In the ever-evolving market of Consumer Discretionary stocks, a standout large-cap Automotive stock has been added to the Best Sector Dividend Stocks model portfolio, reflecting a strategic move for balanced dividend investors.

This company showcases a robust 14-year streak of dividend increases, ranking it in the upper echelon of dividend-paying stocks. With an eye on sustainable growth, its 29% forward payout ratio remains modest and well-aligned with sector norms, indicating a prudent approach to shareholder returns.

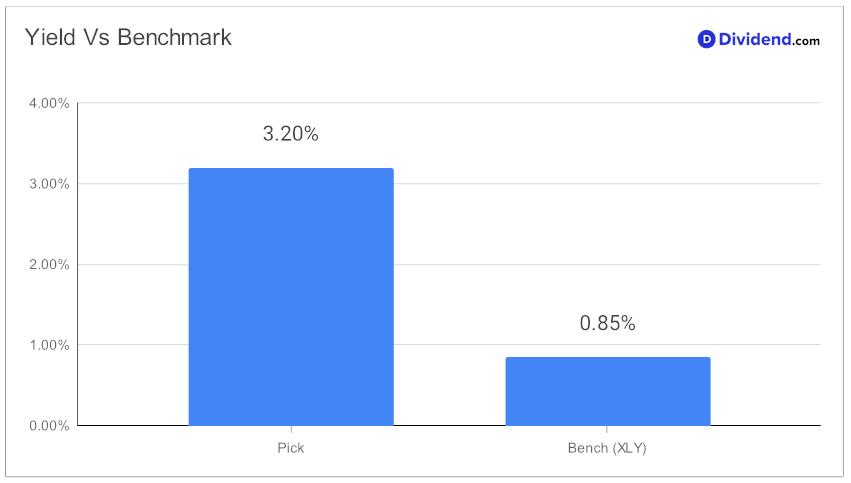

Investors will find comfort in the company’s consistent performance and future prospects for increase, as it’s poised to distribute an estimated $0.460 per share on or around February 9. The stock currently yields 3.2%, significantly more than this portfolio’s benchmark.

This inclusion is the result of a meticulous recommendation process aiming to balance yield, dividend safety, return potential, and risk, specifically within the Consumer Discretionary sector. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 4, 2023.

As we delve deeper into the nuances of this stock, investors will gain a comprehensive understanding of its dividend reliability, growth outlook, and position within the broader market landscape.