The search for consistent dividend growth often leads investors through a maze of options, but one real estate investment trust (REIT) has solidified its place in our Best Dividend Growth Stocks model portfolio. This well-covered large-cap entity stands out for its stellar 10-year dividend increase track record, placing it in the top 30% of all dividend stocks. This exceptional performance indicates a favorable outlook for future dividend hikes, making it an attractive choice for long-term investors.

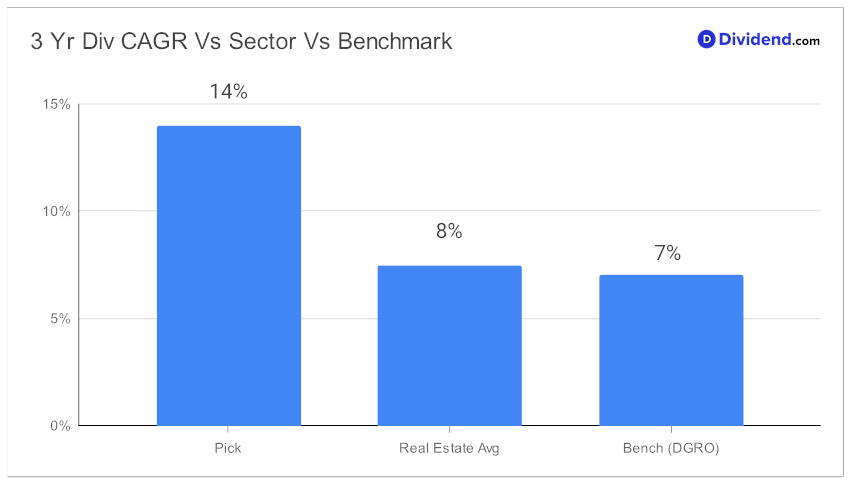

Another highlight worth noting is its three-year dividend per share compounded annual growth rate (CAGR) of 14%, a figure that ranks in the top 40% of all dividend stocks. This demonstrates the REIT’s commitment to delivering consistent growth over time, making it an appealing option for those optimizing for returns potential via dividend growth.

Investors who get on board now can look forward to the next payout—an unchanged, non-qualified $0.870 per share. The stock went ex-dividend on September 15 and has a scheduled pay date of September 29, offering a near-term benefit for new investors.

It is important to note that the Federal Reserve’s significant increases in interest rates have led to higher borrowing costs, negatively impacting commercial real estate, including segments like logistics and warehousing, where our pick has a substantial presence. This has resulted in a marginal YTD stock price increase of only 0.5% for our pick.

Nonetheless, sustained demand from third-party logistics providers and e-commerce companies, coupled with our pick’s extensive geographic reach and advantageous rent-market rate spread, offer substantial growth prospects for the company in its quest to become a leading logistics solution provider.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 18, 2023.

For those seeking a detailed breakdown of the stock’s performance metrics, risk factors, and more, an in-depth analysis follows.

This assessment uses a nuanced recommendation process that not only focuses on returns potential and dividend safety but also considers factors like returns risk and yield attractiveness.