In the ever-evolving landscape of dividend growth investing, a new addition to a prestigious model portfolio is making waves. This large-cap Utility Networks stock stands out not just for its size but for its remarkable performance in the dividend domain. With a 40-year track record of consistent dividend increases, it ranks impressively in the top 10% of dividend stocks. Moreover, its future looks equally promising with expected continuous growth.

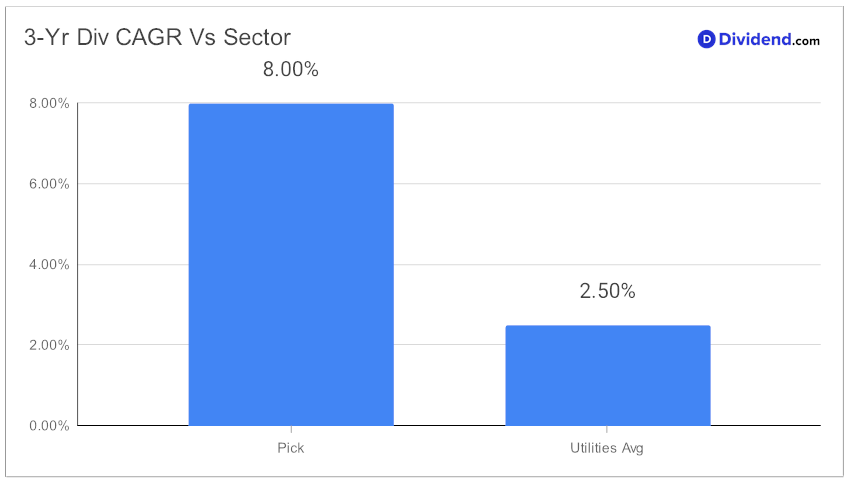

Delving deeper into its financials, the stock exhibits a robust 8% 3-year dividend per share compound annual growth rate (CAGR), placing it in the top 40% of all dividend stocks. Additionally, its low beta of 0.67 indicates a minimal correlation with the broader equity markets, offering a diversification advantage to investors’ portfolios. This aspect is particularly noteworthy for those seeking stability amidst market fluctuations.

The upcoming dividend payout further bolsters the stock’s appeal. Investors can anticipate an estimated $0.805 per share distribution on or around February 7th, a testament to the company’s strong financial health and commitment to shareholder returns.

This addition to the model portfolio is not just a mere inclusion. It’s a strategic choice, optimized for return potential through dividend growth, dividend safety, and to a lesser extent, return risk and yield attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on November 9, 2023.

The in-depth analysis following this introduction will further explore the nuances of this investment, shedding light on why it’s a noteworthy contender in the dividend growth investing space.