Donald Trump’s presidency signaled a major paradigm shift not only in American politics but in global trade as well. An escalating trade war with China almost reached a tipping point last year when the Trump Administration announced duties on $200 billion worth of Chinese goods.

Let’s take a look at the implications of trade policies for investors.

China in the Crosshairs

The confrontation between the U.S. and China has put global economies on high alert. Although Presidents Trump and Xi Jinping of China agreed in December to suspend tariff hostilities for 90 days, the trade deal deadline is only weeks away. Based on the latest commentary from Commerce Secretary Wilbur Ross, both nations remain “miles and miles apart” on a new trade agreement.

Investors, businesses and governments have long perceived a trade war to be a harbinger for slower economic growth. It, therefore, comes as no surprise that the International Monetary Fund (IMF) slashed its global growth forecast for 2019 and 2020. Trade tensions were a primary catalyst for the downward revision.

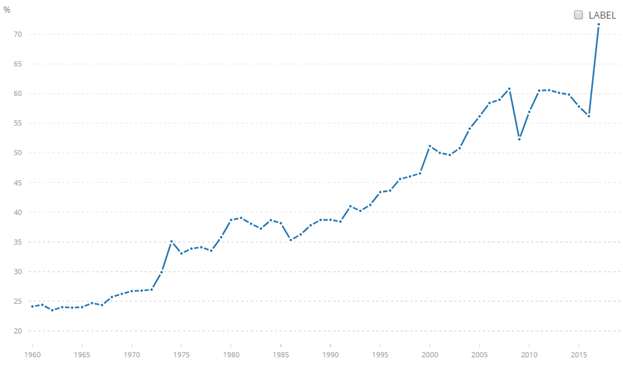

Trade plays a paramount role in the global economy, a trend that has intensified in the era of globalization. The World Bank estimates that trade accounted for a whopping 71.7% of global GDP in 2017, up from 38.7% in 1990.

President Trump has made it abundantly clear that his administration will no longer tolerate China’s unfair trade practices. As a result, the Department of Justice recently filed criminal charges against Huawei, a Chinese telecommunications giant, following a lengthy investigation into its dealings. Included in the litany of charges are allegations of stealing trade secrets from T-Mobile (TMUS ) and offering employees compensation for obtaining confidential information from competitors.

In addition to China, the Trump Administration is pressing Germany over its large trade surplus with the United States and for allegedly manipulating the euro to its advantage. At the same time, the European Union is battling over the future of its trade relationship with the United Kingdom amid an escalating Brexit saga.

Click here to learn more about U.S tariffs on aluminum and steel.

Impact of Trade Wars

Let’s dive into some of the specific ways by which the U.S.-China trade war can impact the economy, indirectly creating concerns for the investment community.

- Pressure on foreign investment

The trade war, whether actual or perceived, has already had a direct impact on the global economy. China’s economic expansion in 2018 reached its lowest point in nearly three decades as foreign direct investment (FDI) to the country dropped in the first 11 months of the year. In the United States, foreign investment declined by about 18% in 2018 compared to the previous year. There’s also some evidence to suggest that the agricultural sector, long protected by government subsidies, is also feeling the pinch.

According to the U.N. Conference on Trade and Development, growth in foreign direct investment around the globe began to fall in 2017 – that is, before the trade war rhetoric escalated. During that year, global FDI fell 23%.

- Pressure on domestic prices for goods and services

The other obvious impact of the trade war is higher costs passed on to consumers. The goal of free trade is to purchase as much as possible while exporting as little as possible to pay for it. This gives consumers the added advantage of buying as much as they can at a discount price. Tariffs mean the higher price of imports is paid for by the consumer. In other words, that 20% duty on Chinese goods will ultimately trickle its way down to the American consumer.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

- Pressure on certain industries

As the Chinese economy continues to weaken as a result of the trade war, so too does demand for American products. American companies with a large presence in mainland China have already suffered. For instance, Caterpillar Inc. (CAT ) posted disappointing earnings in its most recent quarter on waning Chinese demand. The same can also be said for Apple (AAPL ), though competition from other smartphone makers also influenced its latest quarterly earnings result.

The trade wars with China and Europe have also cast a shadow over the U.S. automotive industry. China’s retaliatory tariffs have slapped American automakers the hardest. This has caused car sales in China to drop for the first time in years.

Telecom is another major sector that is feeling the pressure of the trade war. As the United States files criminal charges against Huawei, China has granted an injunction against Apple on behalf of Qualcomm (QCOM ), a rival U.S. company. As a result, many iPhone models have been outright banned in China (hence, Apple’s disappointing earnings guidance).

Soybeans have also been politicized during the trade debate given China’s huge demand for the commodity. Beijing put soybeans on its tariff list last year, much to the dismay of U.S. producers. It would later purchase $180 million worth of the commodity in a show of good faith.

Protect Your Investments

While there’s no sure-fire way of preventing the trade war from impacting your portfolio, the best strategy is to avoid being overexposed to export-oriented equity regions or sectors. This means diversifying away from regions such as Germany, Japan and China and from sectors such as machinery or manufacturing.

It’s also beneficial to select companies whose primary business is in the United States. That’s because the U.S. economy is outperforming many of its peers by a significant margin – a trend that has intensified under the Trump Administration. Domestic consumer companies are a good place to start, as are utilities. Small-cap stocks with low exposure to international markets can also help safeguard against trade risks.

Don’t forget to check our News section to catch the latest updates.

The Bottom Line

The United States and China have made notable progress on trade talks, but a comprehensive deal remains elusive. Investors should keep a close eye on the March 1, 2019, trade deal deadline. That’s when the 90-day truce between the two countries is set to expire.

Check out our Best Dividend Stocks page.