It’s no secret that investors have fallen in love with cash over the last year or two. Thanks to high interest rates, the yields on cash and T-bills have surged. As such, balances in money market funds, CDs, and other short-term instruments have grown to record amounts. This huge cash balance has plenty of potential to be unleashed in equities once the Federal Reserve (Fed) begins its rate cutting initiative.

However, investors may not want to hold their breath.

It turns out that these huge cash balances may not actually translate over in equities. The ‘rising tide lifts all boats’ market may never come. To that end, value may actually have its day in the sun once again and active ETFs could be the way to go.

Investors Love Cash

These days, investors have cash on the brain. As the Fed moved to fight high inflation, it underwent one of the quickest rate tightening activities seen in history, boosting benchmark rates from zero all the way to 5.5%. With that, risk-free assets like T-bills, money market funds, CDs, and even bank deposits have started to pay actual income again.

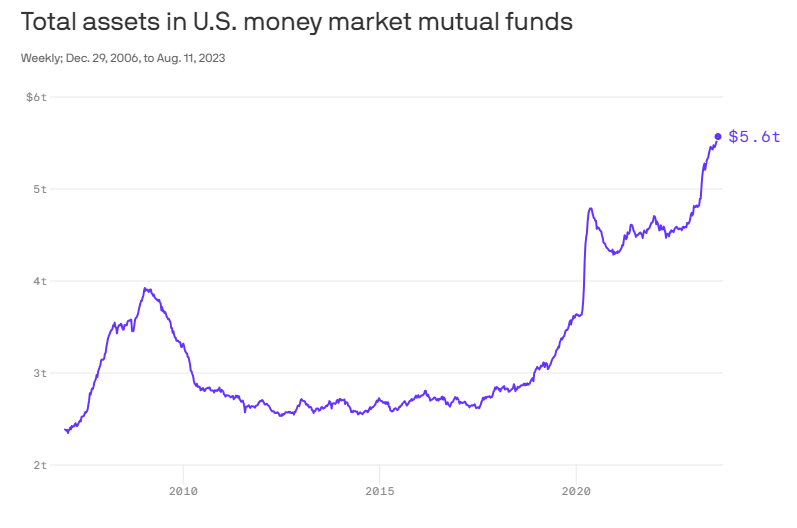

The end result: investors have socked away more than $5.6 trillion into money market funds to take advantage of the yield. This is the most cash in recent history. All in all, investors have stockpiled more cash than the Great Recession and Pandemic. This chart from news agency Axios highlights the surge in cash holdings.

Source: Axios

That huge amount of cash has plenty of potential. The reason has to do with when the Fed starts to cut rates. That 5.5% will quickly fall once the central bank begins monetary loosening. Investors will be keen to find returns in other assets. Many analysts speculate that stocks will be a huge collector of that cash. Previously, this has been the case.

Not So Fast

But the surge in stocks may be muted and less than investors hope for. This is the gist according to several institutions, such as Federated Hermes and Citibank.

For one thing, the cash in money market funds might be ‘sticky.’ As the banking crisis unfolded last year with the collapse of Silicon Valley Bank and others, many savers and investors realized their savings may not be as safe as they once thought. This caused them to seek other forms of liquidity. According to Federated Hermes, since March and the beginning of the banking crisis, roughly $1 trillion has flowed to money market funds. Of that amount, more than 80% could be seen as banking alternatives. Chief market strategists at Miller Tabak + Co. LLC have also expressed people use this money for expenses and it is not readily deployable for stocks.

Then there are the interest rate cuts to consider.

To start, stubborn inflation has continued to push back the timeline of rate cuts. The Fed may be forced to pause for longer than many analysts expect. Second, rate hikes have again entered the chat with rising inflation, perhaps forcing the Fed’s hand. The odds of the Fed cutting all the way back to zero seem slim unless we enter a doomsday scenario. The reality is that 3% to 4% is most likely the norm. That still keeps cash competitive on a returns front.

Value Could Win Big

With the potential of having less cash flowing from the sidelines into stocks, investors are facing an interesting quandary. Already, the S&P 500 has started to hit new record highs, while tech and other growth sectors have become hotspots for portfolios. We’ve already put a lot of stock into the idea the Fed is going to cut soon. Those betting big on equities may fall short.

The answer may be in value investing.

Focusing on stocks with good fundamentals and low valuations could rule the day. As less cash flees money market funds, quality and a good price becomes more important. ‘All hype, all revenue’ firms are likely to fall by the wayside.

The key to accessing this value could be through active management. The problem with value indexes is they don’t necessarily highlight true values. In fact, looking at many of the main value and growth indexes, there is some significant overlap. Second, they still skew toward the largest firms. Many of the market’s true values could be further down the S&P 500.

But with active management, these values can be unlocked. Better still is the ETF structure allows managers to fully invest in their best ideas, eliminating cash drag and size constraints. The creation/redemption mechanism of ETFs provides the ability to avoid these issues.

So, while we have been building record amounts of cash, much of that cash may not ever see the light of day in the market. And that means investors can’t simply buy whatever stocks they want and get a good return. Those that offer cheap metrics, good quality, and sizable income will succeed the most.

Active Value ETFs

These ETFs were selected based on their exposure to value strategies using active management. They are sorted by their one-year total return, which ranges from 4.7% to 23%. They have assets under management of $210M to $8.6B and have expenses of 0.15% to 0.44%. They are currently yielding between 1.6% and 2.4%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| CGDV | Capital Group Dividend Value ETF | $3.8B | 23% | 2.2% | 0.33% | ETF | Yes |

| AVLV | Avantis U.S. Large-Cap Value ETF | $1.53B | 11.9% | 1.84% | 0.15% | ETF | Yes |

| DFUV | Dimensional US Marketwide Value ETF | $8.58B | 7.9% | 1.66% | 0.22% | ETF | Yes |

| JAVA | JPMorgan Active Value ETF | $583M | 7.3% | 1.61% | 0.44% | ETF | Yes |

| AVUV | Avantis U.S. Small-Cap Value ETF | $6.7B | 7.1% | 2% | 0.25% | ETF | Yes |

| DFLV | Dimensional US Large Cap Value ETF | $914M | 6.3% | 2.4% | 0.23% | ETF | Yes |

| DFAT | Dimensional U.S. Targeted Value ETF | $8.2B | 5.3% | 1.6% | 0.28% | ETF | Yes |

| FLV | American Century Focused Large Cap Value ETF | $211M | 4.7% | 1.9% | 0.42% | ETF | Yes |

In the end, investors hoping for a cash flood once the Fed decides to cut rates may be a bit disappointed. The real result may be just a trickle. As such, not every stock will do well, particularly since we’ve placed so much emphasis on the pending rate cut. That means active value strategies should have their day in the sun and help boost returns.

The Bottom Line

The nearly $6 trillion in cash currently in money market funds may not flow into stocks. Thanks to sticky bank deposits and still high yields, this cash is staying put. For investors, this means value could be the big winner going forward as investors look to deploy less money than previously expected.