Actively managed exchange-traded funds experienced a renaissance in 2021, with assets under management growing 44% to $295 billion. While the ARK Innovation ETF (ARKK) was the poster child for the movement, investors flocked to all kinds of active funds last year – not just tech stocks – driven by rising inflation and thematic bets.

Let’s look at some of the most popular active ETF genres over the past year, key drivers behind those inflows, and what’s in store for the future.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Taxable Bonds Take the Top Spot

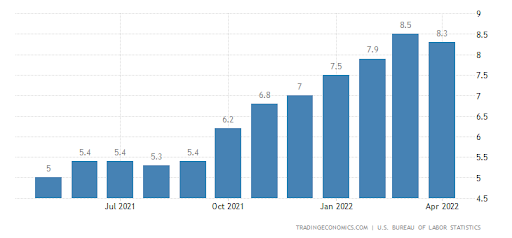

Inflation reached a 41-year high of 8.5% in March, prompting the Federal Reserve to embark on a mission to hike interest rates. While inflation slowed a bit in April, the market projects that interest rates will rise to a 275 to 300 basis point range by the end of the year. As a result, the bond market could continue to feel some severe pain over the coming months.

U.S. inflation has been on the rise since the third quarter of 2021. Source: TradingEconomics

Unfortunately, many conventional bond ETFs have limited flexibility when choosing bond holdings since they track an index. For example, the iShares Core US Aggregate Bond ETF (AGG) tracks the total U.S. investment-grade bond market, falling nearly 10% this year. Rising interest rates will likely continue to take a toll on these funds by depressing bond prices.

Actively managed taxable bond ETFs have become a popular alternative for investors looking to reduce risk while maintaining their bond allocations for income or security. Unlike their passive counterparts, active fund managers have the flexibility to choose corners of the market where bonds may remain attractive and reduce exposure to rate-sensitive issues.

For example, the ClearShares Piton Intermediate Fixed Income ETF (PIFI) fell just 5% so far this year. While the fund invests in intermediate-duration bonds, the managers focus on maximizing total return while delivering conservation goals of income generation, capital preservation, and liquidity – enabling the fund to sidestep some interest rate risk.

Sector & International Equity See Inflows

Active U.S. equity ETFs saw the second-biggest inflows after taxable bonds, but sector and international equities were more surprising, with each drawing a roughly $7 billion inflow. As U.S. equities turn lower in 2022, these two could outperform throughout the remainder of this year as investors seek safe havens for their capital.

ARKK experienced a significant drop in 2022 but fund flows have remained stable. Source: Barchart.com

Sector equity ETFs enable investors to target exposure to specific sectors. With active managers at the helm, these funds allow investors to place ‘thematic’ bets on specific industries that may outperform. Of course, Cathie Woods’ ARK Innovation ETF is the best-known example of these sector equity ETFs with a focus on technology.

International equity ETFs help investors diversify outside of U.S. stock markets. Given the higher level of asymmetric information, there’s an opportunity for active managers to generate alpha, making them a better option than passively-managed funds. And adding international diversification to a portfolio can help improve risk-adjusted returns.

The FCF International Quality ETF (TTAI) is an example of a defensive active international ETF. Rather than investing in a market cap-weighted index, the fund managers use a blend of quantitative modeling and fundamental analysis to seek out international stocks with strong free cash flow characteristics, helping to reduce risk.

The Bottom Line

Commodities, alternative investments, and municipal bonds rounded out the active ETF categories experiencing inflows. Like taxable bonds and the equities mentioned above, these categories likely experienced higher demand due to rising inflation and the risk of an economic downturn, given that gold and alternatives are popular inflation hedges.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.