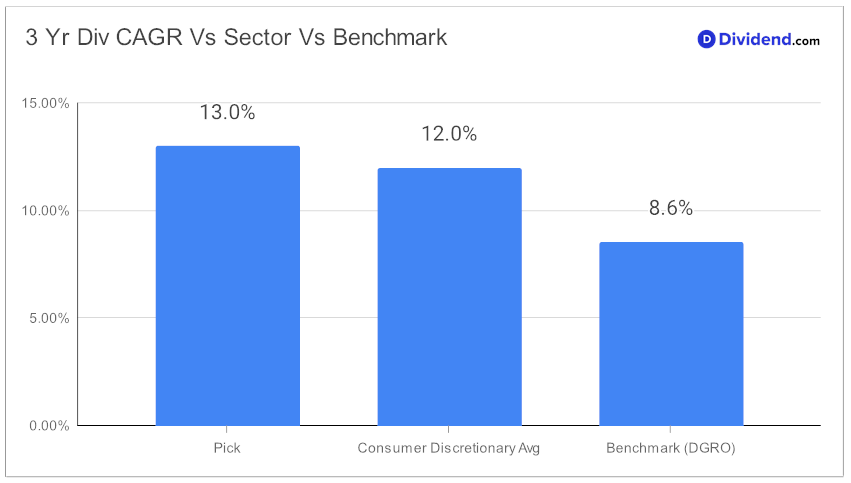

In the ever-evolving landscape of dividend growth investing, a newly added holding in a prestigious model portfolio has caught the attention of savvy investors. This well-established large-cap stock, nestled within the Home/Office Products sector, boasts a commendable track record and promising attributes for dividend enthusiasts. With a forward payout ratio of 37%, it sits comfortably near the sector’s average, indicating a balanced approach to shareholder returns and business reinvestment. Its history of 14 consecutive years of dividend increases places it in the top echelon of dividend stocks, with expectations for continued growth. Remarkably, its 3-year dividend compound annual growth rate (CAGR) of 13% ranks it among the top 20% of all dividend-paying stocks, highlighting its exceptional performance in enhancing shareholder value.

The next payout, a qualified dividend of $1.860 per share, was recently declared and is approaching its ex-dividend date this Friday (February 23), offering an immediate benefit to investors.

This inclusion is based on a rigorous recommendation process prioritizing return potential through dividend growth, while also considering dividend safety, return risk, and yield attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 9, 2024.

The detailed analysis that follows will provide deeper insights into its performance metrics, strategic position, and why it stands out as a compelling choice for dividend growth investors.