In the realm of dividend growth investing, certain stocks stand out for their stability, impressive track record of dividend increases, and the potential to diversify an equity portfolio effectively. One such notable mention is a well-covered large-cap Tech Services stock that has consistently demonstrated financial resilience and growth, making it a steadfast component in the Best Dividend Growth Stocks model portfolio.

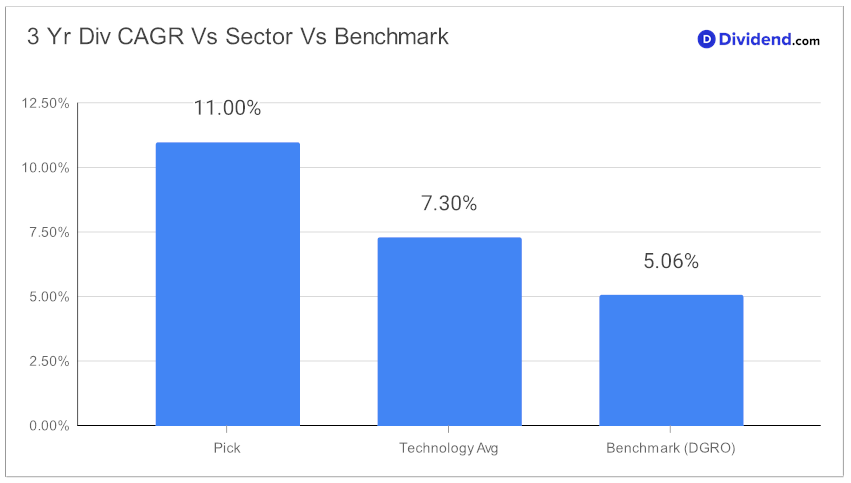

With a forward payout ratio of 32%, this stock aligns well with its sector’s average, showcasing its efficiency in managing dividends. Its commendable 13-year streak of dividend increases places it in the elite top 10% of dividend-paying stocks, with an expectation of continued growth. The stock’s 3-year compound annual growth rate (CAGR) of 11% for dividends per share further underscores its robust dividend growth profile, ranking in the top 40%.

Moreover, its beta of 0.53 indicates minimal correlation with the equity market fluctuations, presenting an attractive diversification option for investors. Year-to-date, it has outperformed both the S&P 500 and its industry, returning 17% compared to the broader market’s 10% and its sector’s 4%. Additionally, since making it to this portfolio back in February 2023, the stock has consistently managed to beat this portfolio’s benchmark.

Looking ahead, investors can anticipate the next payout, estimated at $0.510 per share on or around May 24.

While arriving at the recommendation we also factored in the 3Q24 earnings call discussion by the company management held on 26 Jan, 2024. The consulting firm, recognized for its extensive work in defense, cybersecurity, and healthcare, reported a record-breaking fiscal performance, surpassing yearly guidance. Amid dynamic market conditions, including geopolitical conflicts and budget debates, the firm demonstrated significant growth, leveraging its strategic initiatives focused on emerging technologies such as 5G and artificial intelligence (AI).

Financially, it saw a nearly 13% increase in revenue year-over-year, with a strong future outlook, expecting revenue growth of 14% to 15%. The firm’s commitment to shareholder returns was underscored by more than $150 million returned through repurchases and dividends, with an announced increase in quarterly dividends, reflecting a strong performance and an optimistic future outlook.

This analysis merely scratches the surface. For a deeper dive into how this stock could enhance your portfolio’s returns while ensuring dividend safety and appealing yields, stay tuned for the comprehensive stock analysis that follows.