Active ETF adoption and launches have hit critical mass this year as investors both big and small have started to understand their benefits. Low-cost and tax-efficient active ETFs have plenty of potential to outperform passive funds. And as such, Wall Street has delivered torrid growth in the number of new products on the market.

But it turns out many of those products center around a few sectors.

One of the hottest places for new launches happens to be boring municipal bonds. The number of active muni ETFs has grown exponentially over many other fixed income and equity sectors. And there are plenty of reasons why investors can and should be excited. Municipal bonds happen to be one of the best places where active managers can add real alpha to a portfolio.

The Number of Active Muni ETFs Surge

Truth be told, municipal bonds are a boring subsector of the boring bond market. These bonds are issued by state/local governments and feature tax-advantage/tax-free income potential. The generally conservative nature of these bonds attracts conservative investors, pension funds, and insurance firms, among others. We’re talking about a very buy-and-hold crowd.

So, it’s interesting to see the number of active muni bond ETFs has surged over the last few quarters.

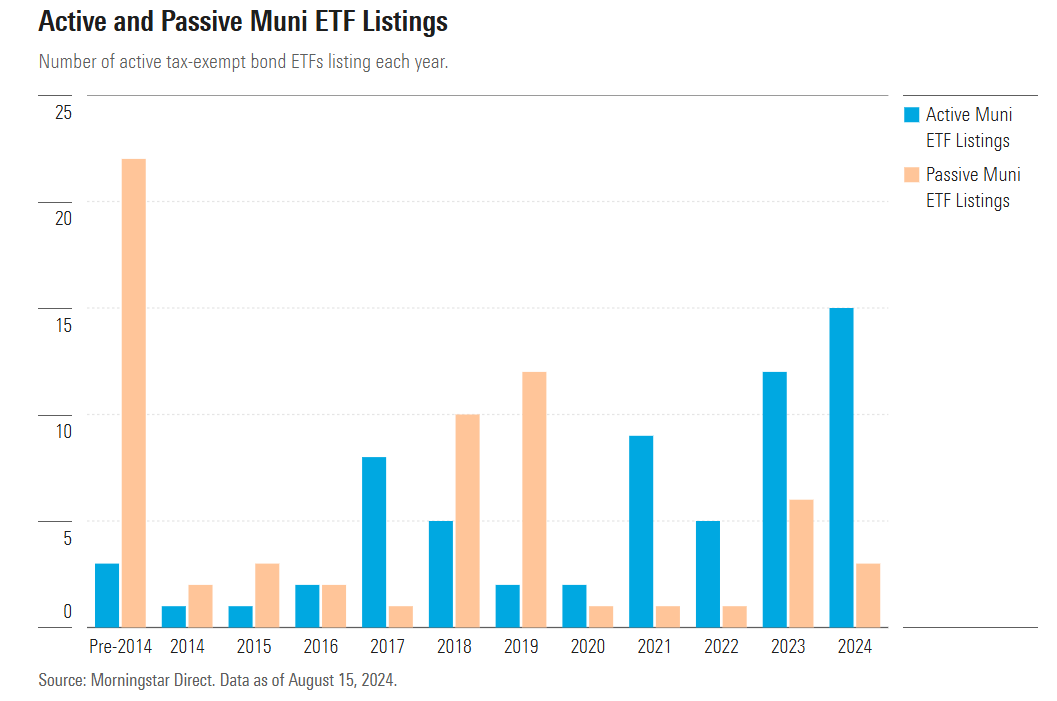

According to Morningstar data, 15 new active muni-bond ETFs have been listed on exchanges this year. This tops last year’s record of 12. All in all, more than 40% of all the active muni bond ETFs to launch have done so in roughly two years. This chart from Morningstar shows just how the sector has picked up steam and has surpassed the number of new passive muni funds in a big way. 1

Source: Morningstar

And more keep coming. Since Morningstar’s report at the end of the summer, more active muni bond ETFs have launched. This includes two from passive investment powerhouse Vanguard: the Vanguard Core Tax-Exempt Bond ETF (VCRM) and Vanguard Short Duration Tax-Exempt Bond ETF (VSDM).

Perhaps the most impressive thing is that money flowing into these active muni ETFs has been more than passive vehicles. For example, during the study period, the active Capital Group Municipal Income ETF (CGMU) pulled in more than $1.3 billion in flows, doubling its size. This was more than the already established and popular passive options—the iShares National Muni Bond ETF (MUB) and the Vanguard Tax-Exempt Bond ETF (VTEB) —combined by about $400 million.

A Strong Reason Why

So why all the active municipal bond love and why are these new ETFs good for investors? Well, it turns out that active management is great for the municipal bond sector.

Fixed income securities—minus Treasury bonds and some investment-grade corporate bonds—are pretty illiquid. There is no exchange for bonds and trades are conducted via the OTCBB and essentially a handshake. Municipal bonds could be some of the most illiquid of the major bond categories, with new supplies often gobbled up quickly and investors choosing to hold their bonds till maturity.

This illiquidity can create pockets of opportunities for active managers to outperform, buy bonds at high yields, or find sellers in desperate positions.

Moreover, active managers cannot look like the major muni bond indexes, which is important for above-average returns.

Just like with the Bloomberg Aggregate Index for investment-grade taxable bonds, the major municipal bond indices feature plenty of construction issues. This includes overweighting the biggest issuers of debt as well as excluding many bond varieties. For example, in the case of the muni market, housing bonds, tobacco bonds, and bonds that are subject to the alternative minimum tax (AMT) are often excluded. Another area that is often missing from standard muni indexes happens to be so-called Conduit bonds. These areas can provide higher yields and potentially differentiated cash flows to a portfolio.

Active managers can over- or underweight portions of the market as they see fit or dive headfirst into these other opportunities. This can provide extra returns. In this case, it does. A study by Morgan Stanley showed that active beats passive over 84 different rolling three-, five-, and 10-year periods with the extra active return clocking in at 68 bps, 53 bps, and 33 bps, respectively, for the periods. These results have been echoed by a host of different studies.

Better still, the ETF structure makes active management even better. This is due to the low costs associated with ETFs and lower tax potential.

Since operating an ETF—even an active one—is pretty cheap, the lower expense ratio provides a higher overall yield for investors. That’s more income they can keep and enhances the cash return of the fund. Second, the creation-redemption mechanism provides managers the ability to sell appreciated securities and pass through capital gains unto APs. This enhances the already tax-free nature of munis and provides extra returns. And speaking of that cash, since the trading of ETFs happens on the secondary market, there’s no cash drag on a portfolio and managers can be fully invested, unlike a mutual fund. Here again, this enhances returns.

Investors Should Be Thrilled

On one hand, there are numerous new active muni ETFs to choose from; on the other, there is plenty of evidence for outperformance. All of this is great news for investors looking to add municipal bonds and their tax-free income to their portfolios. The result is these funds could be the way to go and provide a serious complement to passive ETFs in the space.

The question is which one to buy?

The answer requires digging into the underlying holdings, risk profiles, and historical returns/manager success. Given the difficulty of that, it may make sense to own more than one. The ease of trading, the low cost of ETFs, and the ability to own fraction shares/low minimum investments make this a simple exercise. Pairing a few active funds with a passive ETF could provide the best of both worlds, and enhance income and total returns.

Active Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost and active exposure to the municipal bond market. They are sorted by their YTD total return, which ranges from 2% to 8.5%. They have expense ratios between 0.07% and 0.65% and assets under management of $82M to $3B. They are currently yielding between 2.63% and 5.04%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYMU | iShares High Yield Muni Income Active ETF | $82M | 8.5% | 4.23% | 0.35% | ETF | Yes |

| NEAR | iShares Short Duration Bond Active ETF | $2.96B | 5% | 5.04% | 0.25% | ETF | Yes |

| CGMU | Capital Group Municipal Income ETF | $601M | 4% | 3.18% | 0.27% | ETF | Yes |

| FMB | First Trust Managed Municipal ETF | $1.98B | 3.2% | 3.17% | 0.65% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $557M | 3.1% | 3.03% | 0.35% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.47B | 2.7% | 3.48% | 0.35% | ETF | Yes |

| VTES | Vanguard Short-Term Tax Exempt Bond ETF | $400M | 2.4% | 2.98% | 0.07% | ETF | Yes |

| DFNM | Dimensional National Municipal Bond ETF | $1.23B | 2% | 2.63% | 0.17% | ETF | Yes |

In the end, active management can win in the municipal bond space. So it’s great that so many new active muni funds have been launched. As with any investment, it pays to do some digging and examine the fund before purchase. Likewise, owning a few different active ETFs can provide benefits as well and reduce the volatility of returns and manager expectations.

Bottom Line

As the number of active ETF launches grows, municipal bond funds have taken the fund vehicle to new heights. With a torrid series of launches over the last two years, investors now have plenty of active ETFs to choose from. And they just might want to. Better returns and passive outperformance await.

1 Morningstar (August 2024). Investors Suddenly Have a Lot More Active Muni ETFs to Choose From