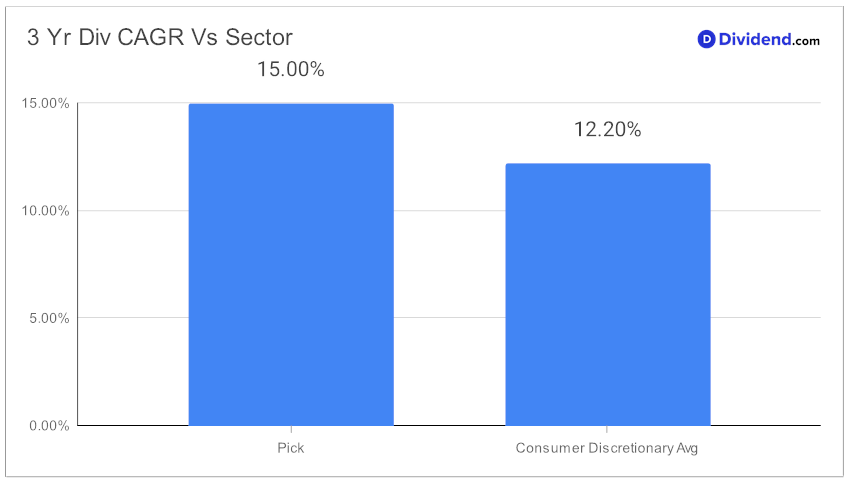

In the ever-evolving landscape of dividend investing, the latest addition to the esteemed Best Sector Dividend Stocks model portfolio stands out as a beacon for balanced dividend investors. This well-covered large-cap stock in the Gaming, Lodging, and Restaurant industry has demonstrated a robust three-year dividend compound annual growth rate (CAGR) of 15%, placing it in the top echelon of all dividend stocks. With a year-to-date return of 4%, it mirrors the industry’s performance and slightly lags behind the S&P 500’s 5%.

The forthcoming payout is poised to enrich shareholders, with an estimated $1.310 per share on the horizon around March 21st. This move underscores the stock’s potential for yielding dividends and showcases a strategic blend of yield, dividend safety, returns potential, and minimized risk, tailored specifically for the Consumer Discretionary sector.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on December 16, 2023. The company reported nearly 10% growth in net sales during the quarter on a year-over-year basis. Additionally, operational efficiencies and strategic planning contributed to improved margins and high guest satisfaction across its different restaurant brands. Despite some ongoing challenges in fine dining industry, the company’s outlook remains optimistic, with the management increasing its forecast for adjusted net earnings per share (EPS).

This brief exploration merely scratches the surface of what our in-depth analysis holds. Join us as we delve deeper into the metrics that make this stock a noteworthy contender for those seeking to diversify their dividend portfolio.