhance returns, help beat back inflation, and make cash a real portfolio asset rather than a placeholder for excess funds.

The Bottom Line

In the end, active ETFs have helped transform many segments of the market and liquidity management is one of them. Thanks to the rise of cash alternative ETFs, investors now have plenty of choice for their portfolios. These choices can lead to better outcomes and returns.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.