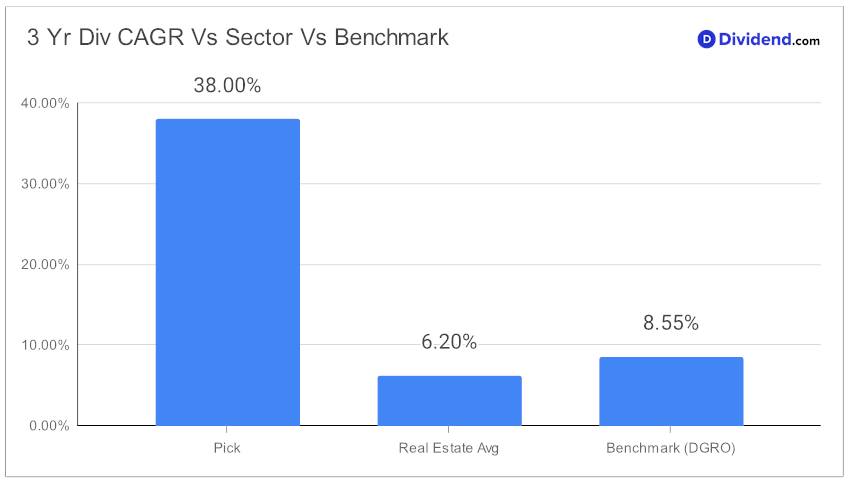

In the ever-evolving landscape of dividend growth investing, a standout performer has been reaffirmed in the prestigious Best Dividend Growth Stocks model portfolio, marking a significant moment for discerning investors. This well-covered large-cap eREIT distinguishes itself not only through its impressive 3-year dividend compound annual growth rate (CAGR) of 38%, positioning it in the top tier of all dividend stocks, but also through its resilience and diversification benefits. With a beta of 0.70, it showcases a lower correlation with equity market fluctuations, offering a strategic hedge within an equity portfolio.

Investors will find the upcoming payout particularly appealing—an 18.2% increase to a non-qualified $0.260 per share, declared recently and moving to the ex-dividend stage mid-March. This move underscores the eREIT’s robust financial health and commitment to rewarding its shareholders.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 24, 2024. The REIT, which specializes in single-family rentals, reported healthy growth in its core funds from operations (FFO), reflecting its strategic position in a market grappling with national housing shortages and affordability challenges. Despite challenges like elevated property taxes and lingering effects of inflation, the management anticipates continued demand for its various housing units in the coming days.

The inclusion in the model portfolio followed a rigorous recommendation process, emphasizing not just return potential through dividend growth, but also dividend safety, mitigating returns risk, and ensuring yield attractiveness. This meticulous approach ensures that only the most promising stocks make the cut, providing investors with a solid foundation for building wealth.

The following in-depth stock analysis delves into the nuances of this eREIT’s performance, offering a comprehensive look at what makes it a compelling pick for any dividend growth investor’s portfolio.